Question: [5/9 Case Study Required a) Identify the problems with the statement of cash flows that the accounting clerk prepared. CS-1 LO Z Granite Surfaces specializes

[5/9

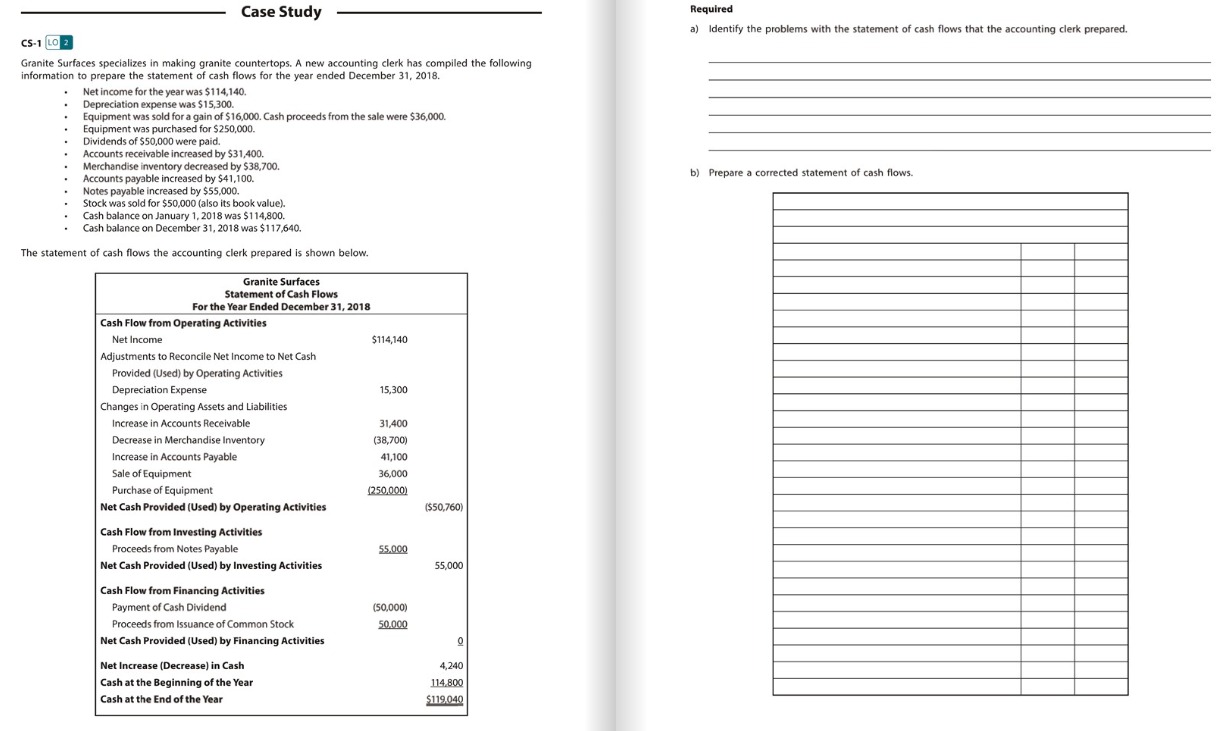

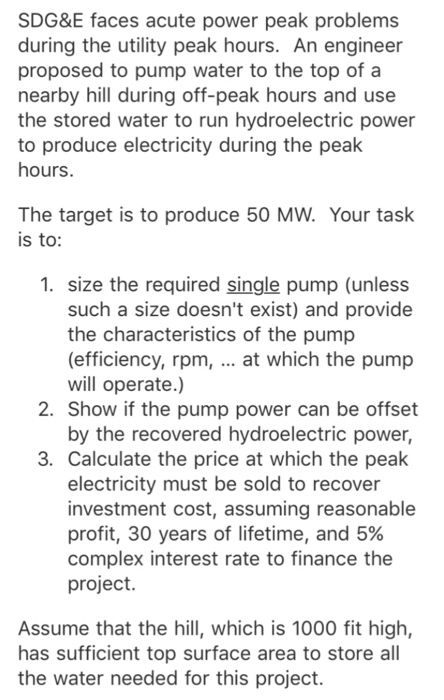

Case Study Required a) Identify the problems with the statement of cash flows that the accounting clerk prepared. CS-1 LO Z Granite Surfaces specializes in making granite countertops. A new accounting clerk has compiled the following information to prepare the statement of cash flows for the year ended December 31, 2018. Net income for the year was $114,140. Depreciation expense was $15,300. Equipment was sold for a gain of $16,000. Cash proceeds from the sale were $36,000. Equipment was purchased for $250,000. Dividends of $50,000 were paid. Accounts receivable increased by $31,400. Merchandise inventory decreased by $38,700. Accounts payable increased by $41,100. b) Prepare a corrected statement of cash flows. Notes payable increased by $55,000. Stock was sold for $50,000 (also its book value). Cash balance on January 1, 2018 was $114,800. Cash balance on December 31, 2018 was $117,640. The statement of cash flows the accounting clerk prepared is shown below. Granite Surfaces Statement of Cash Flows For the Year Ended December 31, 2018 Cash Flow from Operating Activities Net Income $114,140 Adjustments to Reconcile Net Income to Net Cash Provided (Used) by Operating Activities Depreciation Expense 15,300 Changes in Operating Assets and Liabilities Increase in Accounts Receivable 31.400 Decrease in Merchandise Inventory (38,700) Increase in Accounts Payable 41,100 Sale of Equipment 36,000 Purchase of Equipment (250,000) Net Cash Provided (Used) by Operating Activities ($50,760) Cash Flow from Investing Activities Proceeds from Notes Payable 55,000 Net Cash Provided (Used) by Investing Activities 55,000 Cash Flow from Financing Activities Payment of Cash Dividend (50,000) Proceeds from Issuance of Common Stock 50.000 Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash 1,240 Cash at the Beginning of the Year 114.800 Cash at the End of the Year $119.040SDG&E faces acute power peak problems during the utility peak hours. An engineer proposed to pump water to the top of a nearby hill during off-peak hours and use the stored water to run hydroelectric power to produce electricity during the peak hours. The target is to produce 50 MW. Your task is to: 1. size the required smgle pump {unless such a size doesn't exist] and provide the characteristics of the pump (efficiency, rpm, at which the pump will operate.) 2. Show if the pump power can be offset by the recovered hydroelectric power, 3. Calculate the price at which the peak electricity must be sold to recover investment cost, assuming reasonable profit, 30 years of lifetime, and 5% complex interest rate to finance the project. Assume that the hill, which is 1000 fit high, has sufficient top surface area to store all the water needed for this project. 3) How can a firm pursuing a diversification strategy enhance its overall corporate performance by leveraging financial economies? 4) Alliances are often used to pursue business-level goals, but they may be managed at the corporate level. Explain why this portfolio approach to alliance management would make sense