Question: 6. (25 pts) Consider a stock with a volatility o 20 %. The current price of the stock is $62. The European call option on

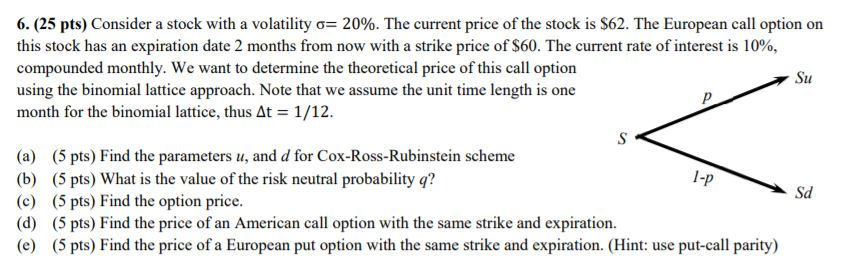

6. (25 pts) Consider a stock with a volatility o 20 %. The current price of the stock is $62. The European call option on this stock has an expiration date 2 months from now with a strike price of $60. The current rate of interest is 10%, compounded monthly. We want to determine the theoretical price of this call option using the binomial lattice approach. Note that we assume the unit time length is one month for the binomial lattice, thus At 1/12 Su S (5 pts) Find the parameters u, and d for Cox-Ross-Rubinstein scheme (b) (5 pts) What is the value of the risk neutral probability q? (c) (5 pts) Find the option price. (5 pts) Find the price of an American call option with the same strike and expiration (d) (5 pts) Find the price of a European put option with the same strike and expiration. (Hint: use put-call parity) (a) 1-p Sd (e) 6. (25 pts) Consider a stock with a volatility o 20 %. The current price of the stock is $62. The European call option on this stock has an expiration date 2 months from now with a strike price of $60. The current rate of interest is 10%, compounded monthly. We want to determine the theoretical price of this call option using the binomial lattice approach. Note that we assume the unit time length is one month for the binomial lattice, thus At 1/12 Su S (5 pts) Find the parameters u, and d for Cox-Ross-Rubinstein scheme (b) (5 pts) What is the value of the risk neutral probability q? (c) (5 pts) Find the option price. (5 pts) Find the price of an American call option with the same strike and expiration (d) (5 pts) Find the price of a European put option with the same strike and expiration. (Hint: use put-call parity) (a) 1-p Sd (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts