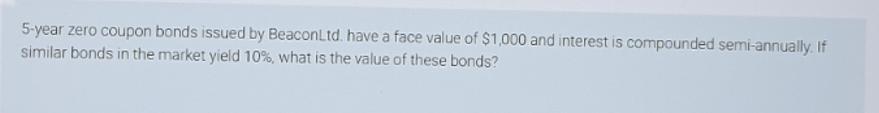

Question: 5-year zero coupon bonds issued by Beacon Ltd. have a face value of $1,000 and interest is compounded semi-annually. If similar bonds in the

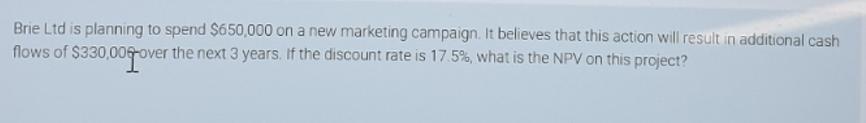

5-year zero coupon bonds issued by Beacon Ltd. have a face value of $1,000 and interest is compounded semi-annually. If similar bonds in the market yield 10%, what is the value of these bonds? Brie Ltd is planning to spend $650,000 on a new marketing campaign. It believes that this action will result in additional cash flows of $330,00 over the next 3 years. If the discount rate is 17.5%, what is the NPV on this project?

Step by Step Solution

3.34 Rating (166 Votes )

There are 3 Steps involved in it

To calculate the value of the 5year zero coupon bonds issued by Beacon Ltd we can use the formula fo... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642ef7073f31_972710.pdf

180 KBs PDF File

6642ef7073f31_972710.docx

120 KBs Word File