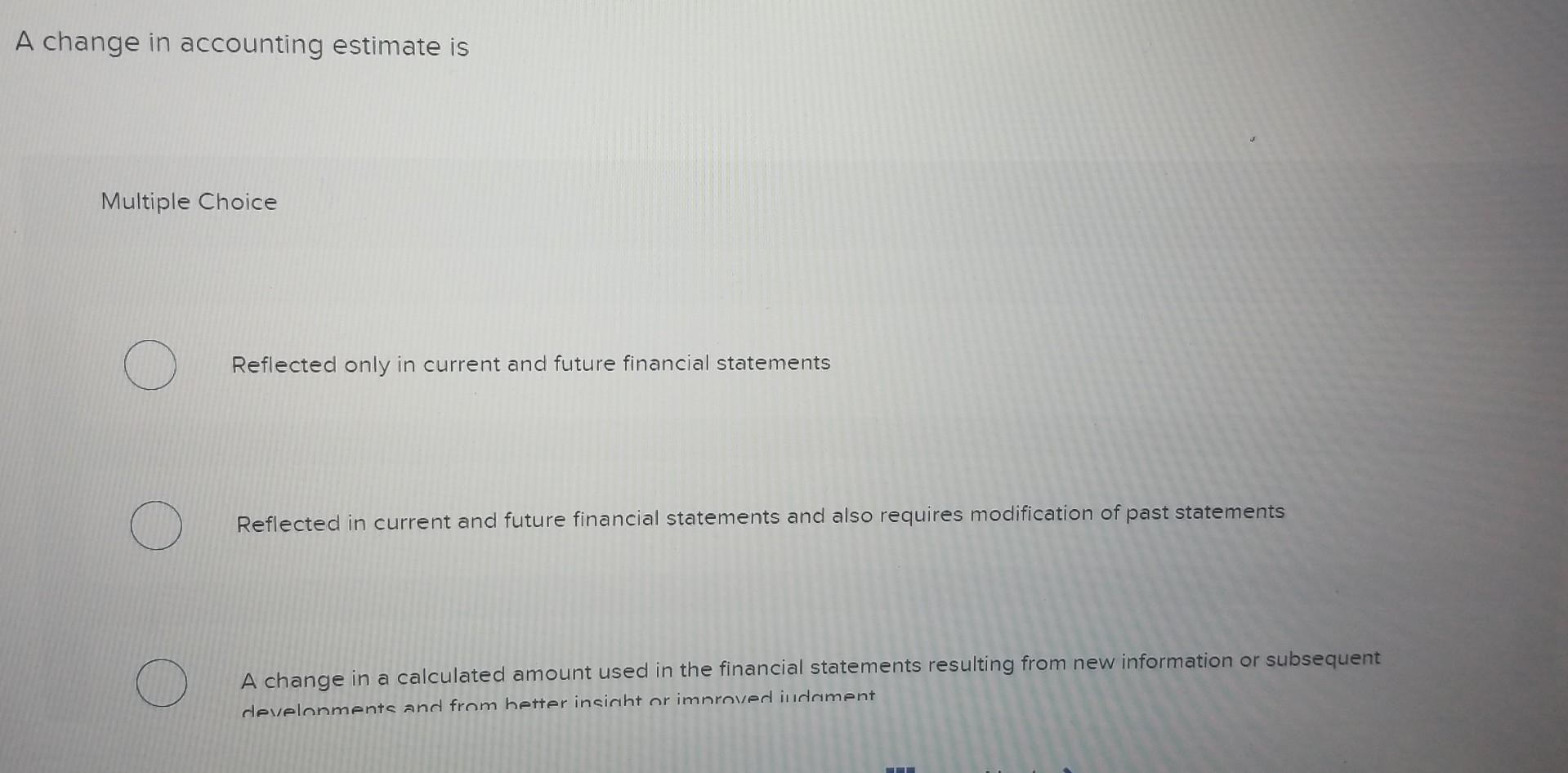

Question: 6 A change in accounting estimate is Multiple Choice Reflected only in current and future financial statements Reflected in current and future financial statements and

6

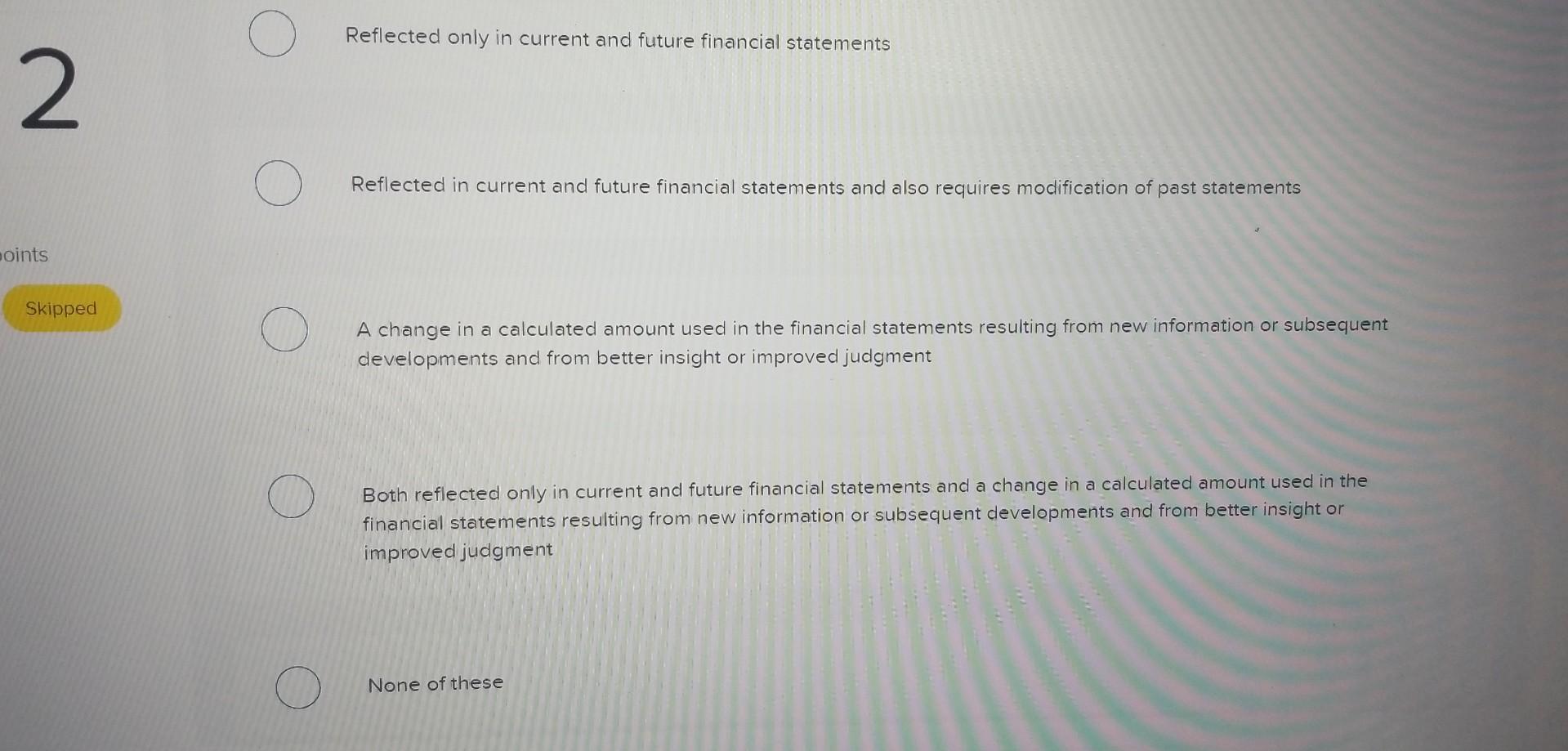

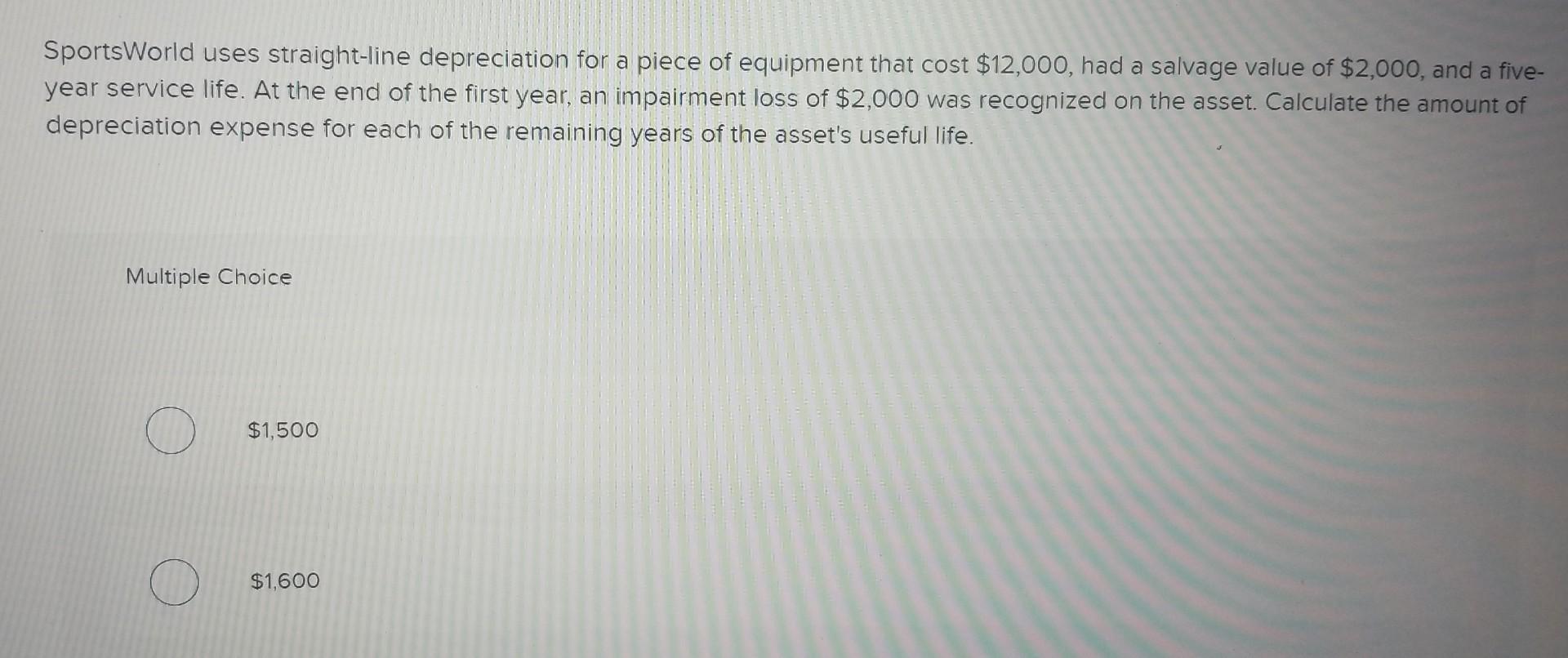

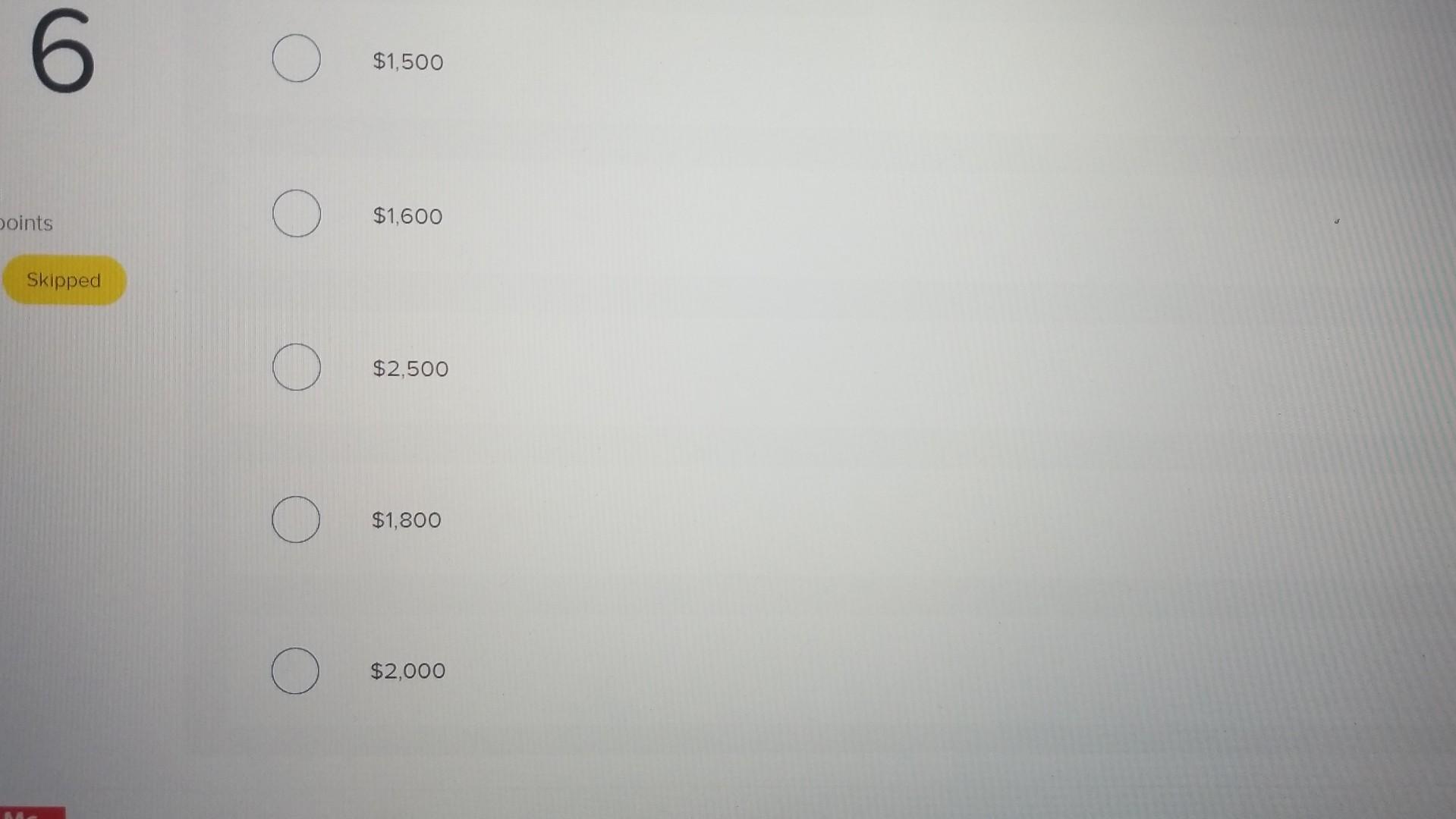

A change in accounting estimate is Multiple Choice Reflected only in current and future financial statements Reflected in current and future financial statements and also requires modification of past statements A change in a calculated amount used in the financial statements resulting from new information or subsequent develnnmentc and from hetter inciaht ar imnroved ilidrment Reflected only in current and future financial statements Reflected in current and future financial statements and also requires modification of past statements A change in a calculated amount used in the financial statements resulting from new information or subsequent developments and from better insight or improved judgment Both reflected only in current and future financial statements and a change in a calculated amount used in the financial statements resulting from new information or subsequent developments and from better insight or improved judgment None of these SportsWorld uses straight-line depreciation for a piece of equipment that cost $12,000, had a salvage value of $2,000, and a fiveyear service life. At the end of the first year, an impairment loss of $2,000 was recognized on the asset. Calculate the amount of depreciation expense for each of the remaining years of the asset's useful life. Multiple Choice $1,500 $1,600 $1,500 $1,600 $2,500 $1,800 $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts