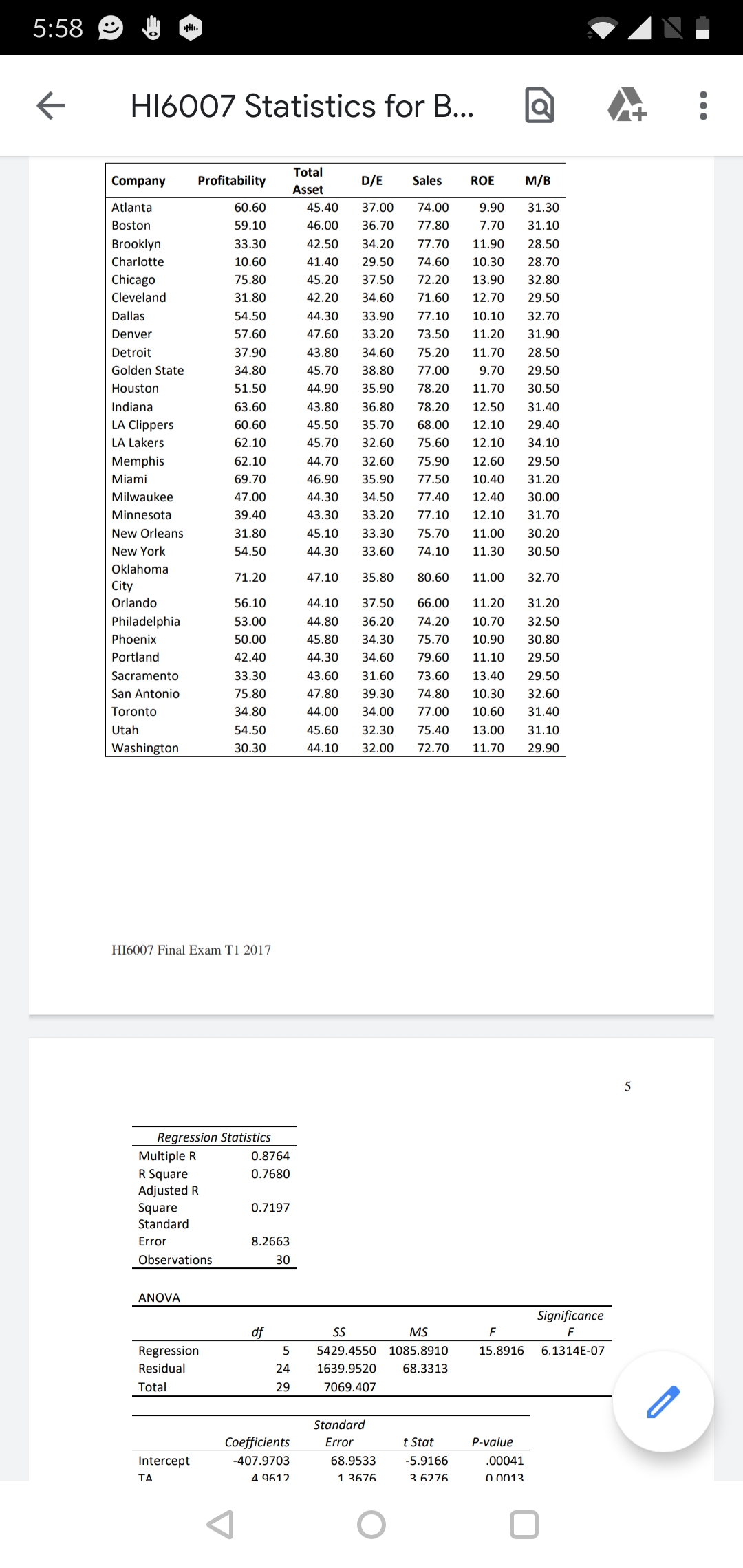

Question: 5:58 HI6007 Statistics for B... Q . . . Total Company Profitability D/E Sales ROE M/B Asset Atlanta 60.60 45.40 37.00 74.00 9.90 31.30 Boston

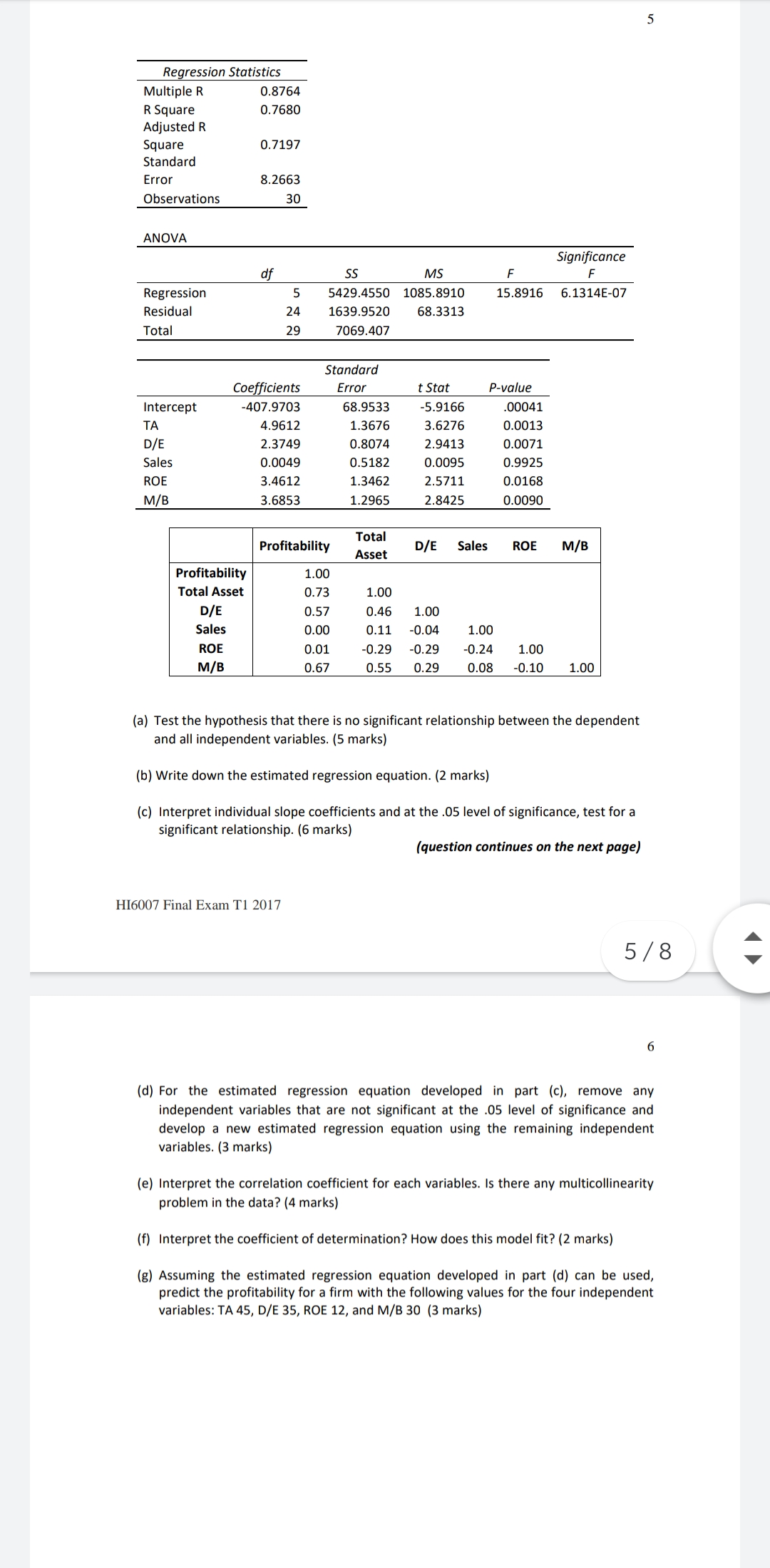

5:58 HI6007 Statistics for B... Q . . . Total Company Profitability D/E Sales ROE M/B Asset Atlanta 60.60 45.40 37.00 74.00 9.90 31.30 Boston 59.10 46.00 36.70 77.80 7.70 31.10 Brooklyn 33.30 42.50 34.20 77.70 11.90 28.50 Charlotte 10.60 41.40 29.50 74.60 10.30 28.70 Chicago 75.80 45.20 37.50 72.20 13.90 32.80 Cleveland 31.80 42.20 34.60 71.60 12.70 29.50 Dallas 54.50 44.30 33.90 77.10 10.10 32.70 Denver 57.60 47.60 33.20 73.50 11.20 31.90 Detroit 37.90 43.80 34.60 75.20 11.70 28.50 Golden State 34.80 45.70 38.80 77.00 9.70 29.50 Houston 51.50 44.90 35.90 78.20 11.70 30.50 Indiana 63.60 43.80 36.80 78.20 12.50 31.40 LA Clippers 60.60 15.50 35.70 68.00 12.10 29.40 LA Lakers 62.10 45.70 32.60 75.60 12.10 34.10 Memphis 62.10 14.70 32.60 75.90 12.60 29.50 Miami 69.70 46.90 35.90 77.50 10.40 31.20 Milwaukee 47.00 44.30 34.50 77.40 12.40 30.00 Minnesota 39.40 43.30 33.20 77.10 12.10 31.70 New Orleans 31.80 45.10 33.30 75.70 11.00 30.20 New York 54.50 44.30 33.60 74.10 11.30 30.50 Oklahoma 71.20 47.10 35.80 80.60 11.00 32.70 City Orlando 56.10 44.10 37.50 66.00 11.20 31.20 Philadelphia 53.00 14.80 36.20 74.20 10.70 32.50 Phoenix 50.00 45.80 34.30 75.70 10.90 30.80 Portland 42.40 44.30 34.60 79.60 11.10 29.50 Sacramento 33.30 43.60 31.60 73.60 13.40 29.50 San Antonio 75.80 47.80 39.30 74.80 10.30 32.60 Toronto 34.80 44.00 34.00 77.00 10.60 31.40 Utah 54.50 45.60 32.30 75.40 13.00 31.10 Washington 30.30 44.10 32.00 72.70 11.70 29.90 HI6007 Final Exam T1 2017 Regression Statistics Multiple R 0.8764 R Square 0.7680 Adjusted R Square 0.7197 Standard Error 8.2663 Observations 30 ANOVA Significance df SS MS F Regression 5 5429.4550 1085.8910 15.8916 6.1314E-07 Residual 24 1639.9520 68.3313 Total 29 7069.407 Standard Coefficients Error t Stat P-value Intercept 407.9703 68.9533 5.9166 00041 TA 4 9617 1 3676 3 6276 0.0013 O ORegression Statistics Multiple R 0.8764 R Square 0.7680 Adjusted R Square 0.7197 Standard Error 8.2663 Observations 30 ANOVA Significance df SS MS F F Regression 5429.4550 1085.8910 15.8916 6.1314E-07 Residual 24 1639.9520 68.3313 Total 29 7069.407 Standard Coefficients Error t Stat P-value Intercept -407.9703 68.9533 -5.9166 00041 TA 4.9612 1.3676 3.6276 0.0013 D/E 2.3749 0.8074 2.9413 0.0071 Sales 0.0049 0.5182 0.0095 0.9925 ROE 3.4612 1.3462 2.5711 0.0168 M/B 3.6853 1.2965 2.8425 0.0090 Profitability Total Asset D/E Sales ROE M/B Profitability 1.00 Total Asset 0.73 1.00 D/E 0.57 0.46 1.00 Sales 0.00 0.11 -0.04 1.00 ROE 0.01 0.29 .0.29 0.24 1.00 M/B 0.67 0.55 0.29 0.08 -0.10 1.00 (a) Test the hypothesis that there is no significant relationship between the dependent and all independent variables. (5 marks) (b) Write down the estimated regression equation. (2 marks) (c) Interpret individual slope coefficients and at the .05 level of significance, test for a significant relationship. (6 marks) (question continues on the next page) HI6007 Final Exam T1 2017 5 / 8 6 (d) For the estimated regression equation developed in part (c), remove any independent variables that are not significant at the .05 level of significance and develop a new estimated regression equation using the remaining independent variables. (3 marks) (e) Interpret the correlation coefficient for each variables. Is there any multicollinearity problem in the data? (4 marks) (f) Interpret the coefficient of determination? How does this model fit? (2 marks) (g) Assuming the estimated regression equation developed in part (d) can be used, predict the profitability for a firm with the following values for the four independent variables: TA 45, D/E 35, ROE 12, and M/B 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts