Question: 6. (Binomial model with two periods; total 2 points.) The continuously compounded interest rate is 9.53102% per year, and each period is one year long,

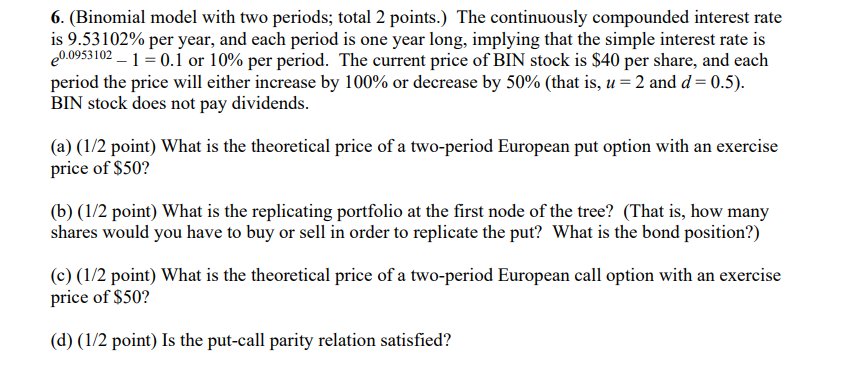

6. (Binomial model with two periods; total 2 points.) The continuously compounded interest rate is 9.53102% per year, and each period is one year long, implying that the simple interest rate is 20.0953102 1 = 0.1 or 10% per period. The current price of BIN stock is $40 per share, and each period the price will either increase by 100% or decrease by 50% (that is, u = 2 and d=0.5). BIN stock does not pay dividends. (a) (1/2 point) What is the theoretical price of a two-period European put option with an exercise price of $50? (b) (1/2 point) What is the replicating portfolio at the first node of the tree? (That is, how many shares would you have to buy or sell in order to replicate the put? What is the bond position?) (c)(1/2 point) What is the theoretical price of a two-period European call option with an exercise price of $50? (d) (1/2 point) Is the put-call parity relation satisfied? 6. (Binomial model with two periods; total 2 points.) The continuously compounded interest rate is 9.53102% per year, and each period is one year long, implying that the simple interest rate is 20.0953102 1 = 0.1 or 10% per period. The current price of BIN stock is $40 per share, and each period the price will either increase by 100% or decrease by 50% (that is, u = 2 and d=0.5). BIN stock does not pay dividends. (a) (1/2 point) What is the theoretical price of a two-period European put option with an exercise price of $50? (b) (1/2 point) What is the replicating portfolio at the first node of the tree? (That is, how many shares would you have to buy or sell in order to replicate the put? What is the bond position?) (c)(1/2 point) What is the theoretical price of a two-period European call option with an exercise price of $50? (d) (1/2 point) Is the put-call parity relation satisfied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts