Question: 5-6 please help for a thumbs up A medium-size consulting engineering firm is trying to decide whether it should replace its office furniture now or

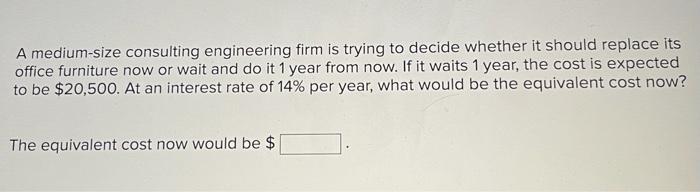

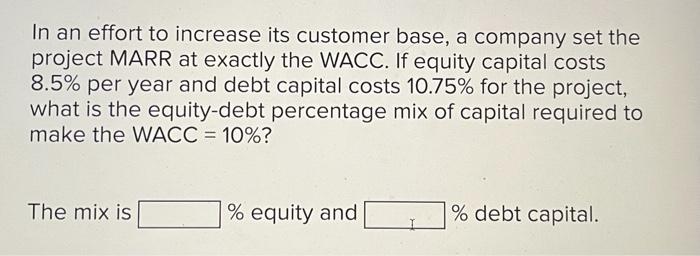

A medium-size consulting engineering firm is trying to decide whether it should replace its office furniture now or wait and do it 1 year from now. If it waits 1 year, the cost is expected to be $20,500. At an interest rate of 14% per year, what would be the equivalent cost now? The equivalent cost now would be $ In an effort to increase its customer base, a company set the project MARR at exactly the WACC. If equity capital costs 8.5% per year and debt capital costs 10.75% for the project, what is the equity-debt percentage mix of capital required to make the WACC = 10%? The mix is % equity and % debt capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts