Question: 598 APPENDIX C: COMPOUND INTEREST TABLES 1% Compound Interest Factors 1% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient

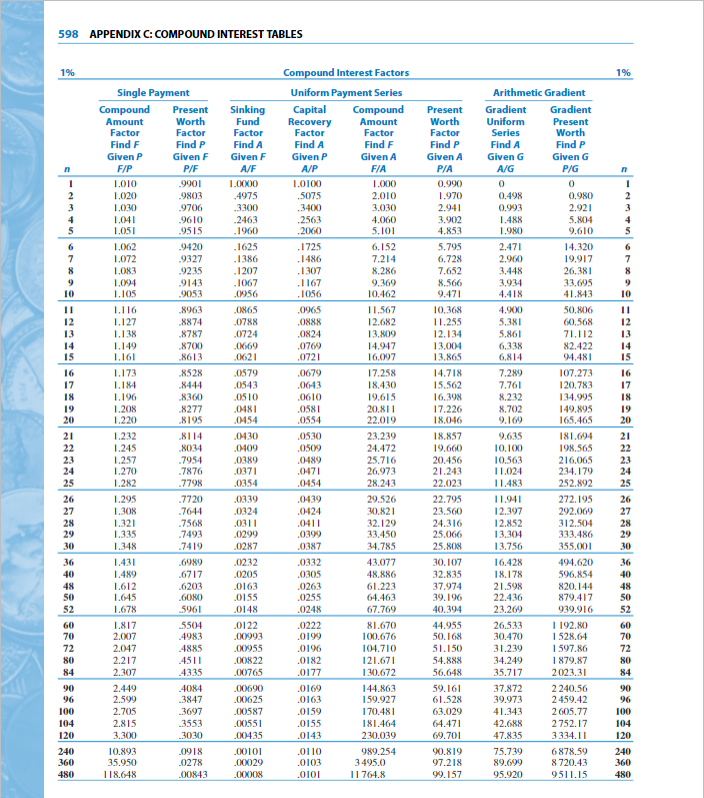

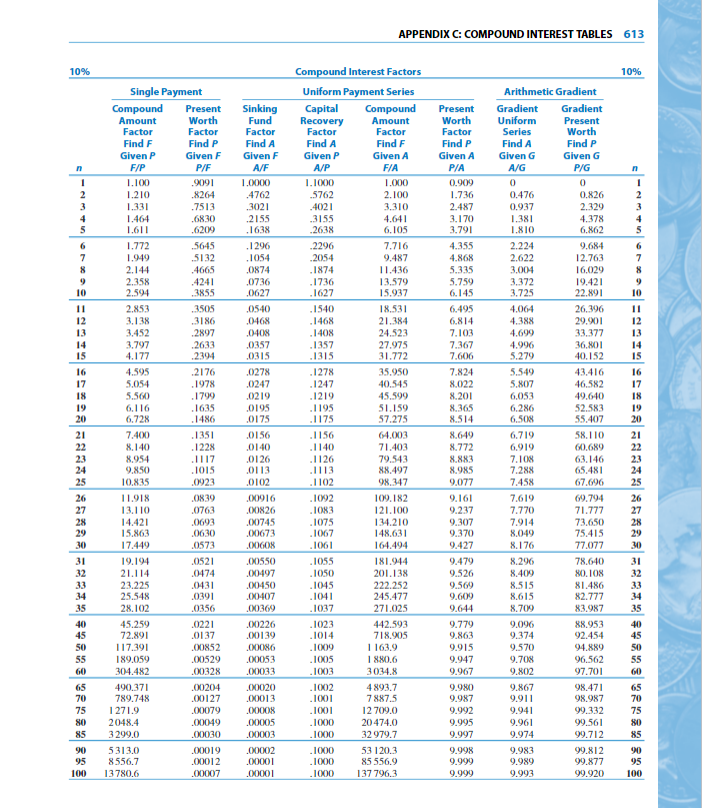

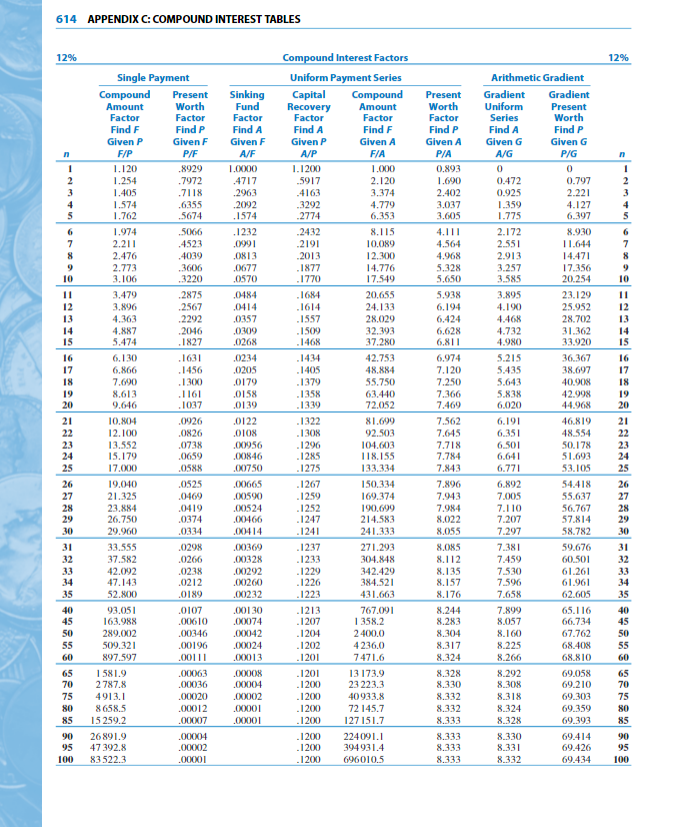

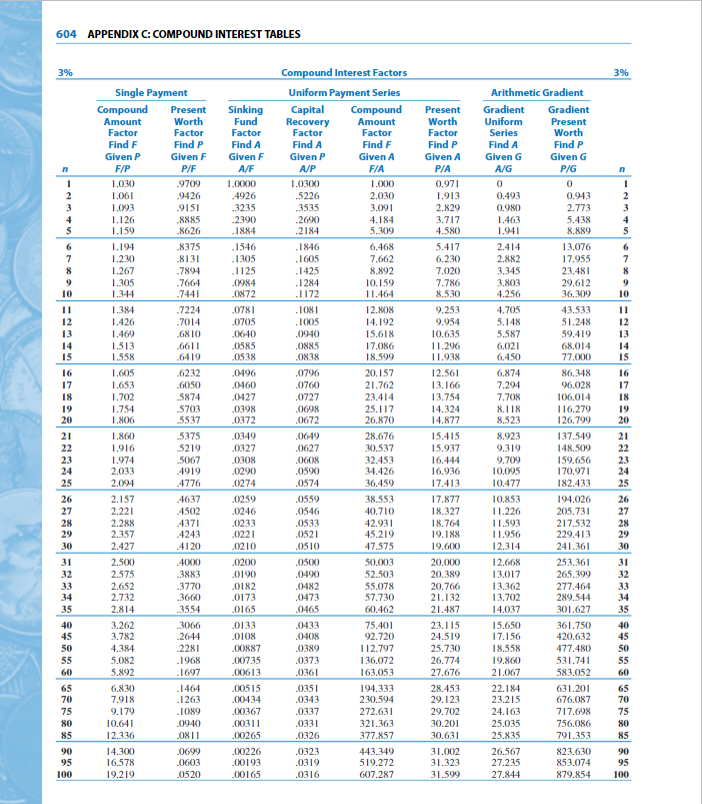

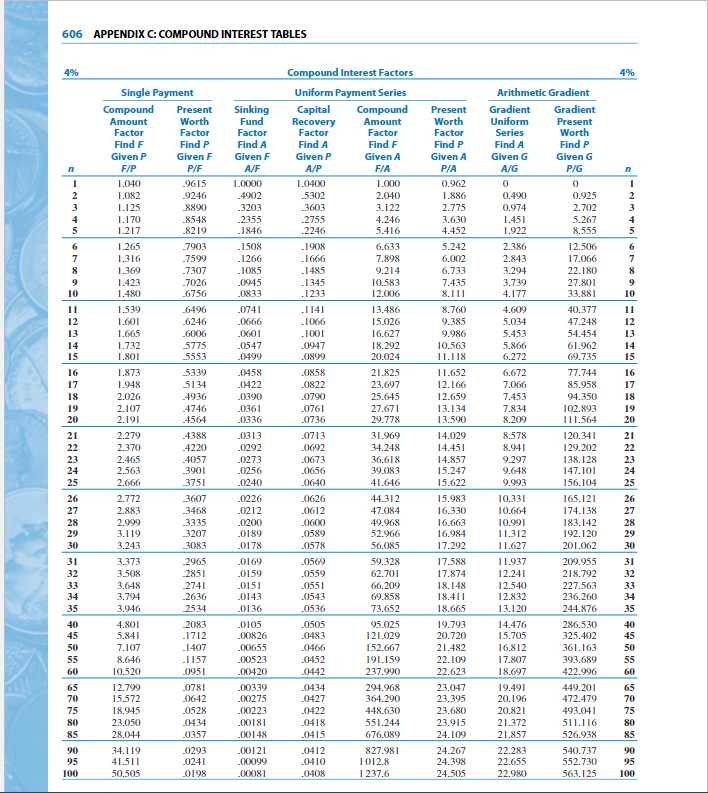

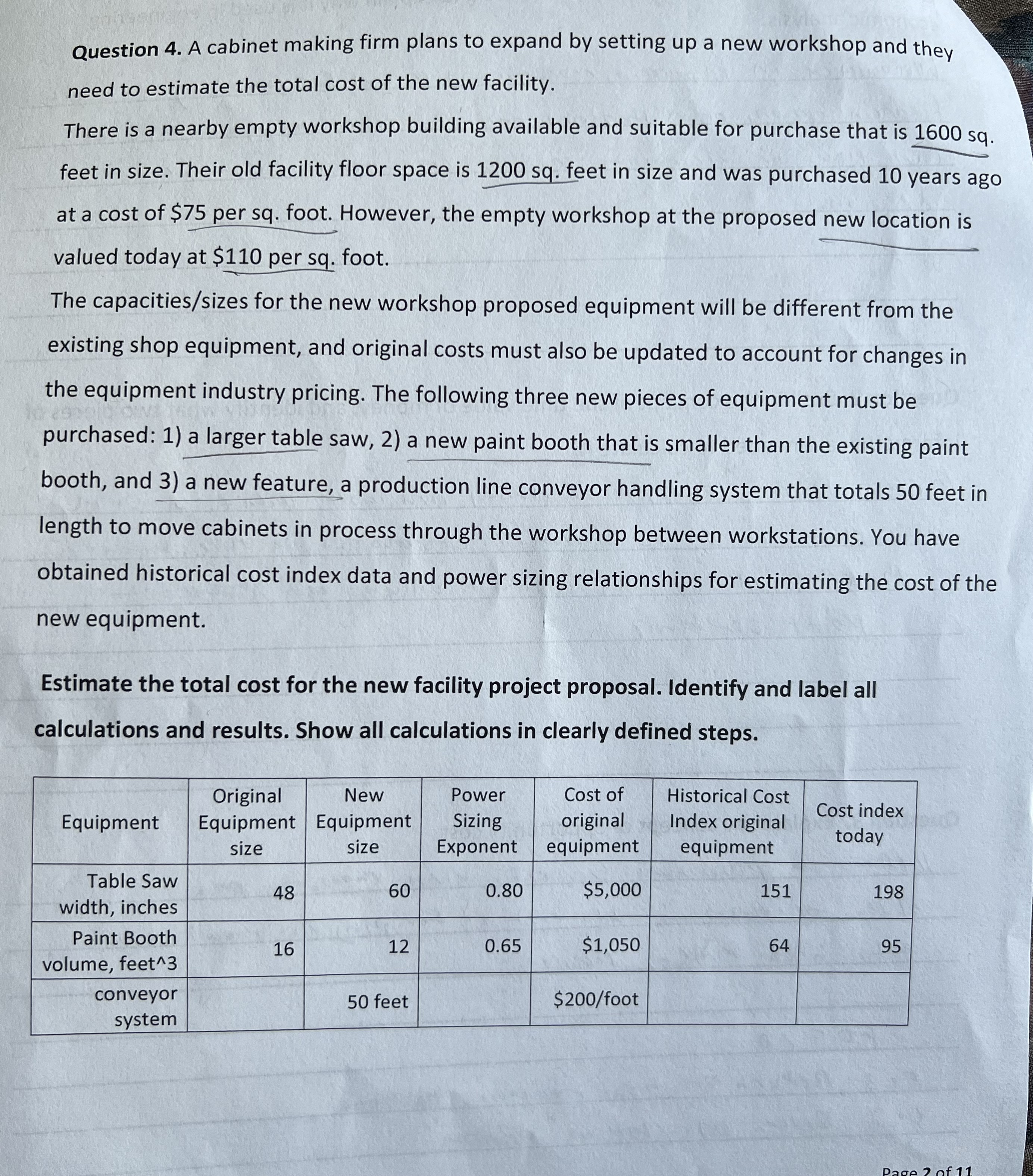

598 APPENDIX C: COMPOUND INTEREST TABLES 1% Compound Interest Factors 1% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient Gradient Amount Worth Fund Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Factor Series Worth Find F Find P Find A Find A Find F Find P Find A Find P Given P Given F Given F Given P Given A Given A Given G Given G F/P P/F A/F A/P F/A P/A A/G P/G 1.010 -9901 1.0000 1.0100 1.000 0.990 0 1.020 -9803 4975 .5075 2.010 1.970 D.498 0.980 1.030 -9706 -3300 .3400 3.030 2.941 0.993 2.921 1.041 9610 .2463 .2563 4.060 3.902 .488 5.80 1.051 -9515 1960 2060 5.101 4.853 1.980 9.610 1.062 9420 1625 1725 6.15 5.795 2.471 14.320 1.072 9327 1386 1486 7.214 6.728 2.960 19,917 1.083 .9235 1207 .1307 8.286 7.65 3.448 26.381 1,094 .9143 1067 .1167 9.369 8.566 3.934 33.695 1.105 .9053 0956 1056 10,462 9.47 4.418 41.843 1.1 16 .8963 0865 .0965 11.567 10.368 4.900 50.806 1.127 .8874 0788 0888 12.682 11.255 5.381 60.568 1.138 -8787 0724 0824 13,809 12.134 5.861 71.1 12 1.149 8700 0669 0769 14.947 13,004 6.338 82.422 14 1.161 8613 0621 .0721 16.097 13.865 6.814 94.481 15 1.173 8528 .0579 17.258 14.718 7.289 107.273 16 1,184 .8444 0543 .0643 18,430 15.562 7.761 120.783 17 1.196 -8360 0510 .0610 19.615 16.398 8.232 134.995 18 1.208 -8277 O48I 0581 20.81 1 17.226 8.702 149.895 19 1.220 8195 0454 0554 22.019 18,0-46 9.169 165.465 20 1.232 81 14 .0430 .0530 23.239 18.857 9.635 181.694 21 1.245 8034 .0509 24.472 19.660 10.100 198.565 22 1.257 .7954 .0389 .0-489 25.716 20.456 10.563 216.065 23 1.270 .7876 .0371 .0471 26.973 21.243 1 1.024 234.179 24 1.282 -7798 0354 0454 28.243 22.023 1 1.483 252.892 25 1.295 .7720 .03.39 .0439 29.526 22.795 11.941 272.195 26 1.308 .7644 0324 .0424 30.821 23.560 12.397 292.069 27 1.321 .7568 031 .0411 32.129 24.316 12.852 312.504 28 1.335 .7493 0299 0399 33.450 25.060 13.304 333.480 29 1.348 -7419 0247 .0387 34.785 25.808 13.756 355.001 30 36 1.431 6989 1232 0332 43.077 30.107 16.428 494.620 36 1.489 6717 0205 0305 48.886 32.835 18.178 596.854 40 1.612 6203 0163 0263 61.223 37.974 21.598 820.144 48 1.645 0155 .0255 64.463 39.196 22.436 879.417 50 1.678 5961 0148 .0248 67.769 40.394 23.269 939.916 52 60 1.817 5504 0122 0227 $1.670 44.955 26.533 1 192.80 60 70 2.007 4983 .00993 .0199 100.676 50.168 30.470 1 528.64 70 72 2.047 -4835 00955 0196 104.710 51.150 31.239 1 597.86 72 80 2.217 4511 00822 .0182 121.671 54.888 34.249 1 879.87 80 84 2.307 335 00765 0177 130.672 56.648 35.717 2023.31 84 90 2.449 4084 00690 .0169 144.863 59.161 37.872 2 240.56 90 96 2.599 -3847 00625 .0163 159.927 61.528 39.973 2 459.42 96 100 2.705 -3697 00587 .0159 170.481 63.029 41.343 2 605.77 100 104 2.815 .3553 00551 .0155 181.464 64.471 42.688 2 752.17 104 120 3.300 3030 00435 .0143 230.039 69.701 47.835 3334.11 120 240 10.893 0918 00101 .0110 989.254 90.819 75.739 6878.59 240 360 35.950 _0278 100029 0103 3495.0 97.218 89.699 8 720.43 360 480 1 18.648 00843 00008 .0101 11 764.8 99.157 95.920 9511.15 480APPENDIX C: COMPOUND INTEREST TABLES 613 10% Compound Interest Factors 10% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient Gradient Amount Worth Fund Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Factor Series Worth Find F Find P Find A Find A Find F Find P Find A Find P Given P Given F Given F Given P Given A Given A Given G Given G F/P P/F A/F A/P F/A P/A A/G P/G 1.10 9091 1.000 1.1000 1.000 0.909 0 1.210 .8264 .4762 -5762 2.100 1.736 0.476 0.826 1.331 .7513 .302 .402 1 3.310 2.487 0.937 2.329 1.464 .6830 2155 -3155 4.641 3.170 1.381 4.378 1.611 6209 1638 2638 6.105 3.791 $10 6.862 1.772 .5645 1296 .2296 7.716 4.355 2.224 9.684 1.949 5132 .1054 -2054 9.487 4.868 2.622 12.763 2.144 .4665 .0874 .1874 11.436 5.335 3.00- 16,029 2.358 4241 0736 1736 13.579 5.759 3,37 2.594 19.421 .3855 .0627 1627 15.937 6. 145 3,725 22.891 2.853 3505 .0540 1540 18.531 6.495 1.064 26.396 3.138 0468 11 .3186 .1468 21.384 6.814 4.388 29.901 3,452 12 .2897 .0408 .1408 24.523 7.103 4.699 33.377 13 3,797 .2633 0357 .1357 27.975 7.367 4.996 4.177 36,80 14 .2394 0315 .1315 31.772 7.606 5.279 10.152 15 4.595 2176 0271 1278 35.950 7.824 5.549 43.416 5.054 16 .1978 .0247 1247 40.545 8.022 5.807 46.582 17 5.560 1790 0219 .1219 45.599 8.201 6.053 49.640 18 6.116 1635 0195 .1195 51.159 8.365 6.286 52.583 19 6.728 .1486 0175 .1175 57.275 8.514 6.50 $5,407 20 7.400 1351 0156 1156 64.003 8.649 6.719 58. 1 10 8.140 21 .1228 .0140 .1140 71.403 8.772 6.919 60.689 22 4.954 1117 .0126 .1126 79.543 H.8H3 7. 1 08 23 9.850 63.140 .1015 .01 13 .1113 38.497 8.985 7.288 65.481 24 10.835 0923 .0102 1 102 98.347 9077 7.458 67.696 25 11.918 .0839 .00916 1092 109.182 9.161 7.619 69.794 13.1 10 26 .0763 00826 .1043 121.100 9.237 7.770 71.777 27 14.421 .0693 00745 .1075 134.210 9.307 7.914 15.863 73.650 .0630 00673 1067 148.631 9.370 8.049 75.415 29 17.449 0573 061 164.494 9.427 .176 77.077 30 19.194 .0521 00550 .1055 181.944 9.479 8.290 78.640 21.114 31 0474 00497 -1050 201.138 9.526 8.409 80. 108 32 23.225 .0431 00450 .1045 222.252 9.569 8.515 33 25.548 $1.486 .0391 00407 -1041 245.477 9.609 8.615 42.777 34 28.102 .0356 00369 037 271.025 9.644 8.709 43.987 15 40 45.259 0221 00226 .1023 45 442.593 9.779 9.096 68.953 72.891 .0137 .00139 -1014 718.905 9.863 9.374 92.454 45 50 1 17.391 00852 00086 -1009 1 163.9 9015 9.570 94.889 50 55 189.059 00529 00053 1005 1 880.6 9.947 9,708 96.562 55 60 304.482 00328 EEDOO 1003 3034.8 9.967 9.80 7.701 60 490.371 00204 00020 1002 70 4 893.7 9.980 9.867 98.471 789.748 00127 65 75 00013 1001 7 887.5 9.987 9.911 98.987 70 1 271.9 .00079 .00008 .1001 12 709.0 9.992 9.941 99.332 75 80 2048.4 00049 00005 .1000 20 474.0 0995 9.961 99.561 80 3299.0 050OO 00003 1000 32 979.7 9.997 9 974 99.712 90 5313.0 00019 .00002 1000 53 120.3 9.998 9.983 99.812 90 8556.7 00012 .00001 -1000 85 556.9 9.999 9.989 95 100 99.877 13780.6 00007 .00001 -1000 137 796.3 9.999 9.993 99.920 100614 APPENDIX C: COMPOUND INTEREST TABLES 12% Compound Interest Factors 12% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient Gradient Amount Worth Fund Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Factor Series Worth Find F Find P Find A Find A Find F Find P Find A Find P Given P Given F Given F Given P Given A Given A Given G Given G F/P P/F A/F A/P IE F/A P/A A/G P/G 1.120 8929 1.0000 1.1200 1.000 0.893 1.254 .7972 4717 5917 2.120 1.690 0.47 0.797 1.405 71 18 .2963 4163 3.374 2.402 0.925 2.221 1.574 .6355 2092 -3292 4.779 3.037 1.359 4.127 1.762 5674 1574 -2774 6.353 3.605 1.775 6.397 1.974 5066 1232 2432 8.115 4.111 2.172 8.930 2.21 1 4523 .0991 .2191 10.089 4.564 2.551 1 1.644 2.476 .4039 0813 -2013 12.300 4.968 2.913 14.471 2.773 3606 0677 1877 14.776 5.328 3.257 17.356 3.106 3220 0570 1770 7.549 5.650 3.585 20.254 3.479 2875 0484 .1684 20.655 5.938 3.895 23.129 3.896 .2567 .0414 -1614 24.133 6.194 4.190 25.952 4.363 .2292 0357 1557 28,029 6.424 4.468 28.702 4.887 2046 0309 .1509 32.393 6.628 4.732 31.362 5.474 1827 1268 1468 37.280 6.81 1 4.980 33.920 6.130 1631 0234 143 42.753 6,974 5.215 36-367 . 1456 0205 .1405 48.884 7,120 5.435 38.697 7.690 .1300 0179 .1379 55.750 7.250 5.643 40.908 8,613 1161 0158 -1358 63.440 7.360 5.838 42 998 9.646 1037 0139 1330 72.052 7.469 6.020 44.968 10.804 0926 0122 1327 81.699 7.562 6.191 46.819 12.100 .0826 1308 92.503 7.645 6.351 18.554 13.552 .0738 00956 .1296 104.603 7.718 6.501 50.178 15.179 .0659 00846 .1285 1 18.155 7.784 6.641 51.693 25 17.000 1588 00750 1275 133.334 7.843 6.771 $3.105 19.040 .0525 00665 1267 150.334 7.896 6.892 54.418 21.325 0469 00590 .1259 169.374 7.943 7.005 55.637 23.884 0419 00524 - 1252 190.699 7.984 7.110 56.767 26.750 0374 00466 -1247 214.583 8.022 7.207 57.814 29.960 0334 00414 1241 241.133 4.055 7.297 58.782 31 33.555 0298 00369 1237 271.293 8.085 7.381 59.676 32 37.582 .0266 00328 1233 304.848 8.112 7.459 60-501 33 42.092 0238 00292 .1229 342.429 8.135 7.530 34 61.261 47.143 0212 00260 .1226 384.521 8.157 7.596 61.961 35 52.800 0189 00232 1223 431.663 4.176 7.65 62.605 40 93.051 0107 00130 .1213 767.091 8.244 7.899 65.1 16 45 163.988 00610 00074 1207 1 358.2 8.283 8.057 66.734 50 289.002 00346 00042 120 2400.0 8.304 8.160 67.762 509.321 00196 00024 . 1202 4236.0 8.317 8.225 68.408 60 897.597 001 11 00013 1201 7471.6 8.324 8.266 68.810 65 1 581.9 00063 1201 13 173.9 9.328 3.292 69.058 65 70 2787.8 00036 .00004 1200 23 223.3 8.330 8.308 69.210 75 4913.1 00020 00002 1200 40 933.8 8.332 8.318 69.303 80 8658.5 .00012 00001 1200 72 145.7 8.332 8.324 69.359 80 85 15 259.2 00007 00001 1200 127 151.7 8.333 8.328 69.393 85 06 26891.9 00004 1200 224091.1 8.333 8.330 69.414 90 47 392.8 00002 1200 394 931.4 8.333 8.331 69.426 95 100 83 522.3 00001 1200 696010.5 8.333 8.332 69.434 100604 APPENDIX C: COMPOUND INTEREST TABLES 3% Compound Interest Factors 3% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient Gradient Amount Worth Fund Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Factor Series Worth Find F Find Find A Find A Find F Find Find A Find P Given P Given F Given F Given Given A Given A Given G Given G F/P P/F A/F A/P F/A P/A A/G P/G n 1.030 .9709 1.0000 1.0300 1.OOO 0.971 0 1.061 9426 4926 5226 2.030 1.913 0.493 0.943 1.093 .9151 3235 .3535 3.091 2.829 0.980 2.773 1.126 .8885 -2390 .2690 4.184 3.717 1.463 5.438 1.159 .8626 .1884 .2184 5.309 4.580 1.941 8.889 1.194 8375 546 1846 6.468 5.417 2.414 13.076 1.230 .8131 1305 .1605 7.662 6.230 2.882 17.955 1.267 -7894 1 125 1425 8.892 7.020 3.345 23.481 1.305 7664 0984 1284 10.159 7.786 3,803 29.612 1.344 7441 0872 1172 11.464 8.530 4.256 36.309 1.384 .7224 0781 1081 12.808 9,253 4,705 43.533 1.426 .7014 0705 1005 14.192 9.954 5.148 51.248 1.469 6810 0640 .0940 15.618 10.635 5.587 59.419 1.513 661 1 0985 .0885 17.086 11.296 6,021 68.014 1.558 6419 0538 08 48 18.599 1.938 6,450 77.000 16 1.605 .6232 496 0796 20.157 12.561 6.874 46.348 16 1.653 -6050 0460 0760 21.762 13.166 7.294 96.028 17 1.702 5874 0427 .0727 23.414 13.754 7.708 106.014 1.754 $703 039 25.117 14.324 H. 1 18 1 16.279 19 1.806 5537 0372 0672 26.870 4.523 126.799 20 21 1.860 5375 034 0649 28.676 15.415 8.923 137.549 22 1.916 5219 0327 1627 30.537 15.937 9.319 148.509 23 1.974 5067 0308 32.453 16.444 9.709 159.656 24 2.033 -4919 0290 .0590 34.426 16.930 10.095 170.971 25 2.094 4776 0274 0574 36.459 17.413 10.477 182.433 25 26 2.157 4637 0259 .0559 38.553 17.877 10.853 194.026 26 27 2.221 -4502 024G .0546 10.710 18.327 1 1.226 205.731 27 28 2.288 -4371 .0233 .0533 42.931 18.764 11.593 217.532 28 29 2.357 .4243 .0221 .0521 45.219 19.188 11.956 229.413 29 30 2.427 4120 0210 0510 47.575 19.600 12.314 241.361 30 31 2.500 4000 .0200 .0500 50.003 20.000 12.668 253.361 31 32 2.575 .3883 0190 .0490 52.503 20.389 13.017 265.309 32 33 2.652 .3770 0182 0482 55.078 20.766 13.362 277.464 33 34 2.732 .3660 0173 .0473 57.730 21.132 13.702 289.544 34 35 2.814 3554 0165 0465 60.462 21.487 14.037 301.627 35 40 3.262 3066 .0133 .0433 75.401 23.1 15 15.650 361.750 40 45 3.782 2644 0108 0408 92.720 24.519 17.156 420.632 45 50 4.384 .2281 00887 .038 1 12.797 25.730 18.558 477.480 50 55 5.082 .1968 00735 0373 136.072 26.774 19.860 531.741 55 60 5.892 -1697 00613 0361 163.053 27.676 21.067 583.052 60 65 6.830 -1464 .00515 0351 194.333 28.453 22.184 631.201 65 70 7.918 .1263 00434 .0343 230.594 29.123 23.215 676.087 70 75 9.179 .1089 00367 .0337 272.631 29.702 24.163 717.698 75 80 10.641 .0940 0031 1 .0331 321.363 30.201 25.035 756.086 80 85 12.336 081 1 00265 .0326 377.857 IE9 OE 25.835 791.353 85 90 14.300 0699 00226 0323 443.349 31.002 26.567 823.630 90 95 16.578 00193 519.272 31.323 27.235 853.074 95 100 19.219 0520 00165 .0316 607.287 31.599 27.844 879.854 100606 APPENDIX C: COMPOUND INTEREST TABLES 4% Compound Interest Factors 4% Single Payment Uniform Payment Series Arithmetic Gradient Compound Present Sinking Capital Compound Present Gradient Gradient Amount Worth Fund Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Factor Series Worth Find F Find P Find A Find A Find F Find P Find A Find P Given P Given F Given F Given P Given A Given A Given G Given G F/ P/F A/ A/F F/A P/A A/G P/G 1.040 9615 1.0000 1.0400 1.000 0.962 0 1.082 9246 -4902 5302 2.040 1.886 0.490 0.925 1.125 .8890 .3203 3603 3.122 2.775 0.974 2.702 1.170 8548 .2355 2755 4.246 3.630 1.451 5.267 1.217 8219 .1846 2246 5.416 4.452 1.922 8.555 1.265 7903 1508 1908 6.633 5.242 2.386 12.506 1.316 -7599 -1266 .1666 7.898 6.002 2.843 17.066 1.369 .7307 -1085 1485 9.214 6.733 3.294 22.180 1.423 7026 -0945 .1345 10.583 7.435 3.734 27.801 1.480 6756 0833 1233 12.006 8.111 4.177 33.881 1.539 6496 .0741 1141 13.480 8.760 4.609 40.377 1.60 .6246 666 1066 15.026 9.385 5.034 47.248 1.665 -6006 -0601 . 1001 16.627 9.986 5.453 54.454 1.732 577 _0547 0947 18.292 10.563 5.860 61.962 1.801 5553 .0499 0899 20.024 11.118 6.272 69.735 16 1.873 5339 -0458 0858 21.825 11.652 6.672 77.744 17 1.948 5134 -0422 23.697 12.166 7.066 85.958 18 2.026 4936 -0390 .0790 25.645 12.659 7.453 94.350 19 2.107 4746 -0361 .0761 27.671 13.134 7.834 102.893 20 2.191 456 330 .0736 29.778 13.590 8.209 1 1 1.564 21 2.279 4388 0313 0713 31.969 14.029 8.578 120.341 22 2.370 4220 .0292 0692 34.248 14.451 8.941 129.202 23 2.465 .4057 _0273 0673 36.618 14.857 9.297 138.128 24 2.563 390 -0256 0656 39.083 15.247 9.648 147.101 25 2.666 .3751 .0240 .0640 41.646 15.622 9.993 56.104 26 2.772 -3607 .0226 .0626 44.312 15.983 10.331 165.121 27 2.883 .346 -0212 .0612 47.084 16.330 10.664 174.138 28 2.999 3335 -0200 .0600 19.968 16.663 10.991 183.142 29 3.119 3207 -0189 52.966 16.984 11.312 192.120 30 3.243 3083 0178 0578 56.085 17.292 1 1.627 201.062 31 3.373 2965 .0169 .0569 59.328 17.588 11.937 209.955 31 32 3.508 2851 .0159 0559 62.701 17.874 12.241 218.792 32 33 3.648 2741 -0151 .0551 66.209 18.148 12.540 227.563 33 34 3.79 2636 0143 .0543 69.858 18.411 12.832 236.260 34 35 3.946 2534 0136 0536 73.652 18.665 13.120 244.876 35 40 4.801 208. 0105 .0505 95.025 19.793 14.476 286.530 45 5.841 -1712 00826 .0483 121.029 20.720 15.705 325.402 50 7.107 -1407 -00655 .0466 152.667 21.482 16.812 361.163 55 8.646 1157 00523 0452 191.159 22.109 17.807 393.689 60 10.520 0951 00420 .0442 237.990 22.623 18.697 22.996 60 65 12.799 0781 00339 0434 294.968 23.047 19.491 449.201 65 70 15.572 0642 00275 0427 364.290 23.395 20.196 472.479 70 75 18.945 0528 00223 .0422 448.630 23.680 20.821 493.041 75 80 23.050 0434 00181 .0418 551.244 23.915 21.372 511.116 80 85 28.044 0357 00148 .0415 676.089 24.109 21.857 526.938 85 90 34.119 0293 .00121 .0412 827.981 24.267 22.283 540.737 95 41.511 -0241 -00099 0410 1012.8 24.398 22.655 552.730 100 50.505 0198 -00081 0408 1237.6 24.505 22.980 563.125 100Question 4. A cabinet making firm plans to expand by setting up a new workshop and they need to estimate the total cost of the new facility. There is a nearby empty workshop building available and suitable for purchase that is 1600 sq. feet in size. Their old facility floor space is 1200 sq. feet in size and was purchased 10 years ago at a cost of $75 per sq. foot. However, the empty workshop at the proposed new location is valued today at $110 per sq. foot. The capacities/sizes for the new workshop proposed equipment will be different from the existing shop equipment, and original costs must also be updated to account for changes in the equipment industry pricing. The following three new pieces of equipment must be purchased: 1) a larger table saw, 2) a new paint booth that is smaller than the existing paint booth, and 3) a new feature, a production line conveyor handling system that totals 50 feet in length to move cabinets in process through the workshop between workstations. You have obtained historical cost index data and power sizing relationships for estimating the cost of the new equipment. Estimate the total cost for the new facility project proposal. Identify and label all calculations and results. Show all calculations in clearly defined steps. Original New Power Cost of Historical Cost Index original Cost index Equipment Equipment Equipment Sizing original today size size Exponent equipment equipment Table Saw 48 60 0.80 $5,000 151 198 width, inches Paint Booth 16 12 0.65 $1,050 64 95 volume, feet^3 conveyor 50 feet $200/foot system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts