Question: 6 : 5 3 Sleeper 8 2 Done ACCY 1 Extra Credit.pdf 3 9 . July 1 2 - The company received $ 1 ,

:

Sleeper

Done ACCY Extra Credit.pdf

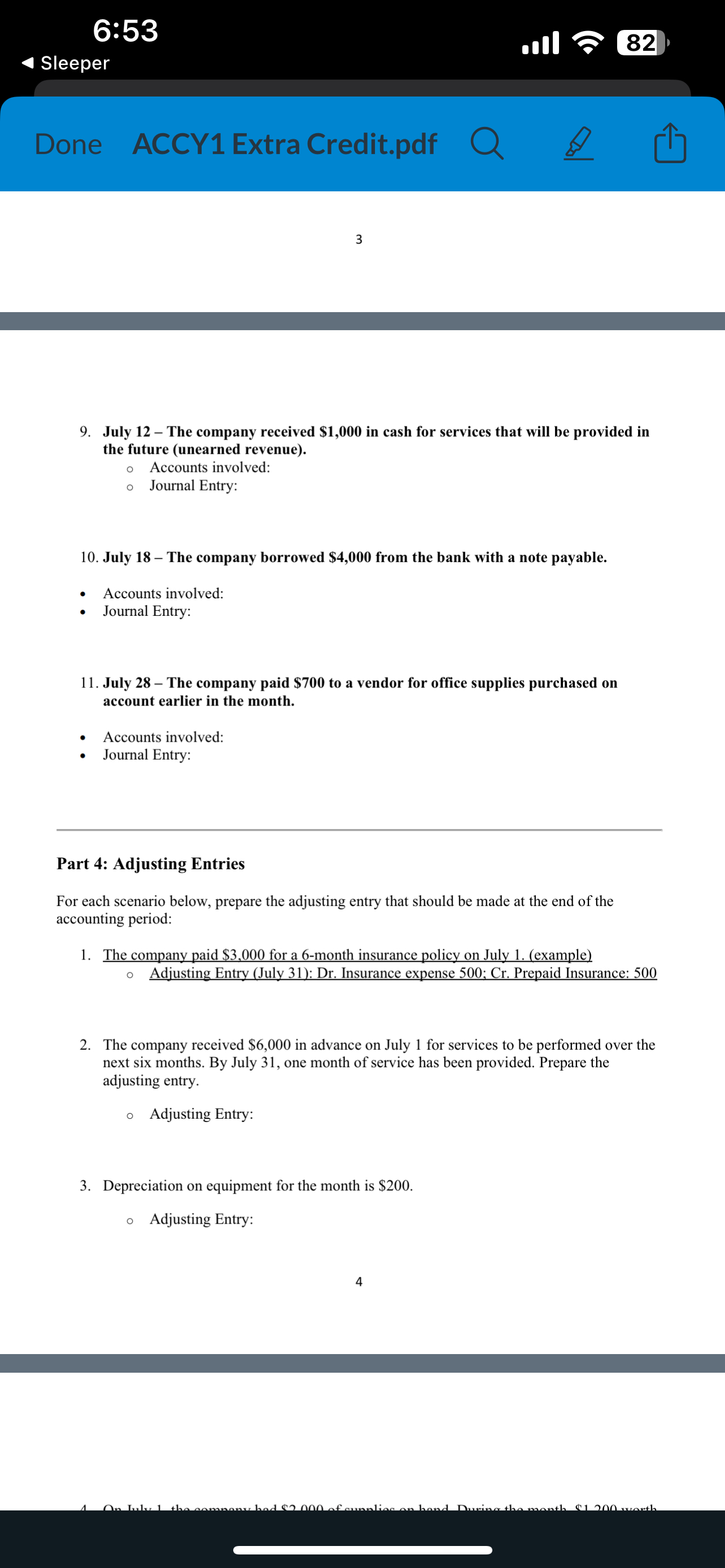

July The company received $ in cash for services that will be provided in the future unearned revenue

Accounts involved:

Journal Entry:

July The company borrowed $ from the bank with a note payable.

Accounts involved:

Journal Entry:

July The company paid $ to a vendor for office supplies purchased on account earlier in the month.

Accounts involved:

Journal Entry:

Part : Adjusting Entries

For each scenario below, prepare the adjusting entry that should be made at the end of the accounting period:

The company paid $ for a month insurance policy on July example

Adjusting Entry July : Dr Insurance expense ; Cr Prepaid Insurance:

The company received $ in advance on July for services to be performed over the next six months. By July one month of service has been provided. Prepare the adjusting entry.

Adjusting Entry:

Depreciation on equipment for the month is $

Adjusting Entry:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock