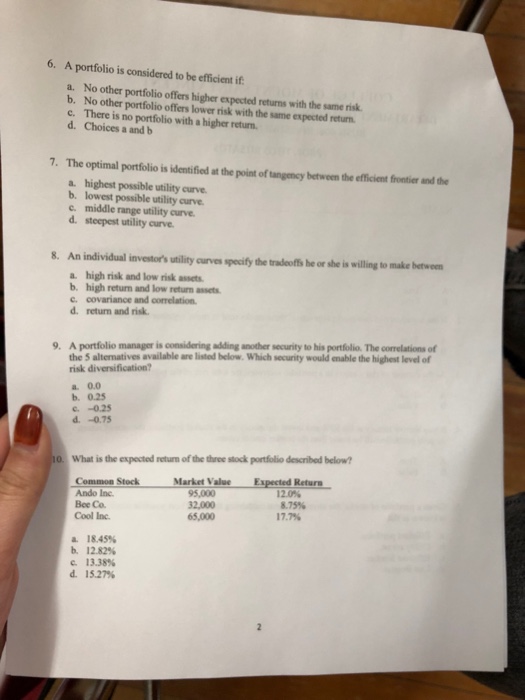

Question: 6. A portfolio is considered to be efficient if a. No other portfolio offers higher expected returns with the same risk b. No other portfolio

6. A portfolio is considered to be efficient if a. No other portfolio offers higher expected returns with the same risk b. No other portfolio offers lower risk with the same expected return c. There is no portfolio with a higher return d. Choices a and b The optimal portfolio is identified at the point of tangency between the efficient frontier and the a. highest possible utility curve b. lowest possible utility curve c. middle range utility curve d steepest utility curve 8. An individual investor's utility curves specify the tradeofts he or she is willing to make betwee a. high risk and low risk assets b. high return and low return assets c. covariance and correlation d. return and risk A portfolio manager is omdering adding ander security to his prtfolio. The correlations of the 5 alternatives available are listed below. Which security would enable the highest level of risk diversification? 9. 0.0 b. 0.25 c -0.25 .-0.75 What is the expected return of the throe stock portfolio described below? Market Vau Expected Reture Common Stock Ando Inc. Boe Co. Cool Inc. 95,000 32,000 65,000 12.0% 8.75% a. 18.45% b.1282% c. 13.38% d. 15.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts