Question: 6) Consider a 10 year bond with face value $1,000, pays 6% coupon semi-annually and has a yield-to-maturity of 7%. How much would the approximate

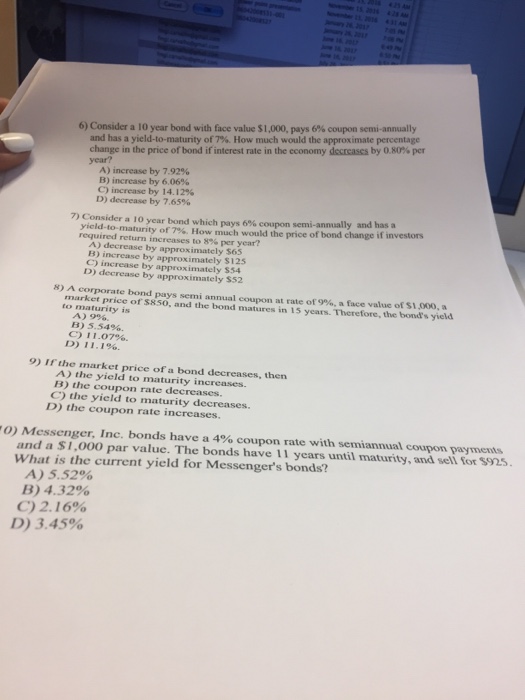

6) Consider a 10 year bond with face value $1,000, pays 6% coupon semi-annually and has a yield-to-maturity of 7%. How much would the approximate percentage change in the price of bond if interest rate in the economy decreases by 0.80% per year? A) increase by 7.92% B)increase by 606% C) increase by 14.12% D) decrease by 7.65% 7) Consider a 10 year bond which pays 6% coupon semi-annually and has yield-to-maturity required return increases to 8% per year? of 7%. How much would the price of bond change if investors A) decrease by approximately $65 B) increase by approximately $125 C) increase by approximately $54 D) decrease by approximately $52 8) A corporate bond pays semi annual coupon at rate of 9%, a face value of Stsoo, a market price of s8s0, and the bond matures in 15 years. Therefore, the bond's yield to maturity is A) 9%. B) 5.54% C) 11.07%. 9) If the market price of a bond decreases, then A) the yield to maturity increases. B) the coupon rate decreases. C) the yield to maturity decreases. D) the coupon rate increases. O Messenger, Inc. bonds have a 4% coupon rate with semiannual coupon payments and a S1,000 par value. The bonds have 11 years until maturity, and sell for $925. What is the current yield for Messenger's bonds? A) 5.52% B) 4.32% C) 216% D) 3.45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts