Question: 5-9 PRESENT AND FUTURE VALUES FOR DIFFERENT PE RIoDs Find the following values using ns and then a financial calculator. Compounding/discounting occurs annually a. An

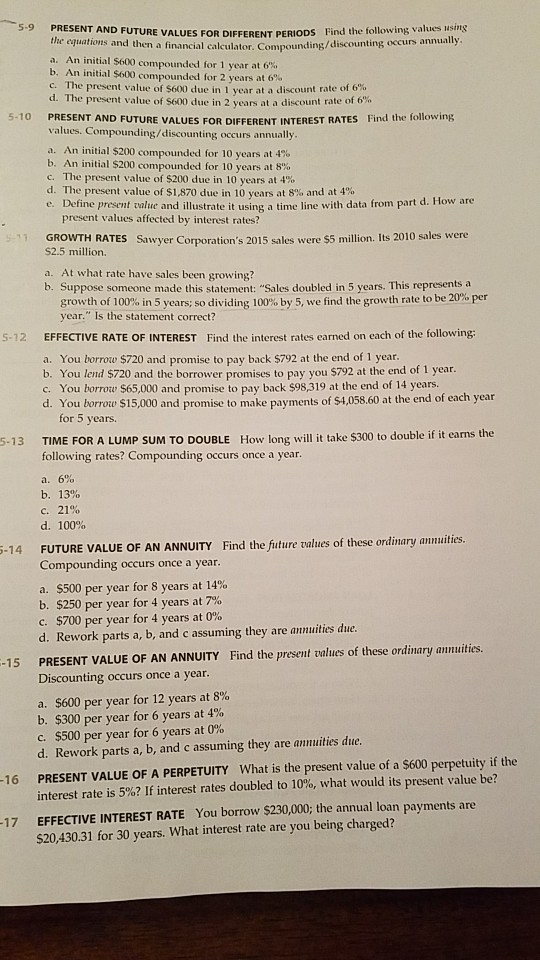

5-9 PRESENT AND FUTURE VALUES FOR DIFFERENT PE RIoDs Find the following values using ns and then a financial calculator. Compounding/discounting occurs annually a. An initial $600 compounded for 1 year at 6% b. An initial $600 compounded for 2 years at 6% c. Th d. e present value of $600 due in 1 year at a discount rate of 6% The present value of S600 due in 2 years at a discount rate of 6%, 5-10 Find the following PRESENT AND FUTURE VALUES FOR DIFFERENT INTEREST RATES values. Compounding/discounting occurs annually a. An initial $200 compounded for 10 years at 4% b. An initial S200 compounded for 10 years at 8% C. The present value of $200 due in 10 years at 4% d. The present value of $1,870 due in 10 years at 8% and at 4% e. Define present value and illustrate it using a time line with data from part d. How are present values affected by interest rates? GROWTH RATES Sawyer Corporation's 2015 sales were $5 million. Its 2010 sales were S2.5 million. a. At what rate have sales been growing? b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth ofior in 5 years so dividing 100% by 5, we find thegrowth tale to be 20%per year." Is the statement correct? S-12 EFFECTIVE RATE OF INTEREST Find the interest rates earned on each of the following a. You borrow $720 and promise to pay back $792 at the end of 1 year b. You lend $720 and the borrower promises to pay you $792 at the end of 1 year. c. You borrow $65,000 and promise to pay back s98,319 at the end of 14 years d. You borrow $15,000 to and promise to make payments of $4,058.60 at the end of each year for 5 years. How long will it take $300 to double if it eans the TIME FOR A LUMP SUM TO DOUBLE following rates? Compounding occurs once a year. a. 6% b. 13% c. 21% d. 100% 5-13 -14 FUTURE VALUE OF AN ANNUITY Find the future values of these ordinary amuities Compounding occurs once a year. a. S500 per year for 8 years at 14% $250 per year for 4 years at 7% c. $700 per year for 4 years at 0% d. Rework parts a, b, and c assuming they are annuities due. PRESENT VALUE OF AN ANNUITY Find the present values of these ordinary annuities Discounting occurs once a year. -15 a. $600 per year for 12 years at 8% b, $300 per year for 6 years at 4% C. $500 per year for 6 years at 0% d. Rework parts a, b, and c assuming they are annuities due. PRESENT VALUE OF A PERPETUITY What is the present value of a $600 perpetuity if the interest rate is 5%? If interest rates doubled to 10%, what would its present value be? 16 You borrow $230,000; the annual loan payments are EFFECTIVE INTEREST RATE $20,430.31 for 30 years. What interest rate are you being charged? 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts