Question: 6) Consider a hypothetical security that pays a continuous dividend over time according to D(t) = Do(1+t). Assuming a (constant) CC rate of interest, r,

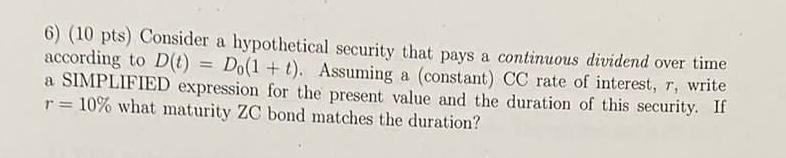

6) Consider a hypothetical security that pays a continuous dividend over time according to D(t) = Do(1+t). Assuming a (constant) CC rate of interest, r, write a SIMPLIFIED expression for the present value and the duration of this security.

If r = 10% what maturity ZC bond matches the duration?

6) (10 pts) Consider a hypothetical security that pays a continuous dividend over time according to D(t) = Do(1+1). Assuming a constant) CC rate of interest, T, write a SIMPLIFIED expression for the present value and the duration of this security. If r= 10% what maturity ZC bond matches the duration? 6) (10 pts) Consider a hypothetical security that pays a continuous dividend over time according to D(t) = Do(1+1). Assuming a constant) CC rate of interest, T, write a SIMPLIFIED expression for the present value and the duration of this security. If r= 10% what maturity ZC bond matches the duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts