Question: 6. (21 points) (Ch. 10) Measuring Economic Exposure. Using the following cost and revenue information shown for New England Corp., a U.S.-based company, determine how

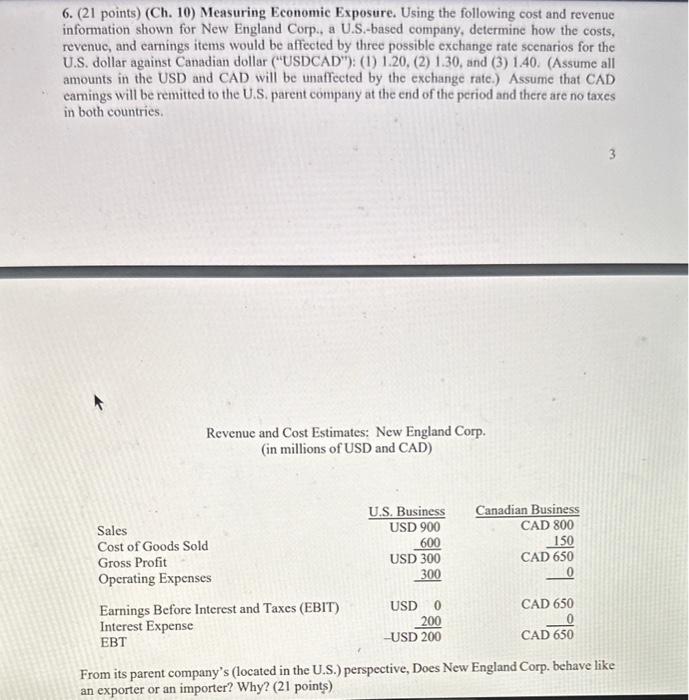

6. (21 points) (Ch. 10) Measuring Economic Exposure. Using the following cost and revenue information shown for New England Corp., a U.S.-based company, determine how the costs. revenuc, and carnings items would be affected by three possible exchange rate scenarios for the U.S. dollar against Canadian dollar ("USDCAD"): (1) 1.20, (2) 1.30, and (3) 1.40. (Assume all amounts in the USD and CAD will be unaffected by the exchange rate.) Assume that CAD camings will be remitted to the U.S. parent company at the end of the period and there are no taxes in both countries. Revenue and Cost Estimates: New England Corp. (in millions of USD and CAD) From its parent company's (located in the U.S.) perspective, Does New England Corp. behave like an exporter or an importer? Why? (21 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts