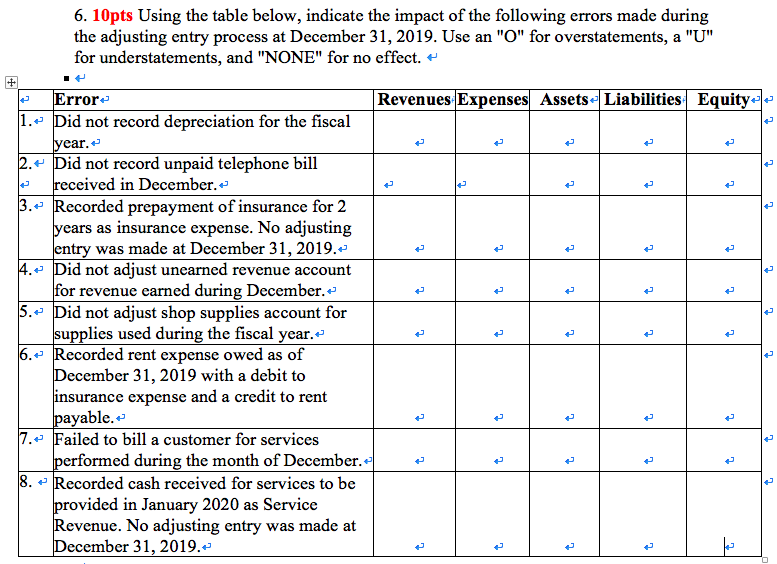

Question: 6. 10pts Using the table below, indicate the impact of the following errors made during the adjusting entry process at December 31, 2019. Use an

6. 10pts Using the table below, indicate the impact of the following errors made during the adjusting entry process at December 31, 2019. Use an "O" for overstatements, a "U" for understatements, and "NONE" for no effect. - le Revenues Expenses Assets. Liabilities Equity U t Errore 1.- Did not record depreciation for the fiscal year. 2.- Did not record unpaid telephone bill received in December. 3. Recorded prepayment of insurance for 2 years as insurance expense. No adjusting entry was made at December 31, 2019. 4. Did not adjust unearned revenue account for revenue earned during December. 5. Did not adjust shop supplies account for supplies used during the fiscal year.- 6. Recorded rent expense owed as of December 31, 2019 with a debit to insurance expense and a credit to rent payable. 7. Failed to bill a customer for services performed during the month of December. 8. ~ Recorded cash received for services to be provided in January 2020 as Service Revenue. No adjusting entry was made at December 31, 2019. t U t t t U t t t U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts