Question: 6 : 0 9 1 m , l 6 5 % Week 1 0 - Assignment: Horizontal and Vertical Analysis Question 3 of 3 Selected

: m

l

Week Assignment: Horizontal and Vertical Analysis

Question of

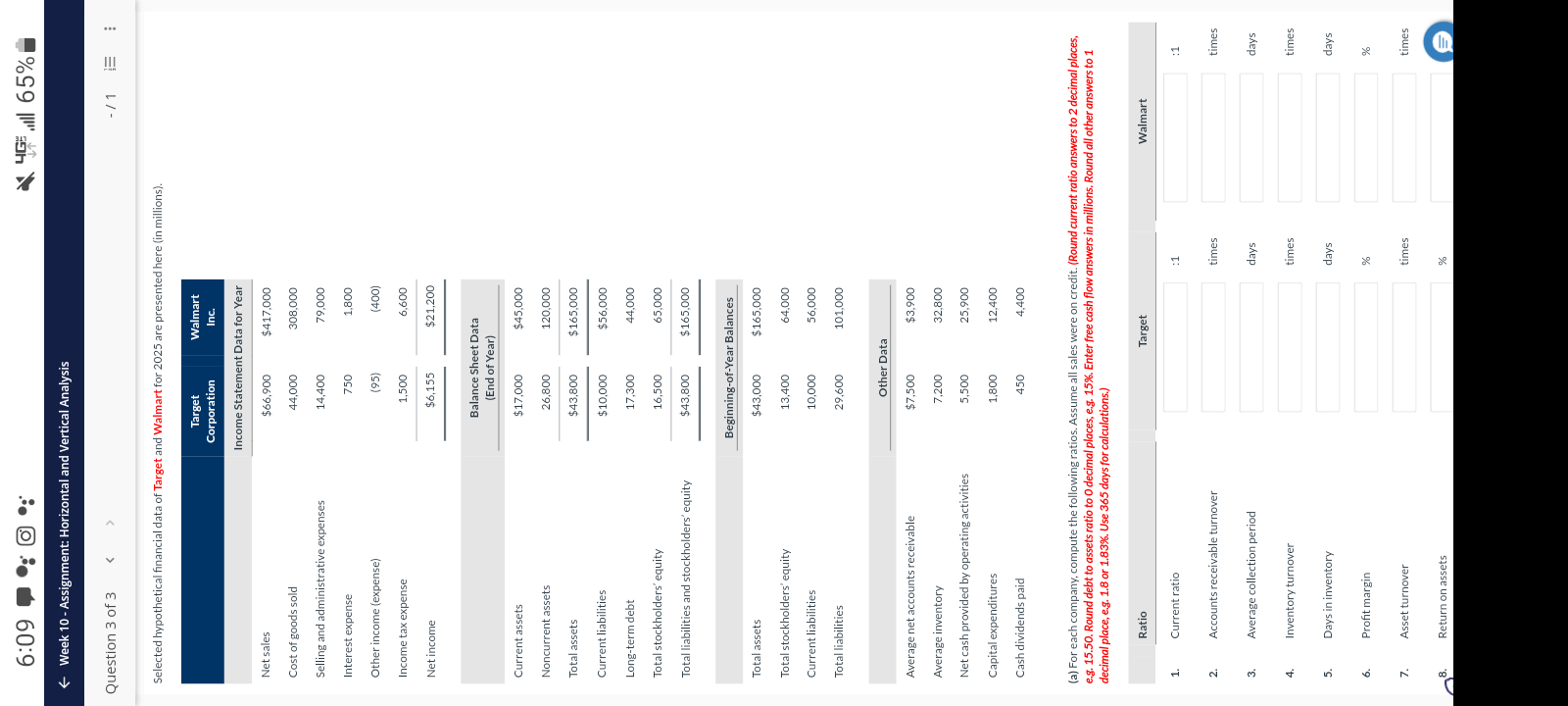

Selected hypothetical financial data of Target and Walmart for are presented here in millions

tabletableTargetCorporationtableWalmartIncIncome Statement Data for YearNet sales,$$Cost of goods sold,Selling and administrative expenses,Interest expense,Other income expenseIncome tax expense,Net income,$$tableBalance Sheet DataEnd of Year$$Noncurrent assets,Total assets,$$Current liabilities,$$Longterm debt,Total stockholders' equity,Total liabilities and stockholders' equity,$$BeginningofYear BalancesTotal assets,$$Total stockholders' equity,Current liabilities,Total liabilities,Other DataAverage net accounts receivable,$$Average inventory,Net cash provided by operating activities,Capital expenditures,Cash dividends paid,

a For each company, compute the following ratios. Assume all sales were on credit. Round current ratio answers to decimal places, eg Round debt to assets ratio to decimal places, eg Enter free cash flow answers in millions. Round all other answers to decimal place, eg or Use days for calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock