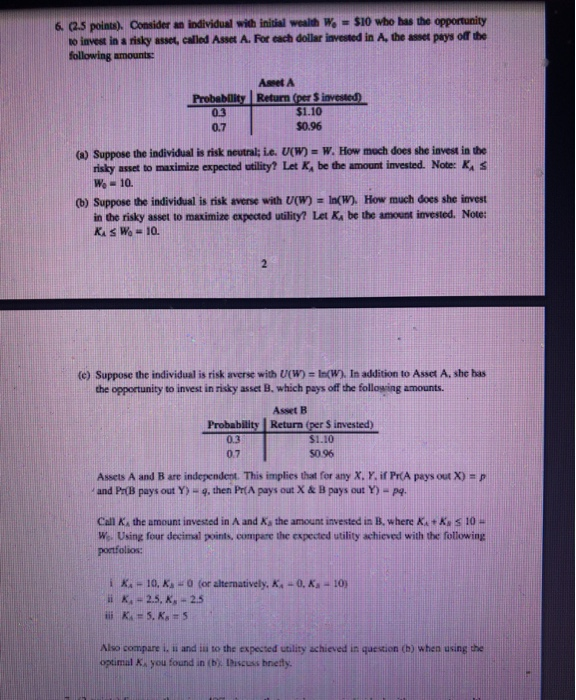

Question: 6. (2.5 points). Consider an individual with initial wealth W. - $10 who has the opportunity to invest in a risky asset, called Asset A.

6. (2.5 points). Consider an individual with initial wealth W. - $10 who has the opportunity to invest in a risky asset, called Asset A. For each dollar invested in A, the asset pays off the following amounts: Aseet A Probability Return (per invested) 03 $1.10 0.7 $0.96 (*) Suppose the individual is risk neutral; i.e. U(W) = W. How much does she invest in the risky asset to maximize expected utility? Let K, be the amount invested. Note: KS W - 10. (b) Suppose the individualis risk averse with U(W) = ln(W). How much does she invest in the risky asset to maximize expected utility? Let K, be the amount invested. Note: KSW - 10. 2 (e) Suppose the individual is risk averse with U(W) = n(w). In addition to Asset A. she has the opportunity to invest in risky asset B. which pays off the following amounts. Asset B Probability Return (per invested) 0.3 $1.10 0.7 $0.96 Assets A and B are independent. This implies that for any X. Y. if PrA pays out X) = ? and Pr B pays out Y) - 4. then Pr[A pays out X & B pays out Y) - 24. Call K, the amount invested in A and the amount invested in B. where Ka+ks 10 - W.. Using four decimal points, compare the expected utility achieved with the following portfolios i ke - 10. K. - 0 for alternatively, K-0. Kg - 103 HK - 2.5, X, - 2.5 ili k = 5. K.5 Also compare i. 11 and is to the expected utility achieved in question (b) when using the optimal. you found in (b) Discuss hnetty. 6. (2.5 points). Consider an individual with initial wealth W. - $10 who has the opportunity to invest in a risky asset, called Asset A. For each dollar invested in A, the asset pays off the following amounts: Aseet A Probability Return (per invested) 03 $1.10 0.7 $0.96 (*) Suppose the individual is risk neutral; i.e. U(W) = W. How much does she invest in the risky asset to maximize expected utility? Let K, be the amount invested. Note: KS W - 10. (b) Suppose the individualis risk averse with U(W) = ln(W). How much does she invest in the risky asset to maximize expected utility? Let K, be the amount invested. Note: KSW - 10. 2 (e) Suppose the individual is risk averse with U(W) = n(w). In addition to Asset A. she has the opportunity to invest in risky asset B. which pays off the following amounts. Asset B Probability Return (per invested) 0.3 $1.10 0.7 $0.96 Assets A and B are independent. This implies that for any X. Y. if PrA pays out X) = ? and Pr B pays out Y) - 4. then Pr[A pays out X & B pays out Y) - 24. Call K, the amount invested in A and the amount invested in B. where Ka+ks 10 - W.. Using four decimal points, compare the expected utility achieved with the following portfolios i ke - 10. K. - 0 for alternatively, K-0. Kg - 103 HK - 2.5, X, - 2.5 ili k = 5. K.5 Also compare i. 11 and is to the expected utility achieved in question (b) when using the optimal. you found in (b) Discuss hnetty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts