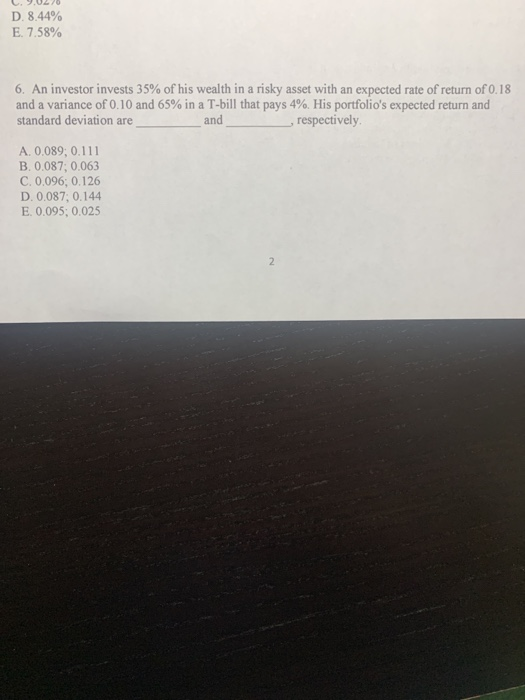

Question: #6 and 7, please show all steps D. 8.44% E 7.58% 6. An investor invests 35% of his wealth in a risky asset with an

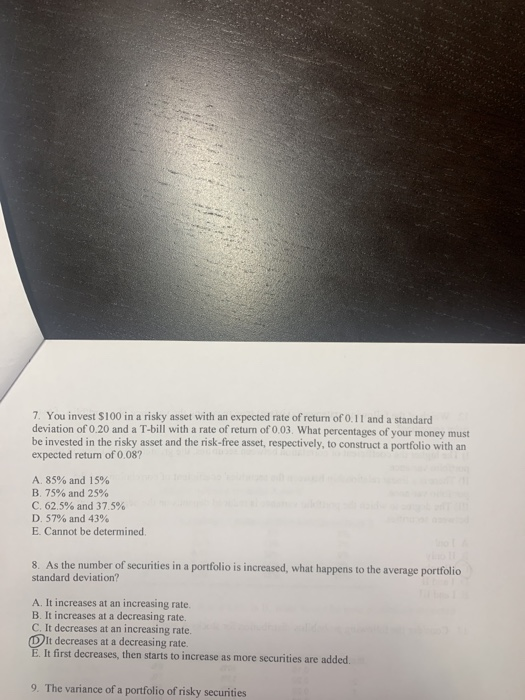

D. 8.44% E 7.58% 6. An investor invests 35% of his wealth in a risky asset with an expected rate of return of 0.18 and a variance of 0.10 and 65% in a T-bill that pays 4%. His portfolio's expected return and standard deviation are and _, respectively A. 0.089; 0.111 B. 0.087; 0.063 C. 0.096; 0.126 D. 0.087, 0.144 E. 0.095; 0.025 7. You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a T-bill with a rate of return of 0.03. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to construct a portfolio with an expected retum of 0.08? A. 85% and 15% B. 75% and 25% C. 62.5% and 37.5% D. 57% and 43% E. Cannot be determined. 8. As the number of securities in a portfolio is increased, what happens to the average portfolio standard deviation? A. It increases at an increasing rate. B. It increases at a decreasing rate. C. It decreases at an increasing rate. Dit decreases at a decreasing rate. E. It first decreases, then starts to increase as more securities are added 9. The variance of a portfolio of risky securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts