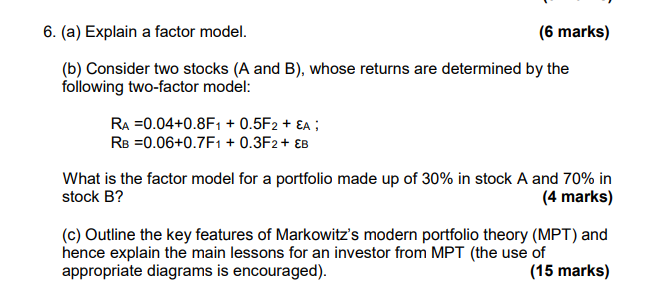

Question: 6. (a) Explain a factor model. (6 marks) (b) Consider two stocks (A and B), whose returns are determined by the following two-factor model: RA

6. (a) Explain a factor model. (6 marks) (b) Consider two stocks (A and B), whose returns are determined by the following two-factor model: RA =0.04+0.8F1 + 0.5F2 + EA ; RB =0.06+0.7F1 + 0.3F2 + EB What is the factor model for a portfolio made up of 30% in stock A and 70% in stock B? (4 marks) (c) Outline the key features of Markowitz's modern portfolio theory (MPT) and hence explain the main lessons for an investor from MPT (the use of appropriate diagrams is encouraged). (15 marks) 6. (a) Explain a factor model. (6 marks) (b) Consider two stocks (A and B), whose returns are determined by the following two-factor model: RA =0.04+0.8F1 + 0.5F2 + EA ; RB =0.06+0.7F1 + 0.3F2 + EB What is the factor model for a portfolio made up of 30% in stock A and 70% in stock B? (4 marks) (c) Outline the key features of Markowitz's modern portfolio theory (MPT) and hence explain the main lessons for an investor from MPT (the use of appropriate diagrams is encouraged). (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts