Question: 6. (Bond Types) Why is a zero bond called such? Why is a convertible bond called such? a 7. (Yield to Maturity) Pincushion Corp. issues

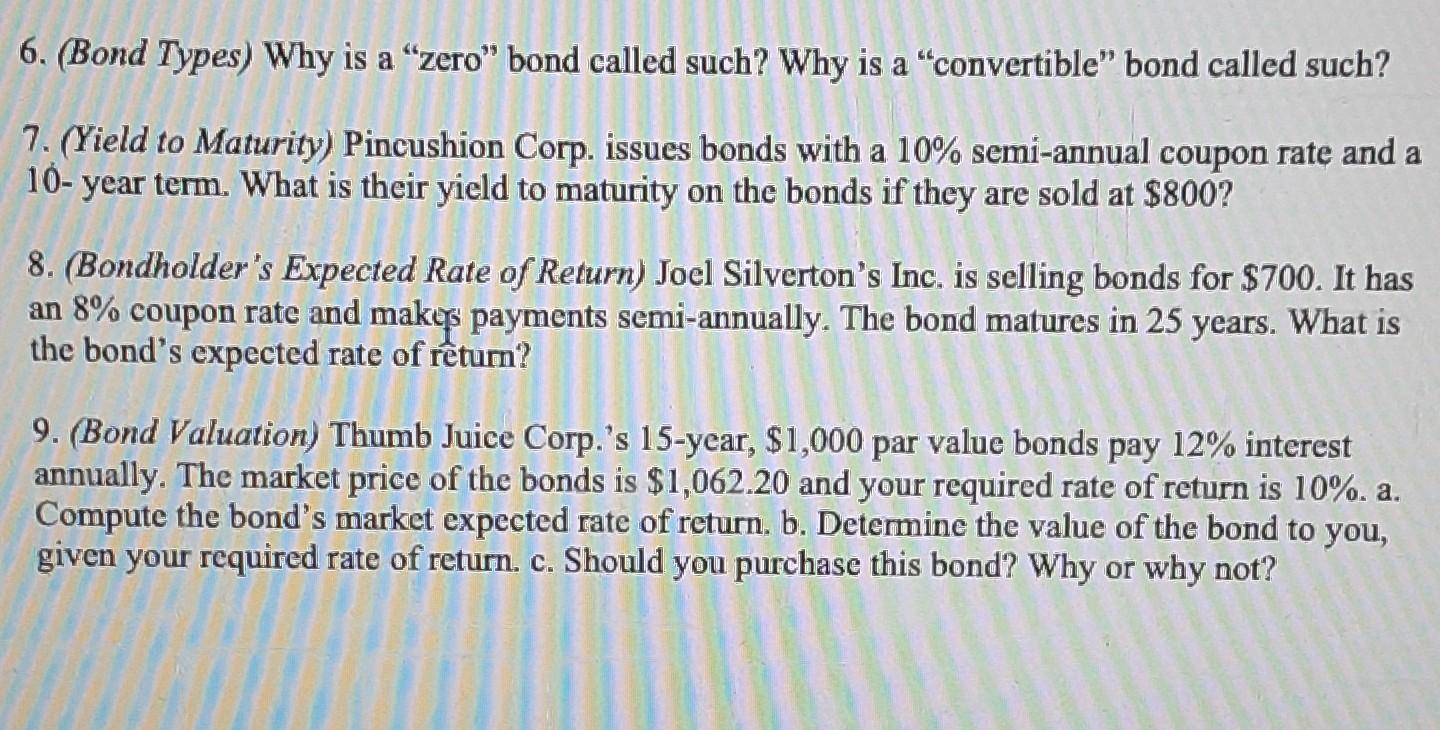

6. (Bond Types) Why is a "zero" bond called such? Why is a "convertible" bond called such? a 7. (Yield to Maturity) Pincushion Corp. issues bonds with a 10% semi-annual coupon rate and a 10- year term. What is their yield to maturity on the bonds if they are sold at $800? 8. (Bondholder's Expected Rate of Return) Joel Silverton's Inc. is selling bonds for $700. It has an 8% coupon rate and makes payments semi-annually. The bond matures in 25 years. What is the bond's expected rate of return? 9. (Bond Valuation) Thumb Juice Corp.'s 15-year, $1,000 par value bonds pay 12% interest annually. The market price of the bonds is $1,062.20 and your required rate of return is 10%. a. Compute the bond's market expected rate of return. b. Determine the value of the bond to you, given your required rate of return. c. Should you purchase this bond? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts