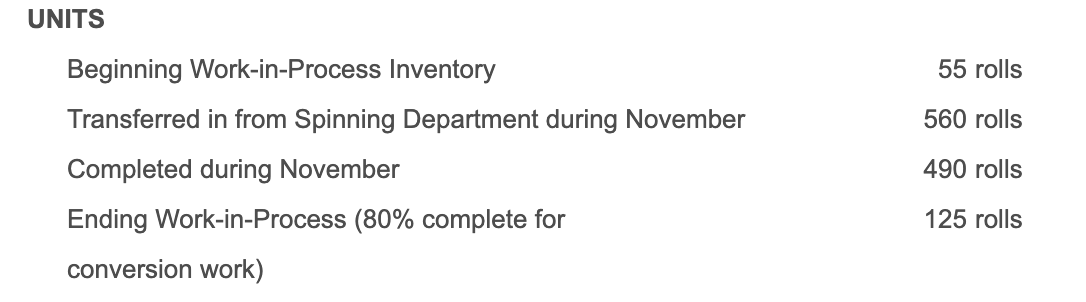

Question: 55 rolls 560 rolls UNITS Beginning Work-in-Process Inventory Transferred in from Spinning Department during November Completed during November Ending Work-in-Process (80% complete for conversion work)

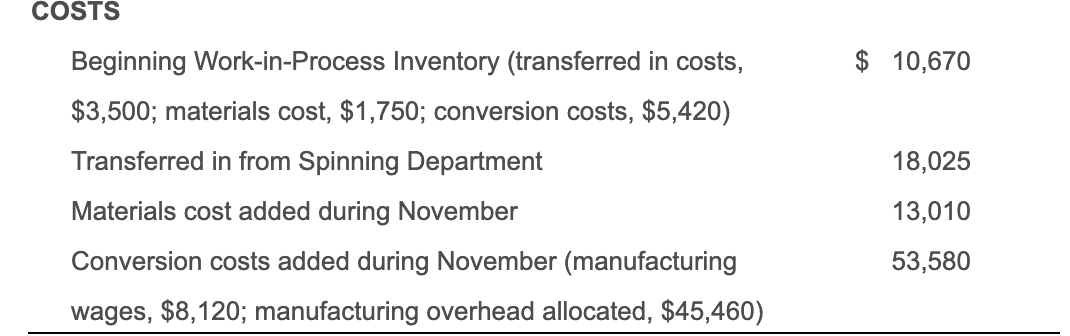

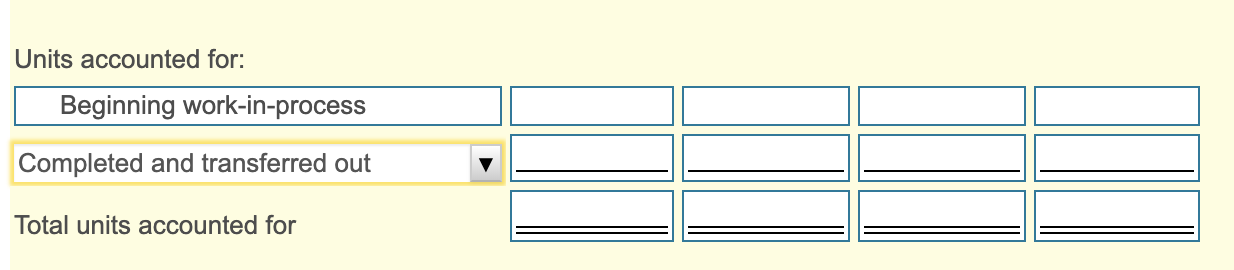

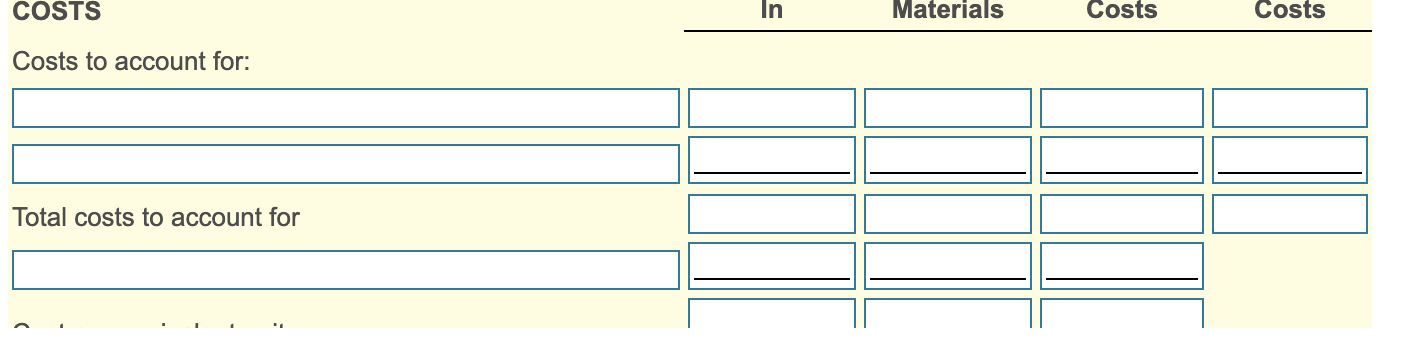

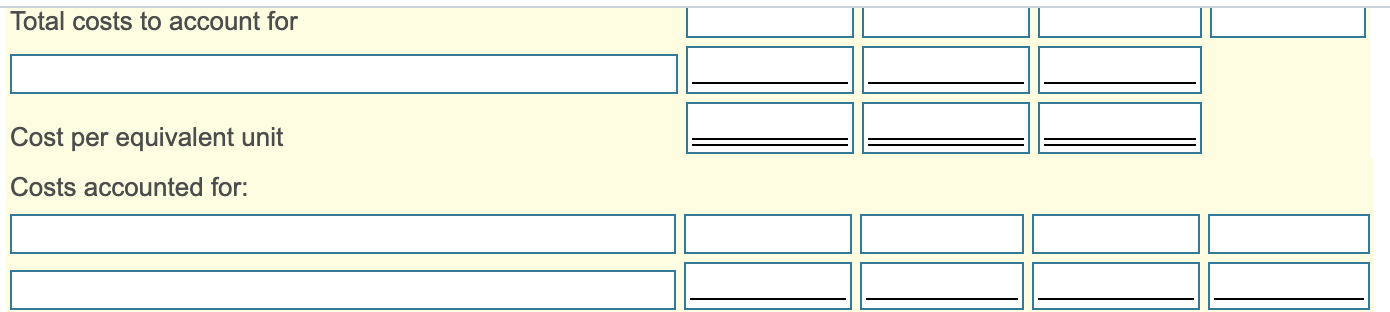

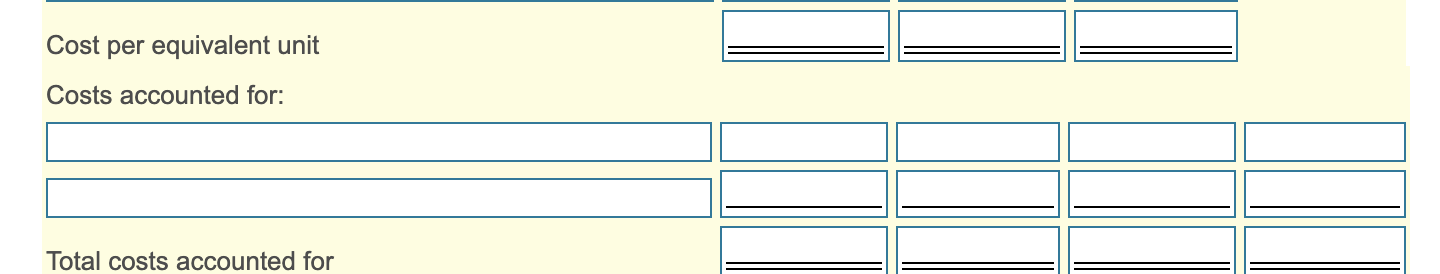

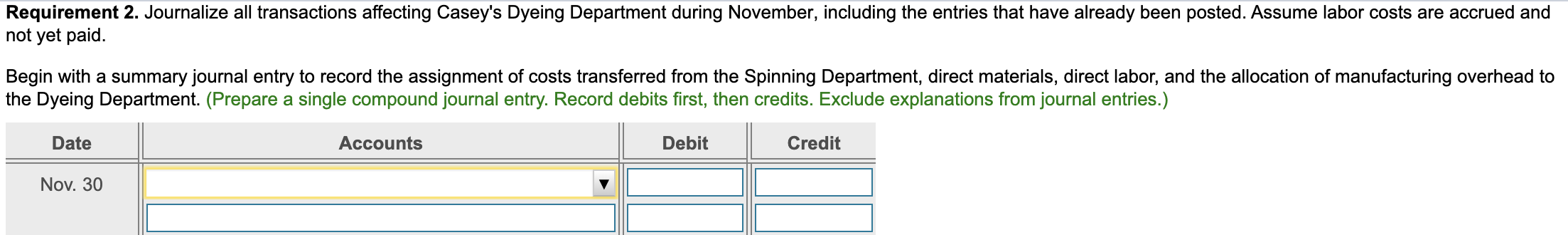

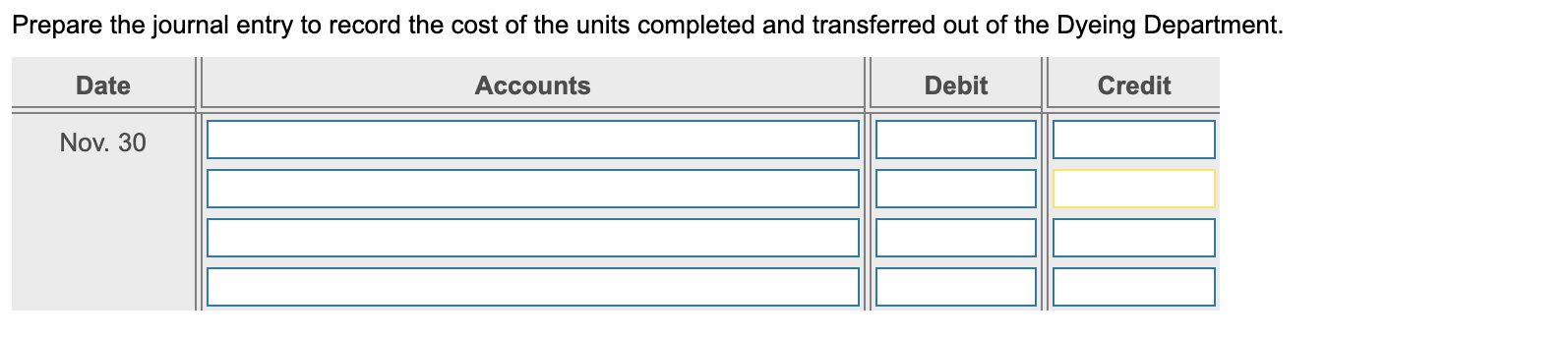

55 rolls 560 rolls UNITS Beginning Work-in-Process Inventory Transferred in from Spinning Department during November Completed during November Ending Work-in-Process (80% complete for conversion work) 490 rolls 125 rolls $ 10,670 COSTS Beginning Work-in-Process Inventory (transferred in costs, $3,500; materials cost, $1,750; conversion costs, $5,420) Transferred in from Spinning Department Materials cost added during November Conversion costs added during November (manufacturing wages, $8,120; manufacturing overhead allocated, $45,460) 18,025 13,010 53,580 Units accounted for: Beginning work-in-process Completed and transferred out Total units accounted for COSTS Materials Costs Costs Costs to account for: Total costs to account for Total costs to account for Cost per equivalent unit Costs accounted for: Cost per equivalent unit Costs accounted for: Total costs accounted for Requirement 2. Journalize all transactions affecting Casey's Dyeing Department during November, including the entries that have already been posted. Assume labor costs are accrued and not yet paid. Begin with a summary journal entry to record the assignment of costs transferred from the Spinning Department, direct materials, direct labor, and the allocation of manufacturing overhead to the Dyeing Department. (Prepare a single compound journal entry. Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Debit Credit Nov. 30 Prepare the journal entry to record the cost of the units completed and transferred out of the Dyeing Department. Date Accounts Debit Credit Nov. 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts