Question: 6, 7, and 8 are all connected. Question 6 1 pts Consider someone who owns 1 share of a AAPL stock priced at $206 per

6, 7, and 8 are all connected.

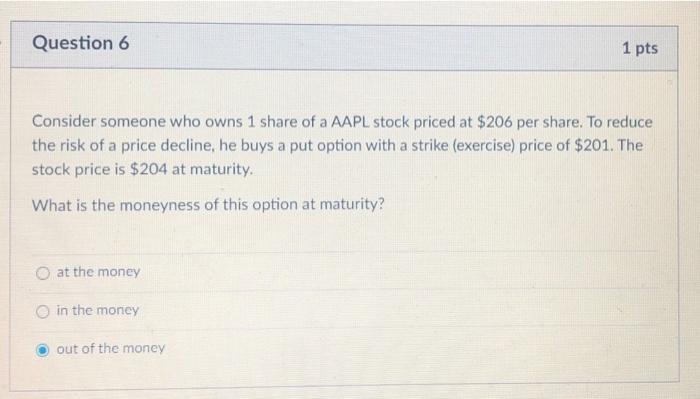

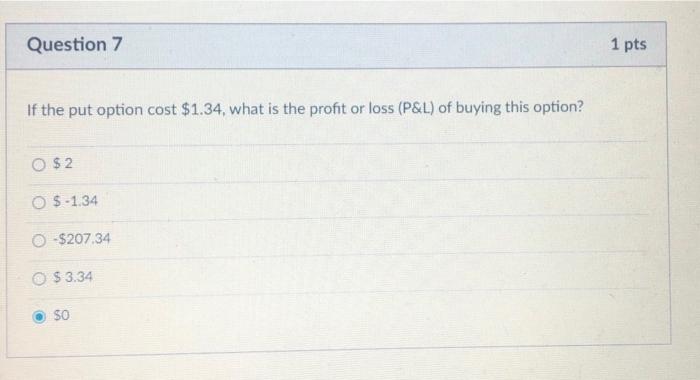

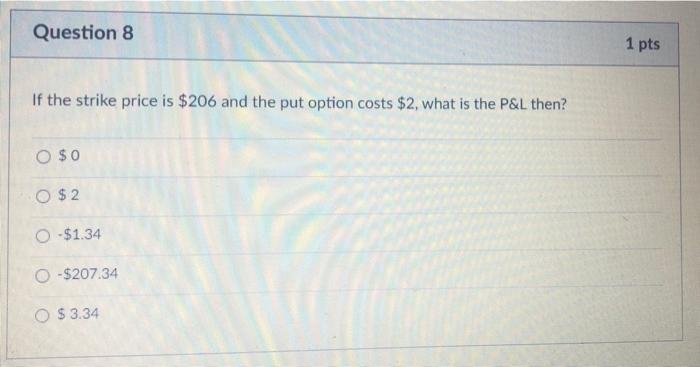

Question 6 1 pts Consider someone who owns 1 share of a AAPL stock priced at $206 per share. To reduce the risk of a price decline, he buys a put option with a strike (exercise) price of $201. The stock price is $204 at maturity. What is the moneyness of this option at maturity? O at the money in the money out of the money Question 7 1 pts If the put option cost $1.34, what is the profit or loss (P&L) of buying this option? O $2 O $-1.34 -$207.34 $ 3.34 SO Question 8 1 pts If the strike price is $206 and the put option costs $2, what is the P&L then? O $0 O $2. O -$1.34 O-$207.34 O $ 3.34

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock