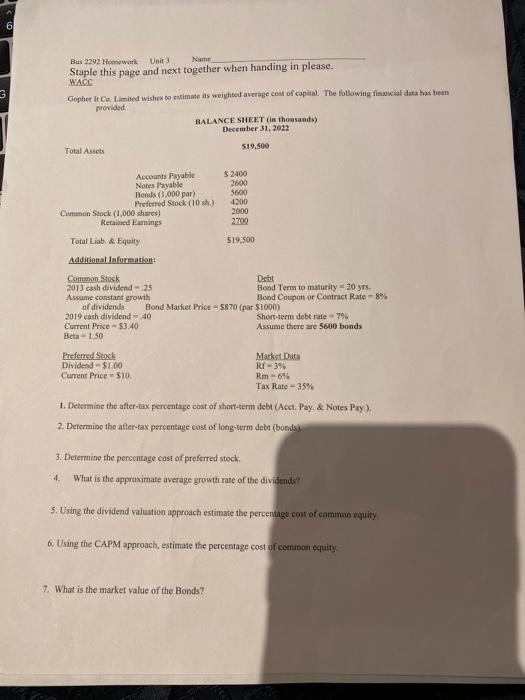

Question: 6 3 Bus 2292 Homework Unit Nam Staple this page and next together when handing in please. WACC Gopher It Co. Limited wishes to estimate

6 3 Bus 2292 Homework Unit Nam Staple this page and next together when handing in please. WACC Gopher It Co. Limited wishes to estimate its weighted average cost of capital. The following financial data has been provided BALANCE SHEET (in thousands) December 31, 2022 $19.500 Total Assets Accounts Payable S 2400 Notes Payable 2600 Bonds (1.000 par) 3600 Preferred Stock (10 sh.) 4200 Common Stock (1,000 shares) 2000 Retained Eamings 2700 Total Liab & Equity 519,500 Additional Information Common Stock Debt 2013 cash dividend 25 Bond Term to maturity = 20 yrs. Assume constant growth Bond Coupon or Contract Rate - 8% of dividends Bond Market Price $870 (par $1000) 2019 cash dividend - 40 Short-term debt rate 796 Current Price $3.40 Assume there are 5600 bonds Beta-150 Prefemed Stock Dividend - $1.00 Current Price 510 Market Data R-3% Rm696 Tax Rate 35% 1. Determine the after tax percentage cost of short-term debt (Acct. Pay & Notes Pay.). 2. Determine the after-tax percentage cost of long-term debt (boods). 3. Determine the percentage cost of preferred stock What is the approximate average growth rate of the dividends? 5. Using the dividend valuation approach estimate the percentage cost of common equity 6. Using the CAPM approach, estimate the percentage cost of common equity 7. What is the market value of the Bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts