Question: 6. (15 points) Consider a two-year Treasury note. The bond pays coupons annually, with coupon rate 10%. The par value of the bond is $1,000.

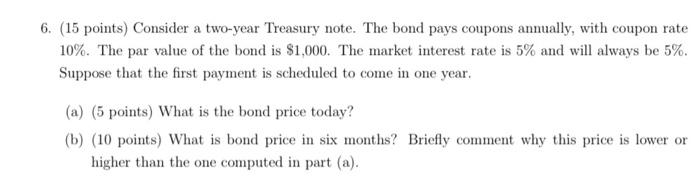

6. (15 points) Consider a two-year Treasury note. The bond pays coupons annually, with coupon rate 10%. The par value of the bond is $1,000. The market interest rate is 5% and will always be 5%. Suppose that the first payment is scheduled to come in one year. (a) (5 points) What is the bond price today? (b) (10 points) What is bond price in six months? Briefly comment why this price is lower or higher than the one computed in part (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts