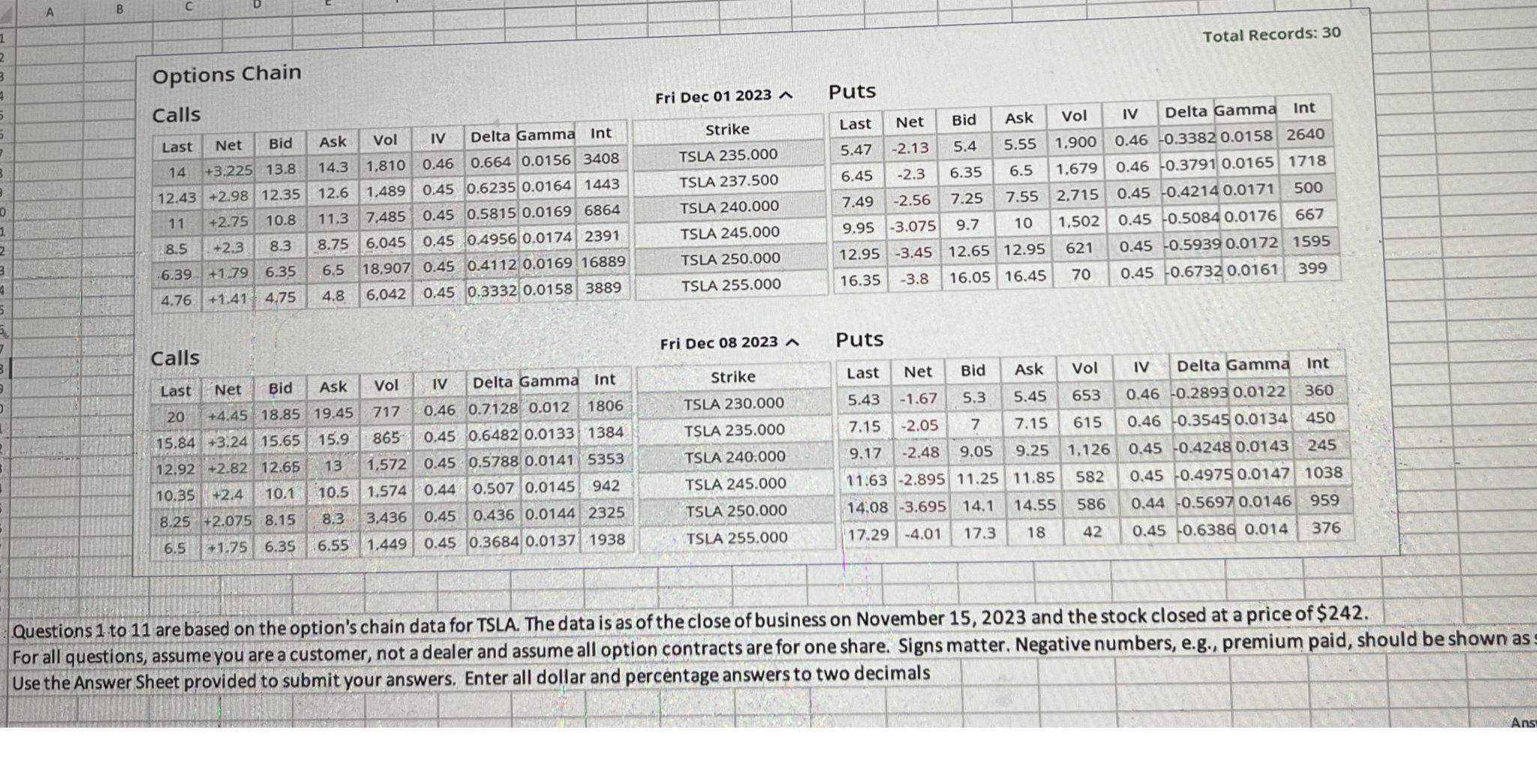

Question: 6 . based only on the information provided in the option chain, and a closing price of $ 2 4 2 , what is the

based only on the information provided in the option chain, and a closing price of $ what is the implied move, ie range in dollars, of TLSA stock over the upcoming year, based on the Dec $ puts?

Based on a normal distribution, what is the probability that TSLA stock remains with one standard deviation of its current price during the next year?

Assume you own TSLA stock at a price of $ what is the max loss of a protected put strategy using the Dec call stuck at $

How much did you receive if you sold the most actively traded option in the Dec series on November

Assume you did not own TSLA stock and you sold the Dec $ call. What is you max profit?

Assume you own TSLA stock at a price of $ and you sold the Dec $ call. What is you max loss?

Three month call options, struck at $ on AT&T T are trading at $ Assuming the stock is trading at $ and interest rates are what is the price of the put with the same strike and expiry? Hint: Use putcall parity.

Six month put options, struck at $ on AT&T T are trading at $ Assuming the stock is trading at $ and interest rates are what is the price of the call with the same strike and expiry? Hint: Use putcall parity.

assume the VIX is trading at and the S&P is at What is the implied move on the S&P index points, over the next days. Round your answer to the nearest full point.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock