Question: 6 : 5 3 Back PE _ 2 3 2 _ M 1 ( 2 ) Prepare the journal entry to record the exchange of

:

Back

PEM

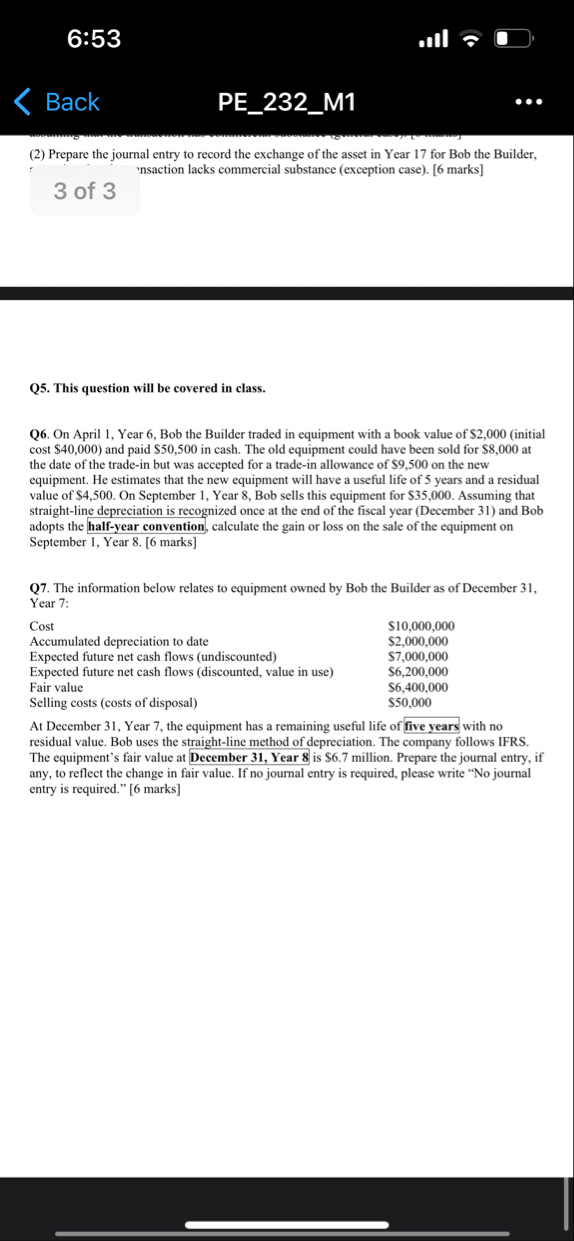

Prepare the journal entry to record the exchange of the asset in Year for Bob the Builder, nsaction lacks commercial substance exception case marks

of

Q This question will be covered in class.

Q On April Year Bob the Builder traded in equipment with a book value of $initial cost $ and paid $ in cash. The old equipment could have been sold for $ at the date of the tradein but was accepted for a tradein allowance of $ on the new equipment. He estimates that the new equipment will have a useful life of years and a residual value of $ On September Year Bob sells this equipment for $ Assuming that straightline depreciation is recognized once at the end of the fiscal year December and Bob adopts the halfyear convention, calculate the gain or loss on the sale of the equipment on September Year marks

Q The information below relates to equipment owned by Bob the Builder as of December Year :

tableCost$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock