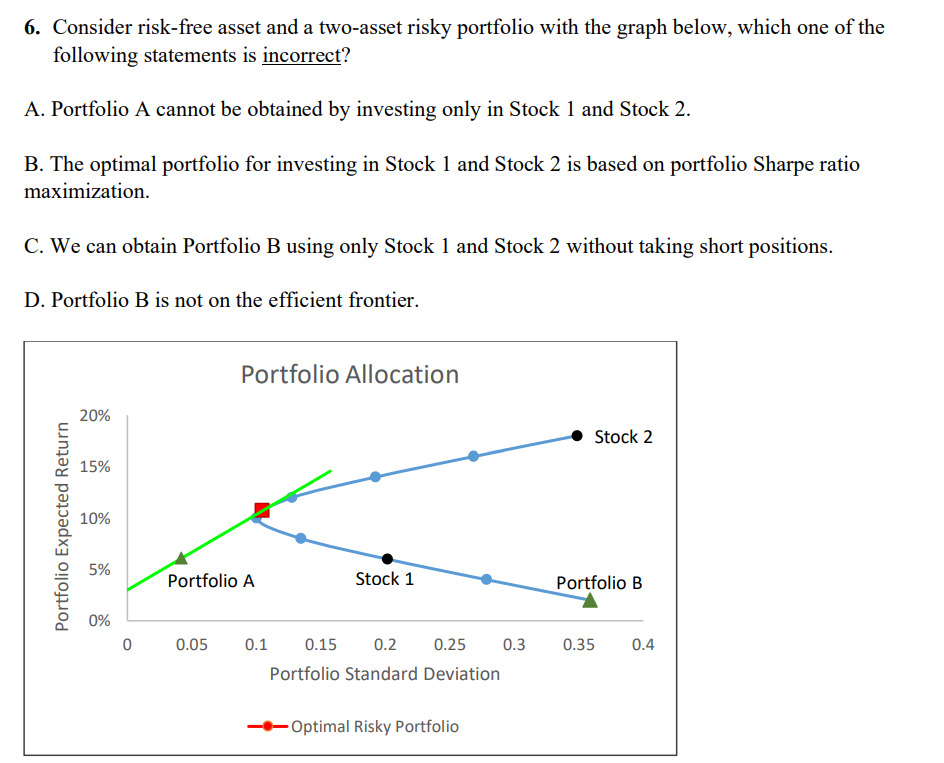

Question: 6 . Consider risk - free asset and a two - asset risky portfolio with the graph below, which one of the following statements is

Consider riskfree asset and a twoasset risky portfolio with the graph below, which one of the following statements is incorrect? A Portfolio A cannot be obtained by investing only in Stock and Stock B The optimal portfolio for investing in Stock and Stock is based on portfolio Sharpe ratio maximization. C We can obtain Portfolio B using only Stock and Stock without taking short positions. D Portfolio B is not on the efficient frontier. Consider you are utilizing Solver to determine the Efficient Frontier for a multiasset portfolio. Which statement correctly describes a characteristic of the Efficient Frontier?

A The Efficient Frontier represents portfolios that maximize return for a given level of volatility.

B Portfolios on the Efficient Frontier have weights that sum to greater than due to leverage.

C All portfolios on the Efficient Frontier have the same expected return.

D The Efficient Frontier can be found by maximizing volatility for a given return.

When constructing a portfolio with two risky assets, the correlation between the asset returns affects the shape and characteristics of the feasible set on a riskreturn graph, which one of the following statements is correct?

A If two risky assets are independent from each other, then there is no diversification effect in the portfolio.

B If all asset returns are perfectly correlated correlation coefficient of the feasible set will form a straight line, indicating no diversification benefit.

C A perfect negative correlation correlation coefficient of between asset returns will cause the feasible set to become a single point, reflecting the impossibility of diversification.

D The correlation between asset returns does not affect the feasible set; it is determined solely by the individual risk and return profiles of the assets. When utilizing Solver to construct a portfolio that minimizes volatility subject to a set return level, which of the following statements is incorrect?

A The target return level is set as a constraint on the portfolio's expected return.

B Solver adjusts the asset weights to achieve the highest possible return without exceeding the specified risk.

C The return level constraint must be set higher than the return of the most profitable asset in the portfolio.

D Asset weights are restricted to sum to representing the entirety of the portfolio's value.

In the context of the Capital Allocation Line CAL which one of the following statements is incorrect when combining a risky portfolio with a riskfree asset?

A The CAL is a straight line in the riskreturn space that starts from the riskfree rate and extends upward to include the risky portfolio.

B The slope of the CAL is equal to the Sharpe ratio of the risky portfolio.

C A portfolio located on the CAL always has an expected return that is greater than the riskfree rate.

D Portfolios that lie on the CAL offer different combinations of risk and return, reflecting an investor's risk prefer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock