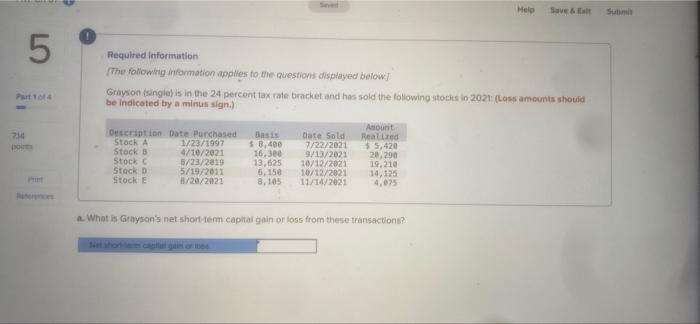

Question: 5-8 please Help Save & 5 Parto Required information The following information applies to the questions displayed below Grayson (single) is in the 24 percent

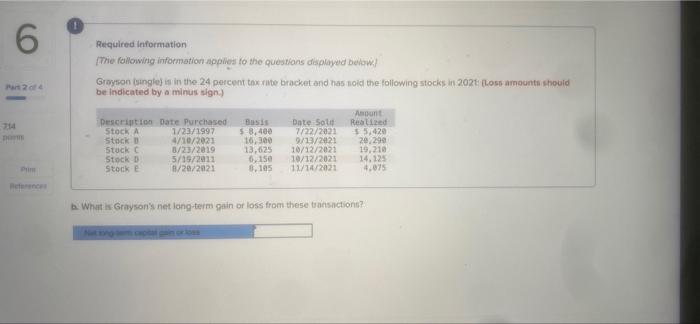

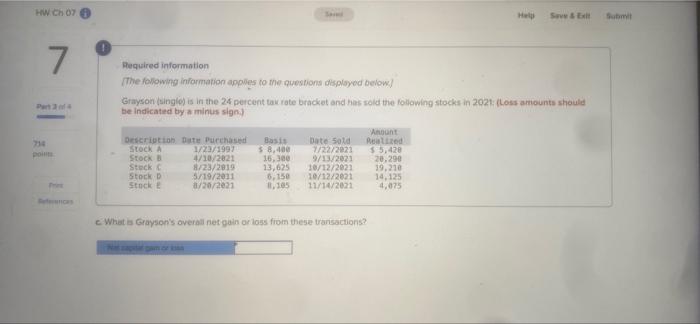

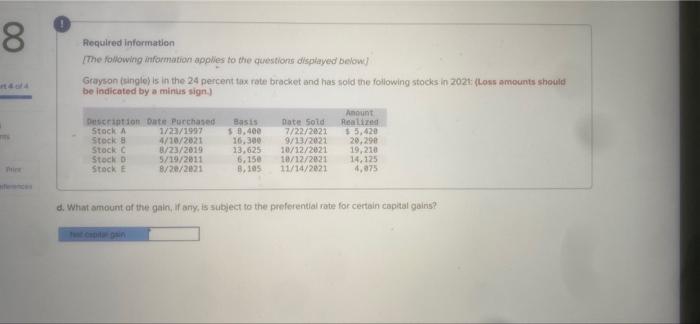

Help Save & 5 Parto Required information The following information applies to the questions displayed below Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2021 (Loss amounts should be indicated by a minus sign.) Amount Description Date Purchased Basis Date Sold Realized Stock A 1/23/1997 $ 8,400 7/22/2021 35,420 Stocks 4/10/2021 16,300 9/13/2021 20,290 Stock 3/23/2019 13.625 10/12/2021 19.210 Stock D 5/19/2011 5,150 10/12/2021 14,125 Stock E 8/20/2021 8,105 11/14/2021 24 What is Grayson's net short-term capital gain or loss from these transactions? 6 Required information The following information applies to the questions displayed below. Grayson angle is in the 24 percent tax rate bracket and has noic the following stocks in 2020 loss amounts should be indicated by a minus sign) Part 2 714 Description Date Purchased Stock 1/23/1997 Stock 4/10/2021 Stuck 8/23/2019 Stock 5/19/2011 Stock e 8/20/2021 5-8.400 16,300 13,625 0.150 8.105 Date Sole 7/22/2021 0/13/2021 10/12/2021 10/12/2021 11/14/2021 Amount Realized $ 5420 20,290 19.210 14.125 4,075 b. What is Grayson's net long-term gain or loss from these transactions? HW.Ch 07 Hely Sex Sutomli 7. Required information The following information as to the questions displayed below! Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2021 (Loss amounts should be indicated by a minus sign Amount Description Date Purchased Basis Date 500 tured STOCK 1/23/1997 $ 8,400 7/22/2021 $5,420 Stock 4/10/2021 15.300 9/13/2021 20.290 Stock 8/23/2015 13,625 10/12/2021 19,210 Stock 5/19/2011 6,150 10/12/2021 14.125 Stock 8/20/2021 1.105 11/14/2031 4,075 pl What is Grayson's overall net gain or loss from these transactions 8 Required information The following information applies to the questions displayed below) Grayson single) is in the 24 percent tax rote bracket and has sold the following stocks in 2021: (Loss amounts should be indicated by a minus sign) Amount Description Date Purchased Basis Date Soto Realized Stock 1/23/1997 $ 3.400 7/22/2021 $5,420 Stock 4/10/2021 16,300 9/13/2021 20,290 Stock B/23/2019 13,625 10/12/2021 19,210 Stock 5/19/2011 6.150 18/12/2021 14,123 Stock E 8/20/2021 8,105 11/14/2021 4,075 d. What amount of the gain, if any, is subject to the preferential rate for certain capital gains

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts