Question: 5pls help me, need URGENT answer and i will give you a rhumbs up! Sly, a plastics processor, is considering the purchase of a high-speed

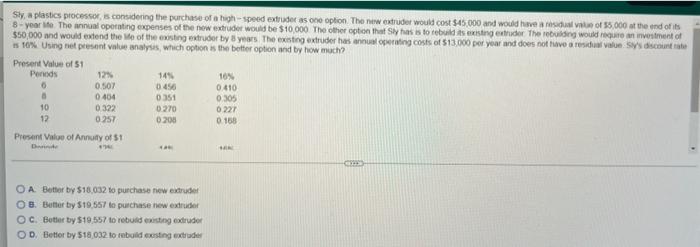

Sly, a plastics processor, is considering the purchase of a high-speed extruded as one option. The new extruder would cost $45.000 and would have a le of 35,000 at the end of its 8-year to The annual operating expenses of the new extruder would be $10,000 The other option that Si has to rebuild its existing studer Themen would recure anvestment of $50,000 and would extend the We of the existing extruder by years. The existing extruder has annual operating costs of $13.000 per year and does not have a residuales discount rate is 10% Using net present value analysis, which ophon is the better option and by how much? Present Value of 51 Penes 12% 149 10% 6 0.507 0456 0.410 . 0404 0351 0.305 10 0.322 0270 0227 12 0257 0 200 0 168 Present Value of Annully of 51 Dan OA Better by $18.032 to purchase new extruder OB Butter by S10.557 to purchase new extruder OC Bottet by $19,557 to rebuldeisting extruder OO Better by 518,032 to rebuild costing extruder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts