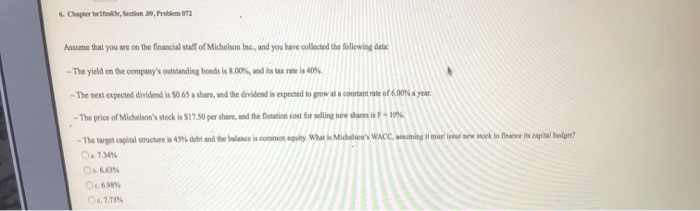

Question: 6. Chapter bror, Section 19. Problem 72 Assume that you are on the financial staff of Michelson Inc., and you have collected the following data:

6. Chapter bror, Section 19. Problem 72 Assume that you are on the financial staff of Michelson Inc., and you have collected the following data: - The yield on the company's outstanding bonds is 8.00%, and is testate is 40% - The next expected dividend is 50.65 share, and the dividend is expected to grow at a constant rate of 6.00% a year. - The price of Michelson's stock is $17.50 per share, and the flat cost for selling new share -10% WACC, mingit must see took to face in capital budget? - The target cuphal structure is 49% debt and the balance is comme equity. What is Michele 7.31% 6.63% 6.6976 1.73%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock