Question: 6. (a)What are limitations which can be derived from break even analysis, both operational and financial? (b) MICROX COM Ltd produces computer components that sales

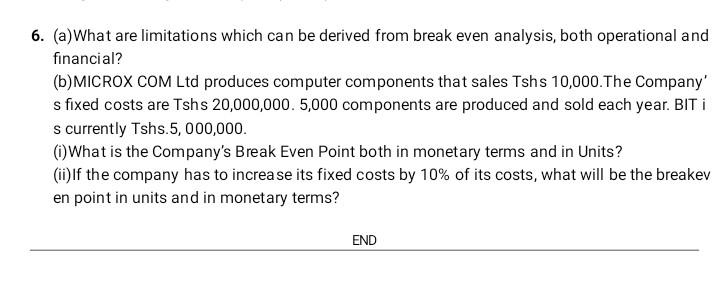

6. (a)What are limitations which can be derived from break even analysis, both operational and financial? (b) MICROX COM Ltd produces computer components that sales Tshs 10,000. The Company' s fixed costs are Tshs 20,000,000. 5,000 components are produced and sold each year. BIT i s currently Tshs.5, 000,000. (i)What is the Company's Break Even Point both in monetary terms and in Units? (ii)If the company has to increase its fixed costs by 10% of its costs, what will be the breakev en point in units and in monetary terms? 6. (a)What are limitations which can be derived from break even analysis, both operational and financial? (b) MICROX COM Ltd produces computer components that sales Tshs 10,000. The Company' s fixed costs are Tshs 20,000,000. 5,000 components are produced and sold each year. BIT i s currently Tshs.5, 000,000. (i)What is the Company's Break Even Point both in monetary terms and in Units? (ii)If the company has to increase its fixed costs by 10% of its costs, what will be the breakev en point in units and in monetary terms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts