Question: 6. Consider four projects, which you expect to generate the following cash flows: Year Project ProiectB ProjectC 400,000) (4,000 400,000) 420,000 30,000 200,000 200,000 200,000

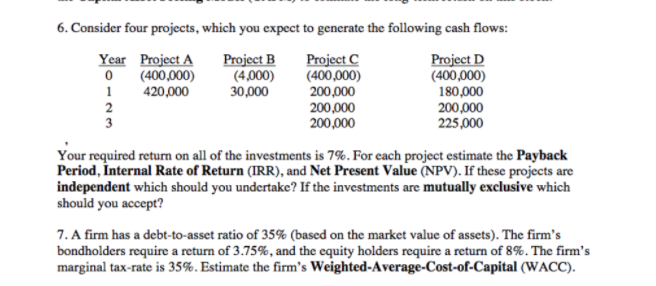

6. Consider four projects, which you expect to generate the following cash flows: Year Project ProiectB ProjectC 400,000) (4,000 400,000) 420,000 30,000 200,000 200,000 200,000 Project D (400,000) 180,000 200,000 225,000 Your required return on all of the investments is 7%. For each project estimate the Payback Period, Internal Rate of Return (IRR), and Net Present Value (NPV). If these projects are independent which should you undertake? If the investments are mutually exclusive which should you accept? 7. A firm has a debt-to-asset ratio of 35% (based on the market value of assets). The firm's bondholders require a return of 3.75%, and the equity holders require a return of 8%. The firm's marginal tax-rate is 35%. Estimate the firm's weighted-Average-Cost-of-Capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts