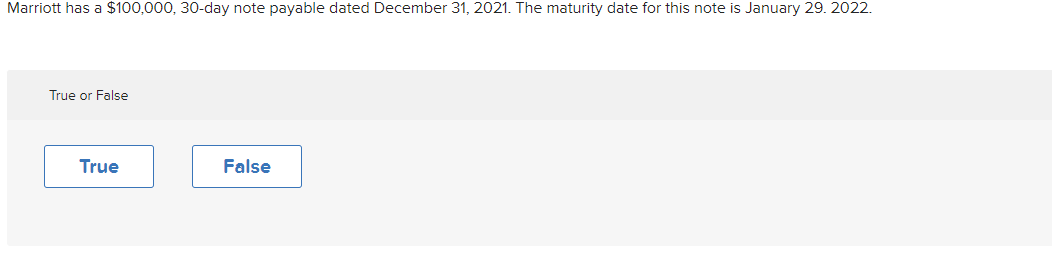

Question: 54 Marriott has a $100,000, 30-day note payable dated December 31, 2021. The maturity date for this note is January 29. 2022. True or False

54

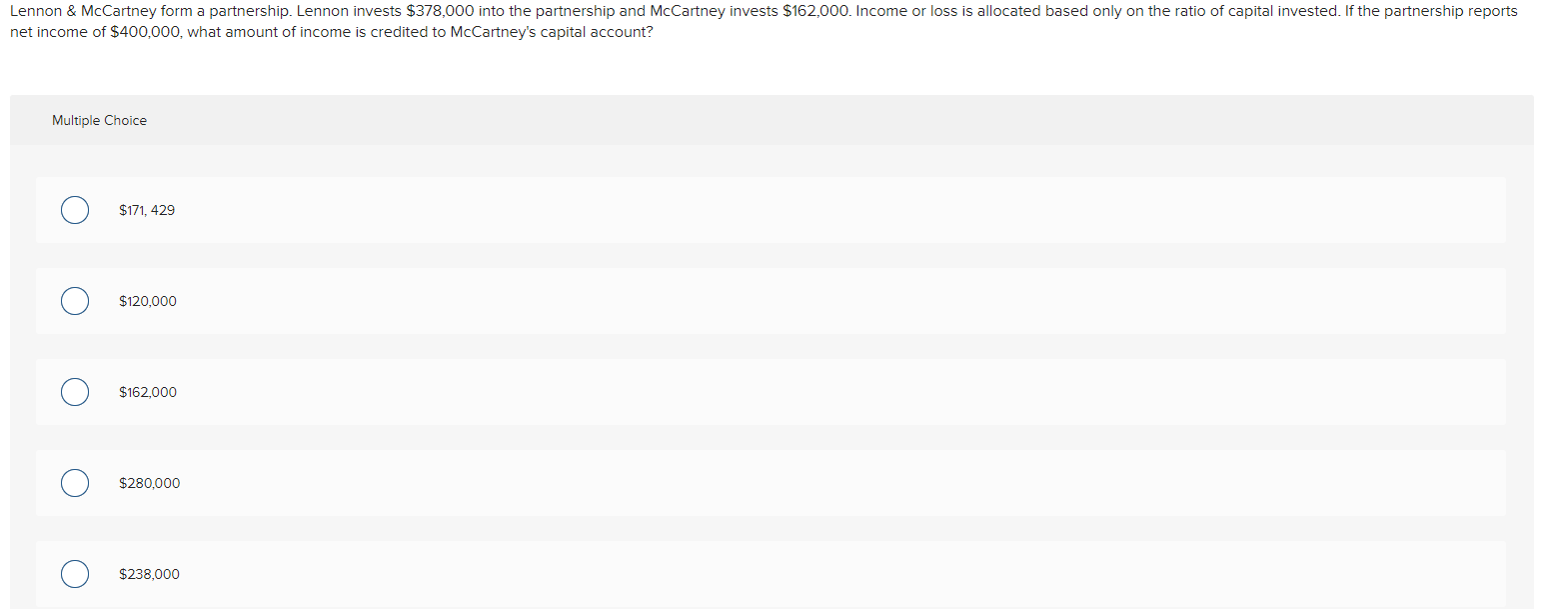

Marriott has a $100,000, 30-day note payable dated December 31, 2021. The maturity date for this note is January 29. 2022. True or False True FalseLennon & Mccartney form a partnership. Lennon invests $378,000 into the partnership and Mccartney invests $162,000. Income or loss is allocated based only on the ratio of capital invested. If the partnership reports net income of $400,000, what amount of income is credited to Mccartney's capital account? Multiple Choice O $171, 429 O $120,000 O $162,000 O $280,000 O $238,000Serena & Venus Williams form a partnership. The partners receive salary allowances of $40,000 and $50,000 respectively. There is an interest allowance of 8% of each partner's investments. Serena invested $125,000 and Venus invested $250,000. Any remaining income( or loss) is allocated equally. If net income is $100,000, the partner's would allocate the income: Multiple Choice O Serena $41,000 / Venus $59,000 O Serena $40,000 / Venus $60,000 O Serena $50,000 / Venus $70,000 O Serena $44,600 / Venus $55,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts