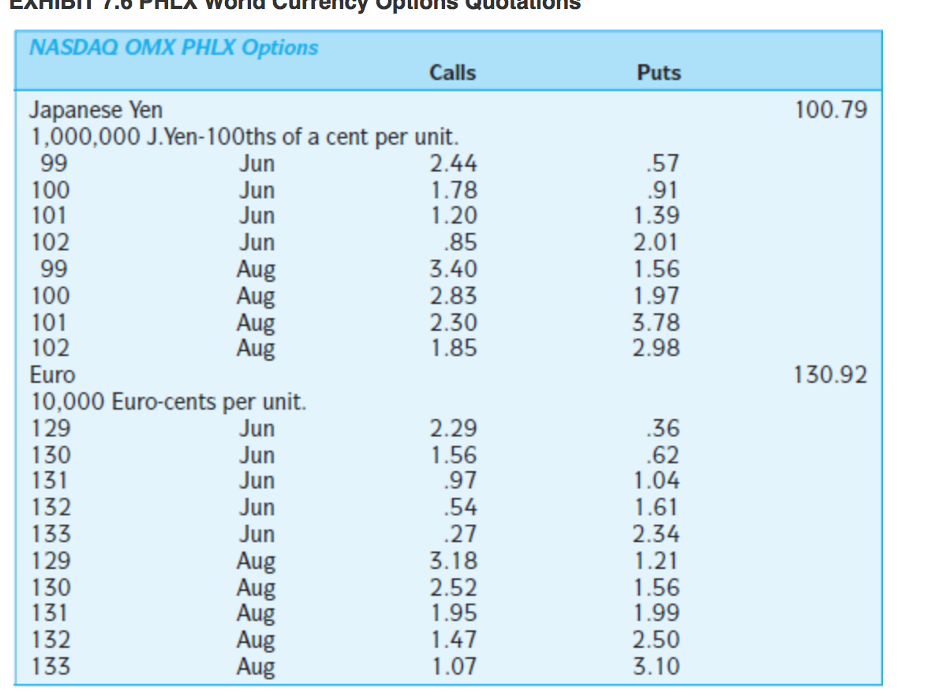

Question: 5.)Using the market data in Exhibit 7.6, calculate the net terminal value of a long position in one 110 Sep Japanese yen European put contract

5.)Using the market data in Exhibit 7.6, calculate the net terminal value of a long position in one 110 Sep Japanese yen European put contract at the terminal spot price (stated in U.S. cents per 100 yen) of 112. Ignore any time value of money effect. (USD, no cents)

6.)Assume that the Japanese yen is trading at a spot price of 110.66 cents per 100 yen. Further assume that the premium of an American call option with a strike price of 110 is 2.24 cents. Calculate the intrinsic value of the call option. (X.XX)

NASDAQ OMX PHLX Options Calls Puts 100.79 .57 .91 1.39 2.01 1.56 1.97 3.78 2.98 Japanese Yen 1,000,000 J.Yen-100ths of a cent per unit. 99 Jun 2.44 100 Jun 1.78 101 Jun 1.20 102 Jun .85 99 Aug 3.40 100 Aug 2.83 101 Aug 2.30 102 Aug 1.85 Euro 10,000 Euro-cents per unit. 129 Jun 2.29 130 Jun 1.56 131 Jun .97 132 Jun .54 133 Jun .27 129 Aug 3.18 130 Aug 2.52 131 Aug 1.95 132 Aug 1.47 133 Aug 1.07 130.92 .36 .62 1.04 1.61 2.34 1.21 1.56 1.99 2.50 3.10 NASDAQ OMX PHLX Options Calls Puts 100.79 .57 .91 1.39 2.01 1.56 1.97 3.78 2.98 Japanese Yen 1,000,000 J.Yen-100ths of a cent per unit. 99 Jun 2.44 100 Jun 1.78 101 Jun 1.20 102 Jun .85 99 Aug 3.40 100 Aug 2.83 101 Aug 2.30 102 Aug 1.85 Euro 10,000 Euro-cents per unit. 129 Jun 2.29 130 Jun 1.56 131 Jun .97 132 Jun .54 133 Jun .27 129 Aug 3.18 130 Aug 2.52 131 Aug 1.95 132 Aug 1.47 133 Aug 1.07 130.92 .36 .62 1.04 1.61 2.34 1.21 1.56 1.99 2.50 3.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts