Question: 6. A project is expected to create operating cash flows of $22,000 a year for three ycars. The initial cost of the fixed assets is

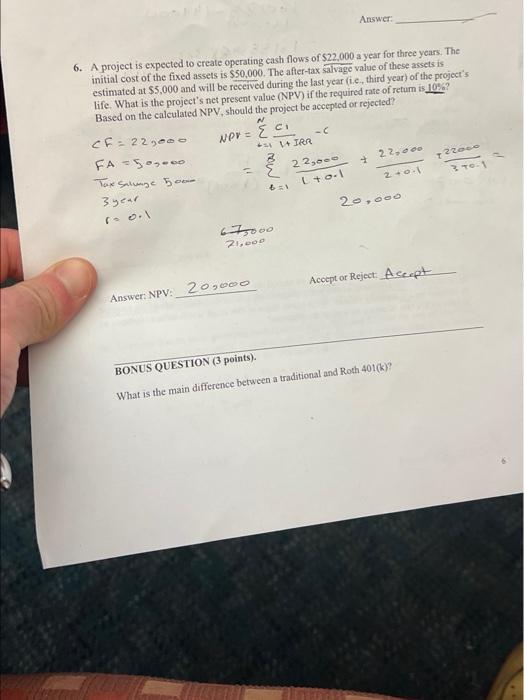

6. A project is expected to create operating cash flows of $22,000 a year for three ycars. The initial cost of the fixed assets is $50,000. The after-tax salvage value of these assets is estimated at $5,000 and will be received during the last year (i.c., third year) of the project's life. What is the project's net present value (NPV) if the required rate of returm is 10% ? Based on the calculated NPV, should the project be aecepted or rejected? CF=22,000NV=i=1N1+IRRc1CFA=5,0,000=b=11+0.122,000+2+0.122,000+3+0.1220003year20,000r=0.1 21,0007,000 Answer: NPV: 20,000 Acoept of Reject A scept BONUS QUESTION (3 points). What is the main difference between a traditional and Roth 401(k)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts