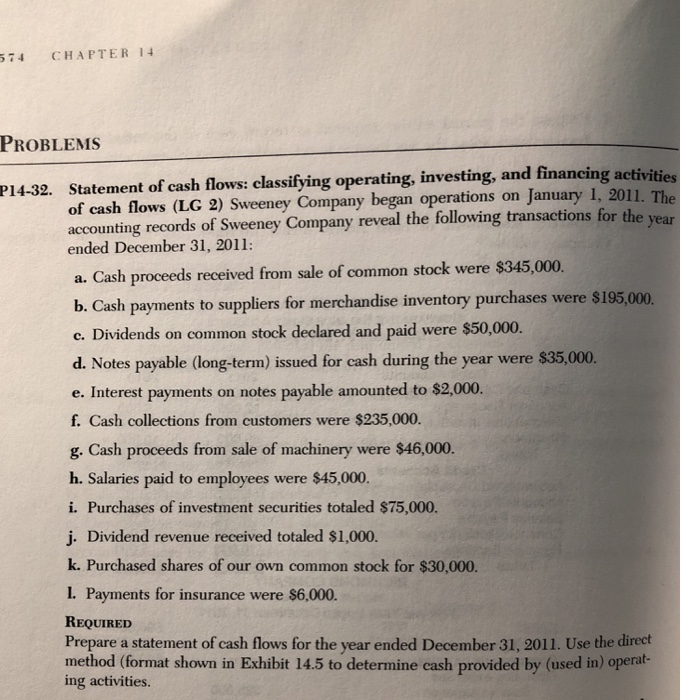

Question: 574 CHAPTER 14 PROBLEMS Statement of cash flows: classifying operating, investing, and of cash flows (LG 2) Sweeney Company began operations on January 1, 2011.

574 CHAPTER 14 PROBLEMS Statement of cash flows: classifying operating, investing, and of cash flows (LG 2) Sweeney Company began operations on January 1, 2011. accounting records of Sweeney Company reveal the following transactions for the year financing activities The P14-32. ended December 31, 2011: a. Cash proceeds received from sale of common stock were $345,000. b. Cash payments to suppliers for merchandise inventory purchases were $195,000. c. Dividends on common stock declared and paid were $50,000. d. Notes payable (long-term) issued for cash during the year were $35,000. e. Interest payments on notes payable amounted to $2,000. f. Cash collections from customers were $235,000. g. Cash proceeds from sale of machinery were $46,000. h. Salaries paid to employees were $45,000. i. Purchases of investment securities totaled $75,000. j. Dividend revenue received totaled $1,000. k. Purchased shares of our own common stock for $30,000. I. Payments for insurance were $6,000. REQUIRED Prepare a statement of cash flows for the year ended December 31, 2011. Use the direct method (format shown in Exhibit 14.5 to determine cash provided by (used in) operat- ing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts