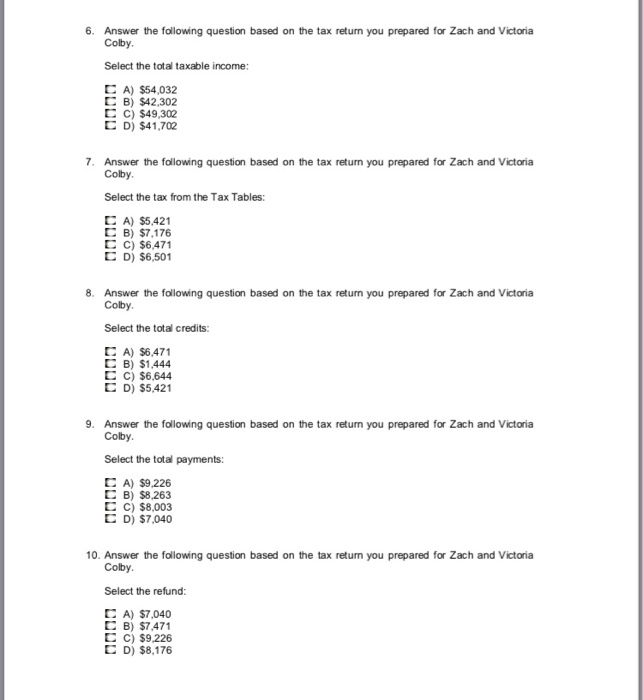

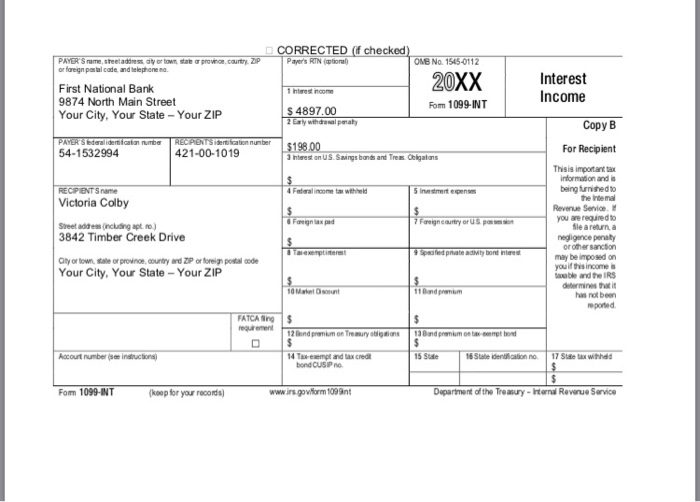

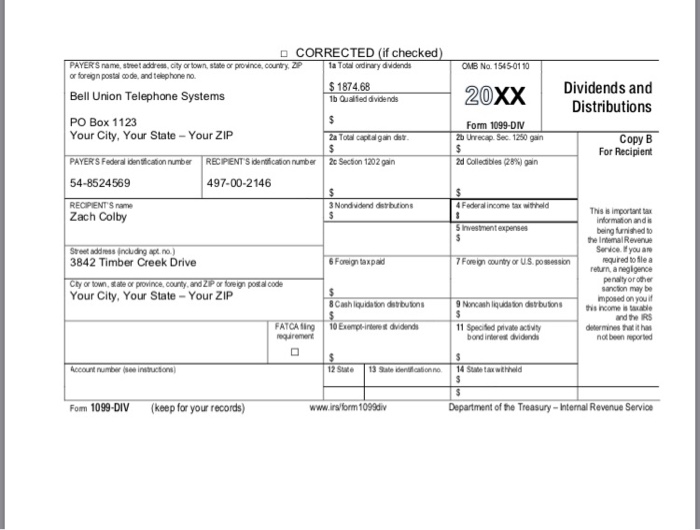

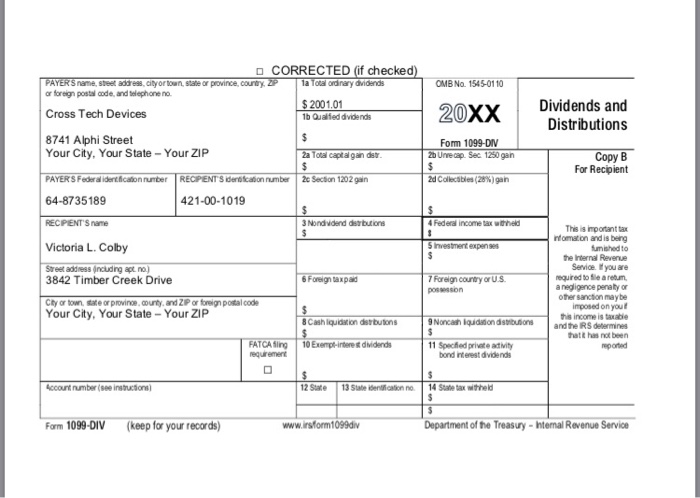

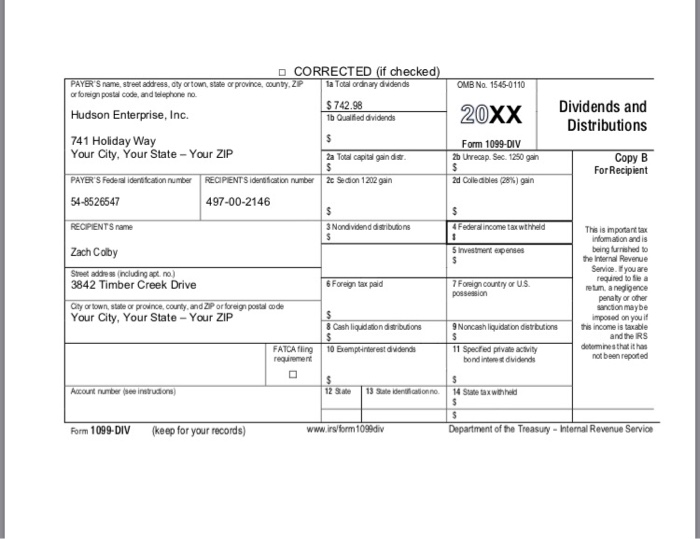

Question: 6. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the total taxable income C A) $54,032

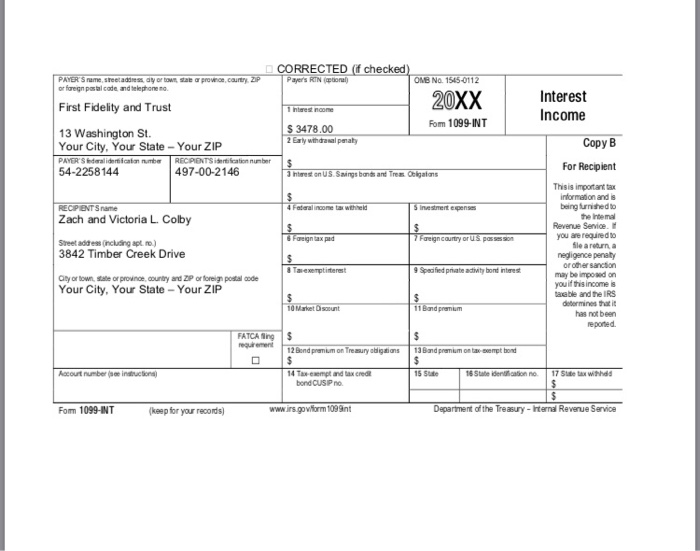

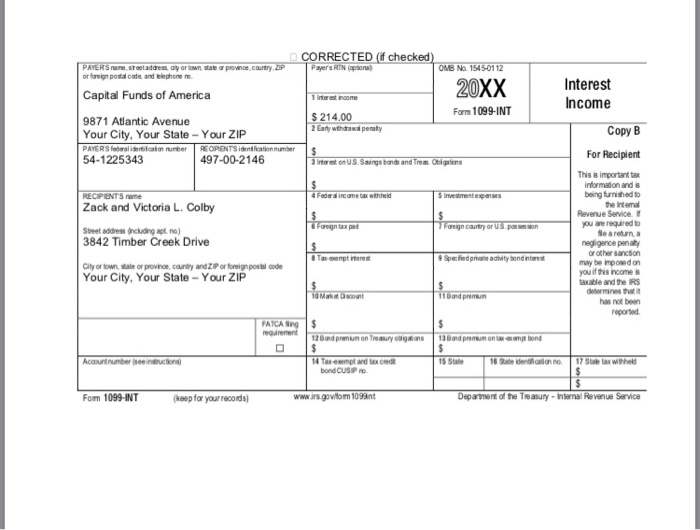

6. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the total taxable income C A) $54,032 C B) $42,302 C C) $49,302 C D) $41,702 7. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the tax from the Tax Tables: t: A) $5,421 B) $7,176 C C) $6,471 C D) $6,501 8. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the total credits: A) $6,471 C B) $1.444 C C) $6.644 C D) $5421 9. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the total payments: t: A) $9.226 C B) $8.263 C C) $8,003 C D) $7,040 10. Answer the following question based on the tax return you prepared for Zach and Victoria Colby Select the refund C A) $7,040 C B) $7,471 C C) $9.226 C D) $8,176

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts