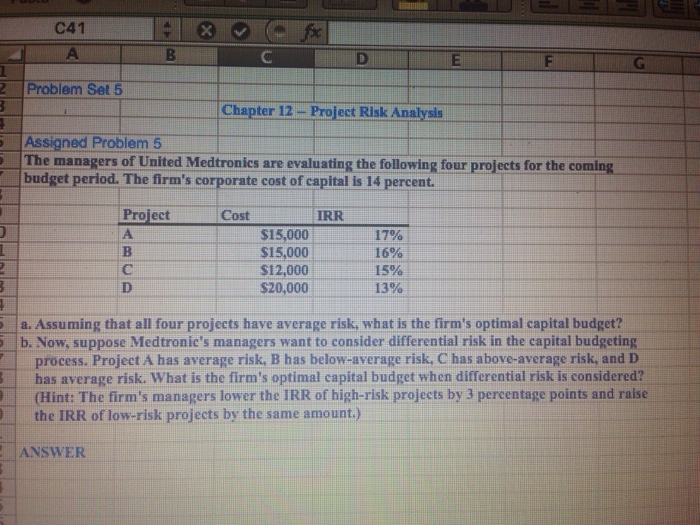

Question: 5.-I need help with this problem... Plz! add equations and functions so I can understand how you got the answer... thx! C41 Problem Set 5

C41 Problem Set 5 Chapter 12-Project Risk Analysis Assigned Problem 5 The managers of United Medtronics are evaluating the following four projects for the coming budget period. The firm's corporate cost of capital is 14 percent. IRR Cost $15,000 16% $15,000 15% $12,000 D $20,000 13% a. Assuming that all four projects have average risk, what is the firm's optimal capital budget? b. Now, suppose Medtronic's managers want to consider differential risk in the capital budgeting process. Project A has average risk, B has below-average risk, Chas above-average risk, and D has average risk. What is the firm's optimal capital budget when differential risk is considered? (Hint: The firm's managers lower the IRR of high-risk projects by 3 percentage points and raise the IRR of low-risk projects by the same amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts