Question: 6. (1 point) The same firm issues two different bonds. The bonds are identical in every respect except for their time to maturity. Bond A

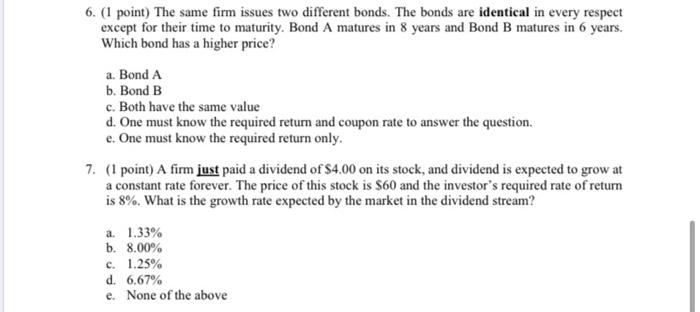

6. (1 point) The same firm issues two different bonds. The bonds are identical in every respect except for their time to maturity. Bond A matures in 8 years and Bond B matures in 6 years. Which bond has a higher price? a. Bond A b. Bond B c. Both have the same value d. One must know the required return and coupon rate to answer the question. e. One must know the required return only. 7. (1 point) A firm just paid a dividend of $4.00 on its stock, and dividend is expected to grow at a constant rate forever. The price of this stock is $60 and the investor's required rate of return is 8%. What is the growth rate expected by the market in the dividend stream? a. 1.33% b. 8.00% c. 1.25% d. 6.67% e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts