Question: 5th time posting ... please give me correct solution... I will upvote thanks in advance 3 of 117 complete) HW Score: 39.39%, 4.33 of 11

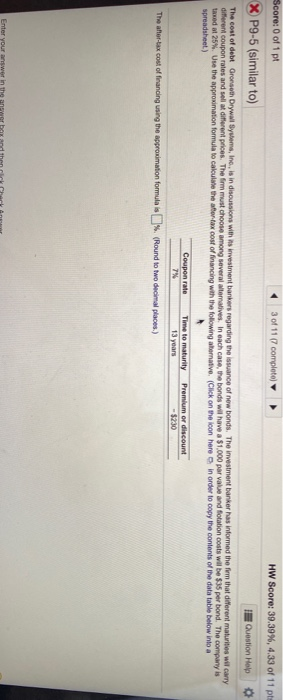

3 of 117 complete) HW Score: 39.39%, 4.33 of 11 pts Score: 0 of 1 pt X P9-5 (similar to) Question Help The cost of debt Gronseth Drywall Systems, Ino, is in discussions with is investment bankers regarding the issuance of new bonds. The investment banker as informed the firm that different maurities will carry different coupon rates and sell at different prices. The firm must choose among several tomatives in each case, the bonds will have a $1.000 par value and Rotation costs will be $35 per bond. The company is laxed at 25%. Use the approximation formula to calculate the after tax cost of financing with the following alternative (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Coupon rate Time to maturity 13 years Premium or discount The after-tax cost of financing using the approximation formules % (Round to two decimal places) Enter your answer in the answer box and thenrik Chery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts