Question: 5-8 SOLVE WITH ALGEBRA This equation can be solved by algebra without using a Financial Calculator. Try to solve it using simple algebra: 1,259.71 =

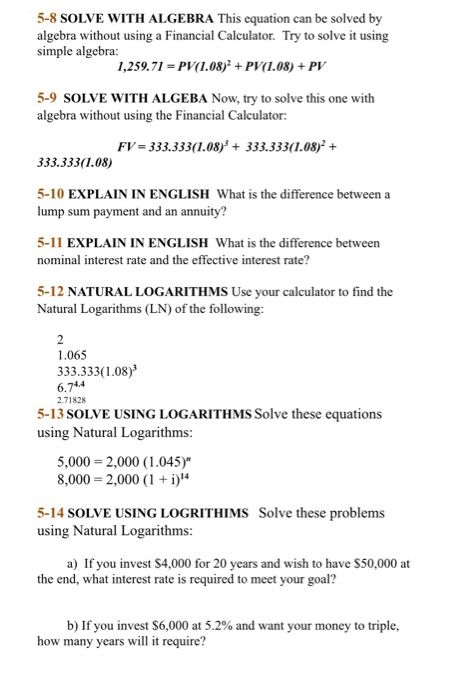

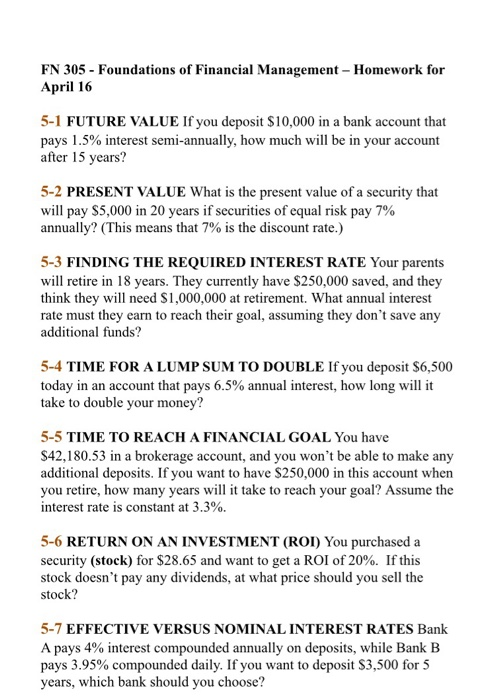

5-8 SOLVE WITH ALGEBRA This equation can be solved by algebra without using a Financial Calculator. Try to solve it using simple algebra: 1,259.71 = PVC 1.08), PVC 1.08) + PV 5-9 SOLVE WITH ALGEBA Now, try to solve this one with algebra without using the Financial Calculator: FV= 333.333( 1.08)3 + 333.333(1.08/ + 333.333(1.08) 5-10 EXPLAIN IN ENGLISH What is the difference between a lump sum payment and an annuity? 5-11 EXPLAIN IN ENGLISH What is the difference between nominal interest rate and the effective interest rate? 5-12 NATURAL LOGARITHMS Use your calculator to find the Natural Logarithms (LN) of the following: 1.065 333.333(1.08) 6.74.4 2.71828 5-13 SOLVE USING LOGARITHMS Solve these equations using Natural Logarithms: 5,000 2,000 1.045)" 8,000 2,000 (1i) 5-14 SOLVE USING LOGRITHIMS Solve these problems using Natural Logarithms: a) If you invest $4,000 for 20 years and wish to have S50,000 at the end, what interest rate is required to meet your goal? b) If you invest $6,000 at 5.2% and want your money to triple. how many years will it require? FN 305 - Foundations of Financial Management Homework for April 16 5-1 FUTURE VALUE If you deposit $10,000 in a bank account that pays 1.5% interest semi-annually, how much will be in your account after 15 years? 5-2 PRESENT VALUE What is the present value of a security that will pay S5,000 in 20 years if securities of equa annually? (This means that 7% is the discount rate.) l risk pay 7% 5-3 FINDING THE REQUIRED INTEREST RATE Your parents will retire in 18 years. They currently have $250,000 saved, and they think they will need S1,000,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? 5-4 TIME FOR A LUMP SUM TO DOUBLE If you deposit $6,500 today in an account that pays 6.5% annual interest, how long will it take to double your money? 5-5 TIME TO REACH A FINANCIAL GOAL You have S42,180.53 in a brokerage account, and you won't be able to make any additional deposits. If you want to have S250,000 in this account when you retire, how many years will it take to reach your goal? Assume the interest rate is constant at 3.3%. 5-6 RETURN ON AN INVESTMENT (ROI) You purchased a security (stock) for $28.65 and want to get a ROI of 20%. If this stock doesn't pay any dividends, at what price should you sell the stock? 5-7 EFFECTIVE VERSUS NOMINAL INTEREST RATES Bank A pays 4% interest compounded annually on deposits, while Bank B pays 3.95% compounded daily. If you want to deposit $3,500 for 5 years, which bank should you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts