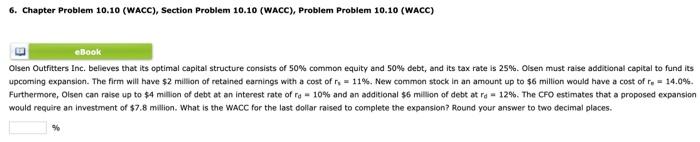

Question: 6. Chapter Problem 10.10 (WACC), Section Problem 10.10 (WACC), Problem Problem 10.10 (WACC) eBook Olsen Outfitters Inc. believes that its optimal capital structure consists of

6. Chapter Problem 10.10 (WACC), Section Problem 10.10 (WACC), Problem Problem 10.10 (WACC) eBook Olsen Outfitters Inc. believes that its optimal capital structure consists of 50% common equity and 50% debt, and its tax rate is 25%. Oisen must raise additional capital to fund its upcoming expansion. The firm will have $2 million of retained earnings with a cost of r = 11%. New common stock in an amount up to $6 million would have a cost of r. = 14.0%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of ro - 10% and an additional $6 million of debt at - 12%. The CFO estimates that a proposed expansion would require an investment of $7.8 million. What is the WACC for the last dollar raised to complete the expansion? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts