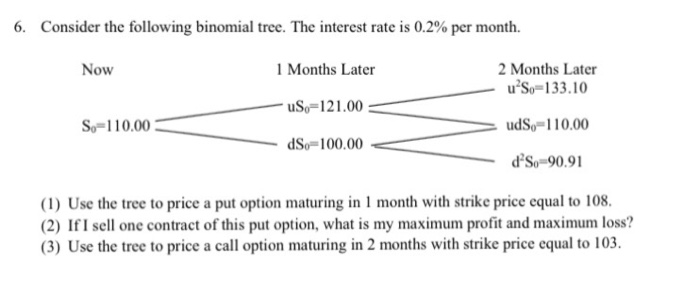

Question: 6. Consider the following binomial tree. The interest rate is 0.2% per month. Now 1 Months Later 2 Months Later u So-133.10 uS121.00 S.-110.00 udS.-110.00

6. Consider the following binomial tree. The interest rate is 0.2% per month. Now 1 Months Later 2 Months Later u So-133.10 uS121.00 S.-110.00 udS.-110.00 - dS. 100.00 d's. 90.91 (1) Use the free to price a put option maturing in 1 month with strike price equal to 108. (2) If I sell one contract of this put option, what is my maximum profit and maximum loss? (3) Use the tree to price a call option maturing in 2 months with strike price equal to 103

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock