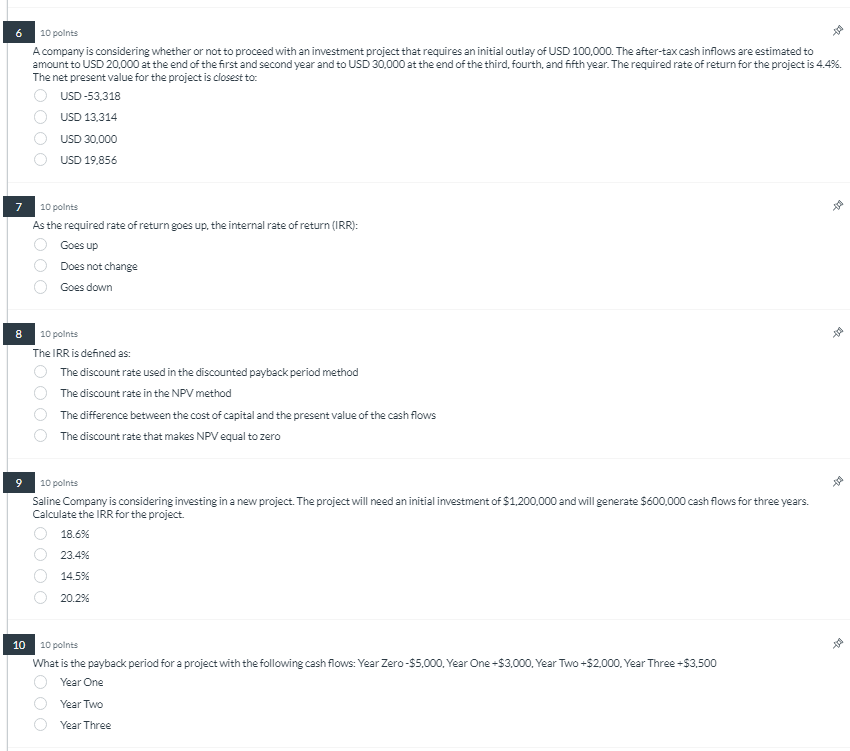

Question: 6 10 points A company is considering whether or not to proceed with an investment project that requires an initial outlay of USD 100,000. The

6 10 points A company is considering whether or not to proceed with an investment project that requires an initial outlay of USD 100,000. The after-tax cash inflows are estimated to amount to USD 20,000 at the end of the first and second year and to USD 30,000 at the end of the third, fourth, and fifth year. The required rate of return for the project is 4.4. The net present value for the project is closest to: O USD-53,318 USD 13,314 O USD 30,000 O USD 19.856 10 points As the required rate of return goes up, the internal rate of return (IRR): O Goes up Does not change O Goes down 8 10 points The IRR is defined as: O The discount rate used in the discounted payback period method O The discount rate in the NPV method O The difference between the cost of capital and the present value of the cash flows The discount rate that makes NPV equal to zero 9 10 points Saline Company is considering investing in a new project. The project will need an initial investment of $1,200,000 and will generate $600.000 cash flows for three years. Calculate the IRR for the project. O 18.6% O 23.4% O 14.5% O 20.29% 10 10 points What is the payback period for a project with the following cash flows: Year Zero-$5,000, Year One +$3,000, Year Two +$2,000. Year Three +$3,500 Year One O Year Two O Year Three

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts