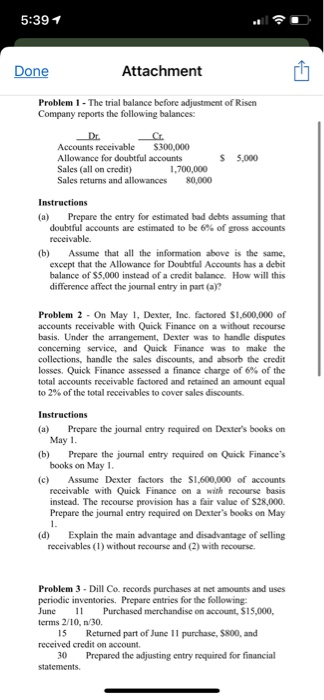

Question: 5:391 Done Attachment Problem 1 - The trial balance before adjustment of Risen Company reports the following balances: Accounts receivable $300,000 Allowance for doubtful accounts

5:391 Done Attachment Problem 1 - The trial balance before adjustment of Risen Company reports the following balances: Accounts receivable $300,000 Allowance for doubtful accounts Sales (all on credit) 1.700,000 Sales returns and allowances 80.000 $ 5,000 Instructions (a) Prepare the entry for estimated bad debts assuming that doubtful accounts are estimated to be 6% of gross accounts receivable. (b) Assume that all the information above is the same, except that the Allowance for Doubtful Accounts has a debit balance of $5,000 instead of a credit balance. How will this difference affect the journal entry in part (a)? Problem 2 - On May 1, Dexter, Inc. factored $1,600,000 of accounts receivable with Quick Finance on a without recourse basis. Under the arrangement, Dexter was to handle disputes concerning service, and Quick Finance was to make the collections, handle the sales discounts, and absorb the credit losses. Quick Finance assessed a finance charge of 6% of the total accounts receivable factored and retained an amount equal to 2% of the total receivables to cover sales discounts. Instructions (a) Prepare the journal entry required on Dexter's books on May 1. (b) Prepare the journal entry required on Quick Finance's books on May 1. (c) Assume Dexter factors the $1,600,000 of accounts receivable with Quick Finance on a with recourse basis instead. The recourse provision has a fair value of $28,000 Prepare the journal entry required on Dexter's books on May (d) Explain the main advantage and disadvantage of selling receivables (1) without recourse and (2) with recourse. Problem 3 - Dill Co. records purchases at net amounts and uses periodic inventories. Prepare entries for the following: June 11 Purchased merchandise on account, S15,000 terms 2/10,n/30 15 Returned part of June 11 purchase, $800, and received credit on account. 30 Prepared the adjusting entry required for financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts