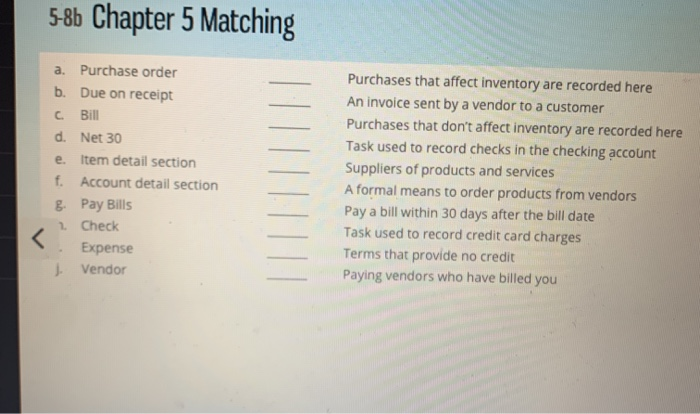

Question: 5-86 Chapter 5 Matching a. Purchase order b. Due on receipt Bill d. Net 30 e. Item detail section f. Account detail section g. Pay

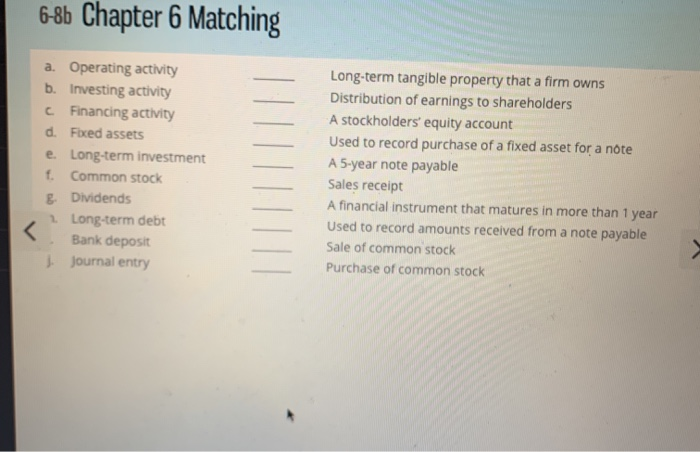

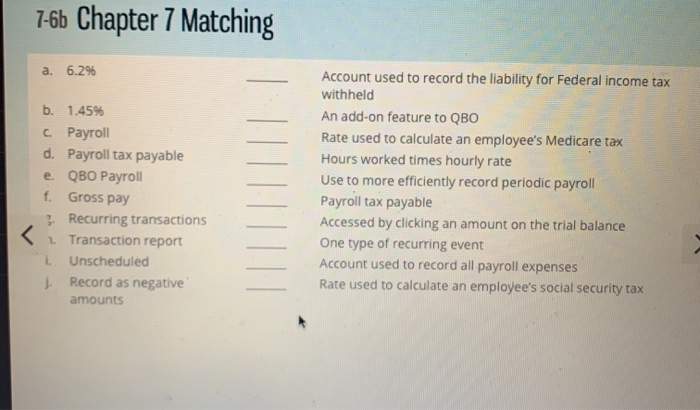

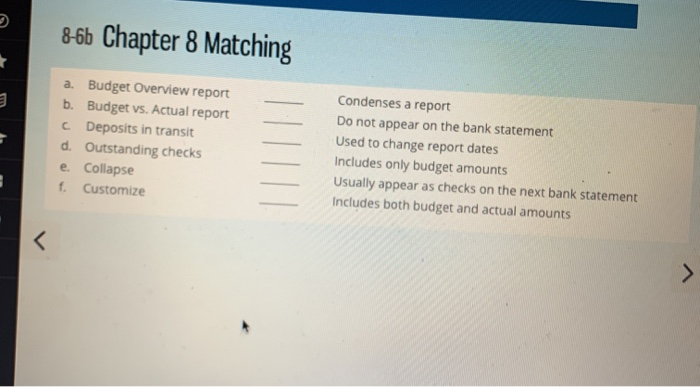

5-86 Chapter 5 Matching a. Purchase order b. Due on receipt Bill d. Net 30 e. Item detail section f. Account detail section g. Pay Bills 2. Check Expense J. Vendor Purchases that affect inventory are recorded here An invoice sent by a vendor to a customer Purchases that don't affect inventory are recorded here Task used to record checks in the checking account Suppliers of products and services A formal means to order products from vendors Pay a bill within 30 days after the bill date Task used to record credit card charges Terms that provide no credit Paying vendors who have billed you 6-8b Chapter 6 Matching a. Operating activity b. Investing activity C Financing activity d. Fixed assets e. Long-term investment f. Common stock & Dividends 1. Long-term debt Bank deposit Journal entry Long-term tangible property that a firm owns Distribution of earnings to shareholders A stockholders' equity account Used to record purchase of a fixed asset for a note A 5-year note payable Sales receipt A financial instrument that matures in more than 1 year Used to record amounts received from a note payable Sale of common stock Purchase of common stock 7-6b Chapter 7 Matching a. 6.2% b. 1.45% C Payroll d. Payroll tax payable e QBO Payroll f. Gross pay Recurring transactions Transaction report 1. Unscheduled J. Record as negative amounts Account used to record the liability for Federal income tax withheld An add-on feature to QBO Rate used to calculate an employee's Medicare tax Hours worked times hourly rate Use to more efficiently record periodic payroll Payroll tax payable Accessed by clicking an amount on the trial balance One type of recurring event Account used to record all payroll expenses Rate used to calculate an employee's social security tax 8-6b Chapter 8 Matching a Budget Overview report b. Budget vs. Actual report C Deposits in transit d. Outstanding checks e Collapse f. Customize Condenses a report Do not appear on the bank statement Used to change report dates Includes only budget amounts Usually appear as checks on the next bank statement Includes both budget and actual amounts 5-86 Chapter 5 Matching a. Purchase order b. Due on receipt Bill d. Net 30 e. Item detail section f. Account detail section g. Pay Bills 2. Check Expense J. Vendor Purchases that affect inventory are recorded here An invoice sent by a vendor to a customer Purchases that don't affect inventory are recorded here Task used to record checks in the checking account Suppliers of products and services A formal means to order products from vendors Pay a bill within 30 days after the bill date Task used to record credit card charges Terms that provide no credit Paying vendors who have billed you 6-8b Chapter 6 Matching a. Operating activity b. Investing activity C Financing activity d. Fixed assets e. Long-term investment f. Common stock & Dividends 1. Long-term debt Bank deposit Journal entry Long-term tangible property that a firm owns Distribution of earnings to shareholders A stockholders' equity account Used to record purchase of a fixed asset for a note A 5-year note payable Sales receipt A financial instrument that matures in more than 1 year Used to record amounts received from a note payable Sale of common stock Purchase of common stock 7-6b Chapter 7 Matching a. 6.2% b. 1.45% C Payroll d. Payroll tax payable e QBO Payroll f. Gross pay Recurring transactions Transaction report 1. Unscheduled J. Record as negative amounts Account used to record the liability for Federal income tax withheld An add-on feature to QBO Rate used to calculate an employee's Medicare tax Hours worked times hourly rate Use to more efficiently record periodic payroll Payroll tax payable Accessed by clicking an amount on the trial balance One type of recurring event Account used to record all payroll expenses Rate used to calculate an employee's social security tax 8-6b Chapter 8 Matching a Budget Overview report b. Budget vs. Actual report C Deposits in transit d. Outstanding checks e Collapse f. Customize Condenses a report Do not appear on the bank statement Used to change report dates Includes only budget amounts Usually appear as checks on the next bank statement Includes both budget and actual amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts