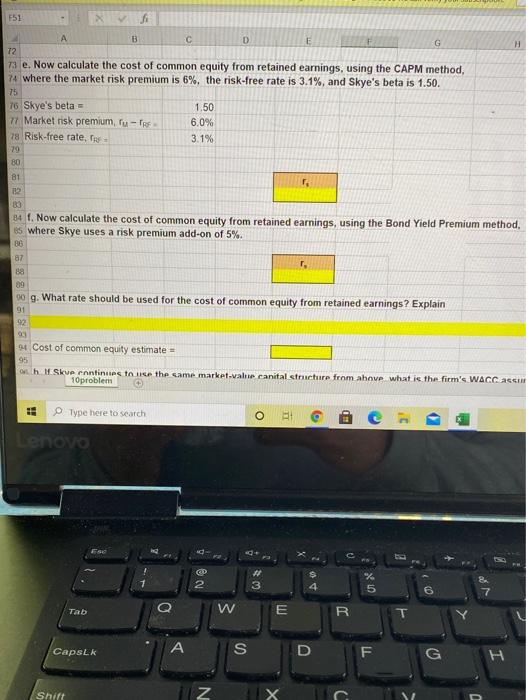

Question: 551 B E G H A D 72 73 e. Now calculate the cost of common equity from retained earnings, using the CAPM method, 74

551 B E G H A D 72 73 e. Now calculate the cost of common equity from retained earnings, using the CAPM method, 74 where the market risk premium is 6%, the risk-free rate is 3.1%, and Skye's beta is 1.50. 75 76 Skye's beta- 1.50 77 Market risk premium, ru - 6.0% 78 Risk-free rate, les 3.1% 70 80 81 Ba 84 f. Now calculate the cost of common equity from retained earnings, using the Bond Yield Premium method, 65 where Skye uses a risk premium add-on of 5%. 86 87 , 88 09 90 g. What rate should be used for the cost of common equity from retained earnings? Explain 91 92 94 Cost of common equity estimate 95 onth Skuernntinnestolte the same market value canital structure from above what is the firm's WACC ascun 10problem Type here to search Lenovo Fas N@ W $ UX Q Tab W E R A CapsLk S TI G Shift Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts