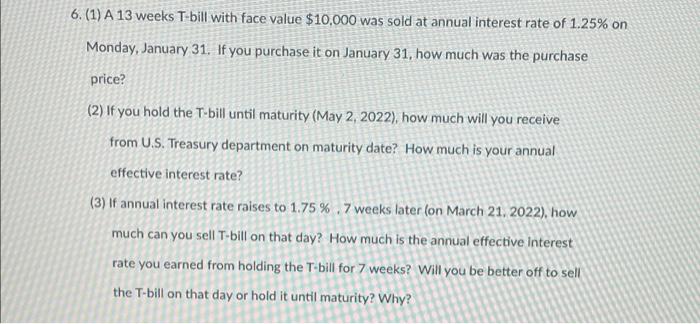

Question: 6. (1) A 13 weeks T-bill with face value $10,000 was sold at annual interest rate of 1.25% on Monday, January 31. If you purchase

6. (1) A 13 weeks T-bill with face value $10,000 was sold at annual interest rate of 1.25% on Monday, January 31. If you purchase it on January 31, how much was the purchase price? (2) If you hold the T-bill until maturity (May 2, 2022), how much will you receive from U.S. Treasury department on maturity date? How much is your annual effective interest rate? (3) If annual interest rate raises to 1.75% 7 weeks later (on March 21, 2022), how much can you sell T-bill on that day? How much is the annual effective interest rate you earned from holding the T-bill for 7 weeks? Will you be better off to sell the T-bill on that day or hold it until maturity? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts