Question: 6. Ch03 Financial Planning Exercise 4 Chapter 3 Financial Planning Exercise 4 Effect of tax credit versus tax exemption Explain and calculate the differences resulting

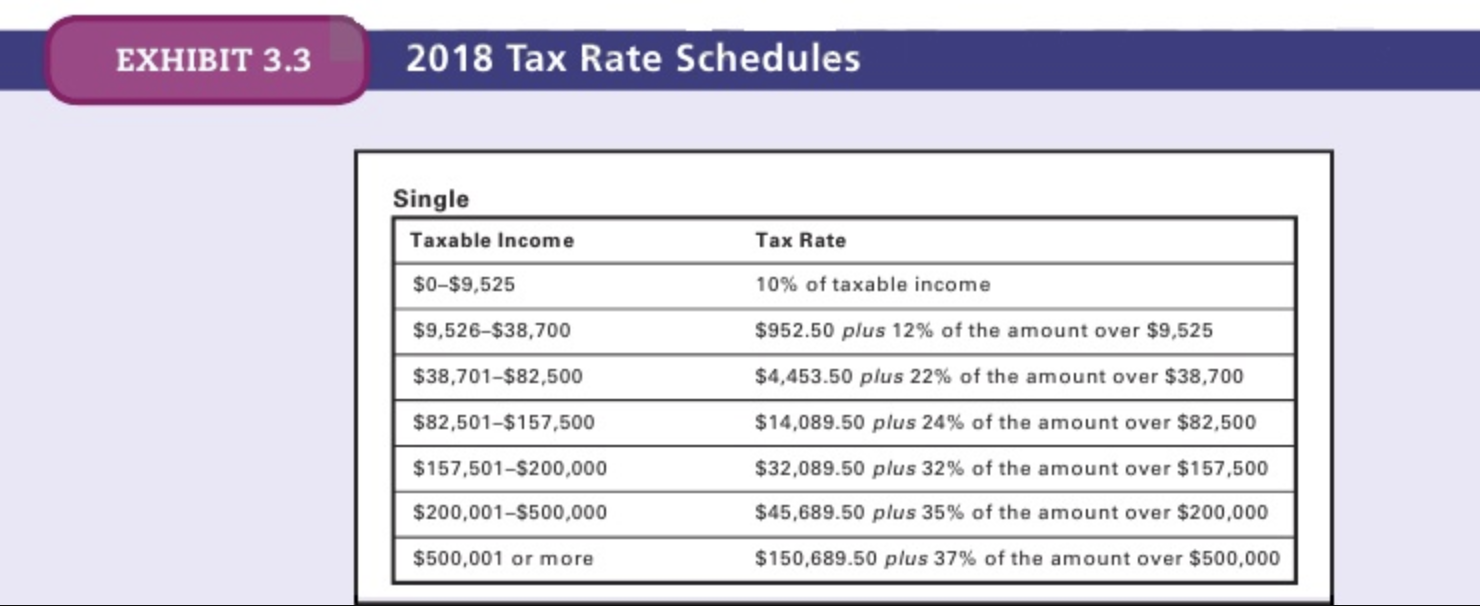

6. Ch03 Financial Planning Exercise 4 Chapter 3 Financial Planning Exercise 4 Effect of tax credit versus tax exemption Explain and calculate the differences resulting from a $1,000 tax credit versus a $1,000 tax deduction for a single taxpayer with $46,000 of pre-tax income. The standard deduction in 2018 was $12,000 for single. Note that personal exemptions were suspended for 2018. Use Exhibit 3.3 to determine the corresponding tax rate. Round the answers to the nearest cent. After-tax Income (Tax Deduction) After-tax Income (Tax Credit) $ $ 2018 Tax Rate Schedules

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock