Question: 6 : 5 3 Sleeper . . ll 8 2 Done ACCY 1 Extra Credit.pdf 4 . On July 1 , the company had $

:

Sleeper

ll

Done ACCY Extra Credit.pdf

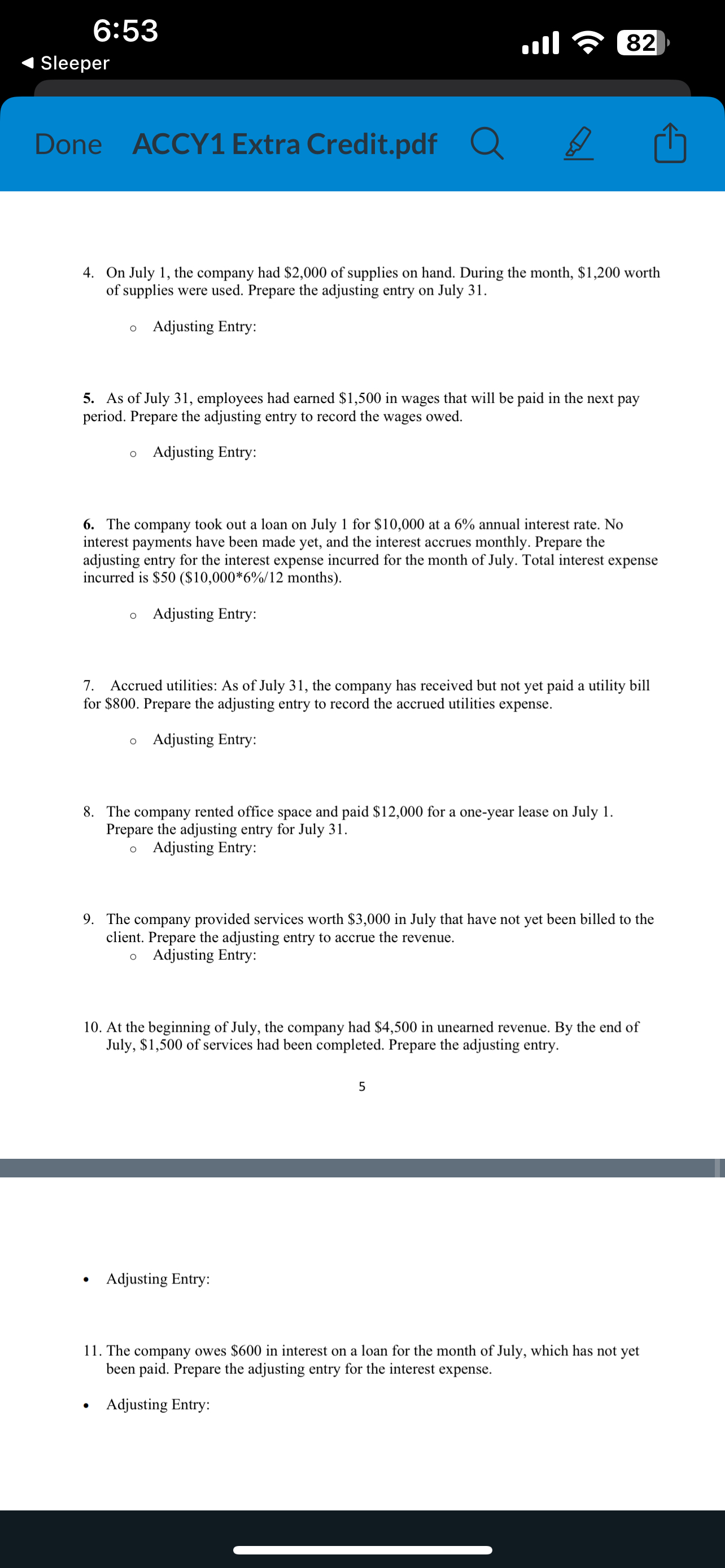

On July the company had $ of supplies on hand. During the month, $ worth of supplies were used. Prepare the adjusting entry on July

Adjusting Entry:

As of July employees had earned $ in wages that will be paid in the next pay period. Prepare the adjusting entry to record the wages owed.

Adjusting Entry:

The company took out a loan on July for $ at a annual interest rate. No interest payments have been made yet, and the interest accrues monthly. Prepare the adjusting entry for the interest expense incurred for the month of July. Total interest expense incurred is $ $ months

Adjusting Entry:

Accrued utilities: As of July the company has received but not yet paid a utility bill for $ Prepare the adjusting entry to record the accrued utilities expense.

Adjusting Entry:

The company rented office space and paid $ for a oneyear lease on July Prepare the adjusting entry for July

Adjusting Entry:

The company provided services worth $ in July that have not yet been billed to the client. Prepare the adjusting entry to accrue the revenue.

Adjusting Entry:

At the beginning of July, the company had $ in unearned revenue. By the end of July, $ of services had been completed. Prepare the adjusting entry.

Adjusting Entry:

The company owes $ in interest on a loan for the month of July, which has not yet been paid. Prepare the adjusting entry for the interest expense.

Adjusting Entry:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock